Transactions are integral value creation elements. Realizing the potential is bound by active portfolio management and making decisions with strategic foresight.

Alliances & Joint Ventures

Unlocking opportunities to maximize growth through alliances and joint ventures

In the world of strategic alliances, joint ventures (JVs) are every portfolio's multifunction tool – versatile in application and design. At the intersection of shared capabilities, reciprocal know-how and united resources, JVs facilitate accelerated growth, enhanced reliability and increased efficiency.

During the many JVs we’ve helped create or support, we have identified three fundamental motivations for our clients:

- Leveraging expertise and knowledge

The decision to form a partnership of this type carries a magnitude of potential benefits, underpinned by an amalgamation of expertise and knowledge. By uniting resources and capabilities, JVs can accelerate goal attainment, driving efficiency and reliability. Each participating firm infuses the venture with its unique talent and perspective, fostering an environment ripe for success. - Access to markets and networks

Joint ventures serve as a strategic catalyst in penetrating domestic or foreign markets. Companies from disparate geographical regions or industries can form a partnership to realize their shared objectives. Whether it's exploiting an expansive local distribution network, circumventing governmental restrictions on foreign businesses, leveraging technological networks or appropriating valuable industry expertise, joint ventures can open new vistas of opportunity for our clients. - Financial and operative flexibility

Joint ventures offer adaptability, being either short or long-term with options to extend or end the partnership depending on performance, while maintaining individual brand identities and reducing risks. They cut financial risks by combining skills and scale benefits, lowering financial costs through shared overheads and technology use.

Our approach to alliances and joint ventures

Roland Berger’s strategic, value-driven approach sets the stage for impactful facilitation of alliances and JVs. Through our consulting services, we provide companies with comprehensive guidance, from strategy formulation and deal execution to final implementation, with a strong focus on value creation at every step. With a wealth of strategic industry knowledge and a demonstrable history of successful value extraction in joint ventures, equity carve-outs, post-merger integrations and IPOs, we stand out from other consulting firms. Our proven methodology in handling joint venture preparation and alliance portfolio projects allows us to adeptly handle complexities on both the investor and the joint venture side, all while proficiently minimizing transaction-associated risks for our clients.

"Joint ventures provide a strategic avenue for established organizations, enabling them to leap over internal barriers that traditionally obstruct growth and innovation, paving the way for sustainable progress and advancement in areas like AI or sustainability."

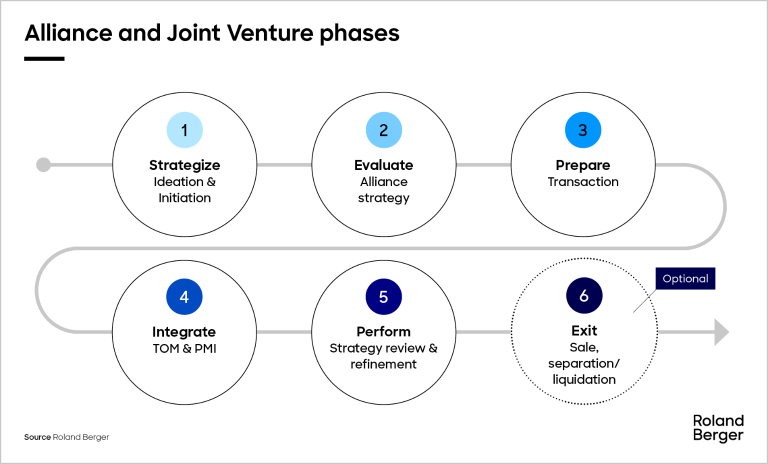

The journey of successful joint ventures encompasses five integral phases and an optional exit phase. It all starts with phase one, Strategize, where our consultants set clear objectives and align these with the overarching strategic vision of both companies involved through ideation and initiation. In phase two, Evaluate, we devise an alliance strategy and formulate a comprehensive blueprint for the partnership. This strategy is based on our proven alliance and JV framework, which focuses on control, investment and strategy fundamentals such as purpose and business model.

Following the planning phase, our consultants dive into transactional details. This is the third phase, Prepare. It entails meticulous preparation, defining explicit steps, aligning the revenue share and resource allocation, setting up a governance structure at eye level with all relevant stakeholders, as well as risk identification and mitigation to ensure a smooth transaction. Potential exit, carve-out and/or sourcing activities must also be carefully prepared in this phase. Integrate, the fourth stage, brings the post-merger integration (PMI) skillset into play, including comprehensive target operating model (TOM) design to implement the transaction planning made in phase three. In the alliance or JV blueprint, we ensure a seamless combination of the assets, personnel and operations in one document, respecting the strategic objectives and cultural limitations of the two companies involved in the parternship negotiation.

In phase five, our consultants perform the alliance or JV. First, we review the strategy and, if necessary, refine it to secure the transaction’s success. We assess the JV's efficiency, identify and tackle any existing challenges and streamline business models for optimum effectiveness. The optional sixth phase, Exit, involves creating a strategy for a potential sale, separation or liquidation to ensure the partnership continues to align with the evolving business objectives of the partner companies.

Throughout this alliance or JV process, communication and targeted change interventions underpin each phase. Using targeted content for each stakeholder group, we maintain coherence and transparency, fostering trust and managing expectations along the way.

Key success factors in navigating the alliance or joint venture lifecycle

Ready to explore the plurality of options for your business? Our alliance and joint venture experts are here to support you. Contact us to discuss how we can help you navigate all phases of the joint venture lifecycle and transform challenges into solutions. Jointly, we can bring together the best of different worlds.

Register now to receive regular insights into our Transaction & Investor Services topics.

_person_320.png?v=799507)