Companies face challenges as a result of transformation and crises. Our comprehensive restructuring advice helps you to find convincing solutions, identify trends at an early stage and successfully realign yourself to remain competitive.

Cash Management

By Matthias Holzamer and Caroline Merk

Successful strategies for efficient capital employment and more financial leeway

Active cash management is a game changer. Even when faced with upheaval after upheaval and unprecedented uncertainty about the economy and business trends, companies are still failing to acknowledge the benefits of systematic liquidity planning and management.

"With pressure on profits and a rising cost of capital, cash management plays a fundamental role in corporate management. This is not just the CFO's remit – operational business units also have a key role to play here."

Predictive cash management creates financial buffers for greater crisis resilience, providing more of a cushion against unexpected events. It allows internationally operating companies in particular to make the necessary investments in the expansion of production capacities or increased R&D activities faster and in a more targeted manner.

Often, capital-efficient business models can also be a competitive advantage. At the same time, having too much working capital is an indication that a company has built up an excessive amount of fixed and current assets and is therefore missing out on potential return on capital. Last but not least, optimized cash management can be used as a differentiating factor for any upcoming financing, as companies with sound cash planning can expect to receive better terms on the capital markets or with banks and investors.

Cash management is what you need in times of crisis and upheaval

In our experience, companies' willingness to prioritize their cash management system varies greatly depending on the economic conditions they are operating under. When business is good, willingness is usually low or non-existent. Also, companies operating in stable markets who often have a sound knowledge of working capital and liquidity management frequently do not use this to their advantage in business.

In times of crisis and great upheaval, however, cash management is a must. Defined liquidity parameters can only be achieved with proactive planning and appropriate cash flows. Companies that seek to make themselves fit for the future and ensure maximum resilience through unstable times can best achieve their goals with a cash-focused organization: with a permanent cash office and the right incentives and reporting lines.

Our cash excellence framework brings lasting results

Our cash excellence framework takes your company's cash management to the next level. First, we get a proper overview: How available is your cash-relevant data and what quality is it? Has the actual and historical cash situation been analyzed and is it integrated into your P&L and cash planning? What theories have you come up with based on the available data and the initial analyses?

We take the answers to those questions and use them to determine the right ambition level for cash management at your company. The main ratios we apply are the cash conversion cycle (CCC), cash conversion rate (CCR), net cash flow (NCF), and net working capital (NWC). In addition, we use benchmarks and inefficiency analyses to examine the gap to industry best practice and define plausible and achievable targets for the above ratios. Then we refine these in the next step, for instance by clearly breaking down and allocating targets for inventories, liabilities, and receivables. We also scrutinize and validate top-down target allocation and develop overarching levers for liquidity optimization.

Building on that basis, we define and validate specific qualitative and quantitative measures for optimizing your cash position in a bottom-up approach, and document these in standard templates. We make sure that the individual measures are broken down to the company, plant, or business unit level and assigned to specific departments or business functions. Doing so enables them to be comprehensively and continuously monitored. In the final step in the process, further detailing of the measures helps ensure target achievement by increasing cash inflows and reducing cash outflows.

Seven success factors for working capital optimization

Our cash excellence framework for financially healthy and flexible companies is based on seven success factors with a proven track record from countless projects:

- Ensuring end-to-end transparency over all KPIs and ratios in the cash and working capital management system within the relevant core processes

- Pursuing a top-down strategy of benchmarking against industry best practice, with ambitious, business-specific working capital targets

- Critically appraising the company's actual working capital management and examining the levers for operational optimization available within the industry and beyond

- Including all relevant business functions in formulating business-specific measures

- Preparing flanking measures to optimize structural factors: targets/strategy, organization/resources, processes, financial analysis/KPIs, and systems

- Training project members and creating incentives for the cash management project

- Coaching other staff and embedding the targets from the cash management project in the business plan and in people's annual objectives

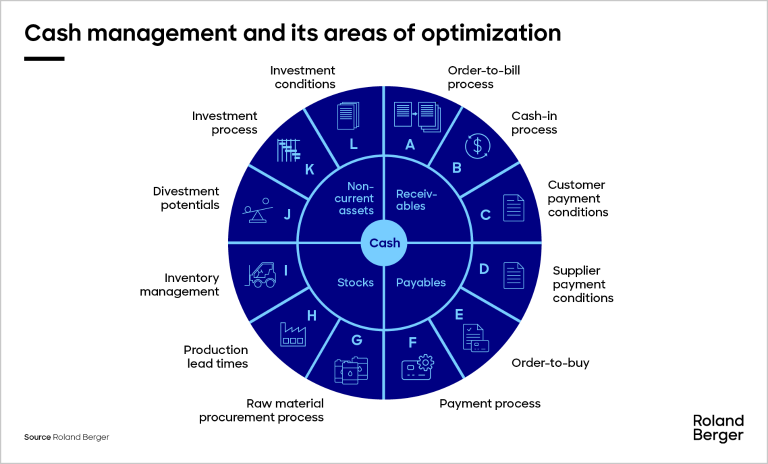

Our proven best practices are applied across all areas of cash management, ranging from optimizing payment terms and invoicing to efficiently managing payment processes and optimizing accounts payable in the long term. We also support companies in the financial analysis of investment decisions and processes, the divestment of businesses, the management of inventories, and the financial optimization of production planning and production flow.

"Many companies lack clear, end-to-end cash flow management. This underlines the need for a centrally organized cash management system."

Efficient governance secures success

The governance concept we initiate in parallel ensures the seamless integration of all measures into the organization as a whole. We define meetings across hierarchies and ensure consistent communications at all levels. Cash ambassadors – who are there to point out problems at an early stage – are an important element of a campaign to implement a cash culture that ensures the long-term commitment of everyone involved. Defining an escalation pyramid that differentiates between the underlying issues is also a very useful approach.

Clear targets, a consistent meeting structure, permanent risk monitoring, and KPI reporting serve to stabilize ongoing cash management as well as financial management, and help ensure that financial management within the organization sees continual improvement. In the target state, the company will have an automated, interactive KPI dashboard that meets reporting requirements across all levels of the hierarchy.

Especially when upheaval and disruption bring challenges to businesses, active cash management is a must to keep companies financially healthy and secure the necessary financial flexibility. Businesses with more cash normally have a decisive advantage against the competition.

Register now to receive regular updates on our restructuring and turnaround topics and publications.