Digital due diligence

Assessing a company's digital readiness, robustness and growth potential

Digital is becoming the "new normal". As digital business models and online-based businesses enjoy rapid growth, they are becoming more and more attractive for investors. Traditional companies are also developing their digital offering, either with a view to capturing new value opportunities or as a way to protect themselves from digital competitors. Before making major investments, investors thus increasingly performing a "Digital Due Diligence". This is a systematic assessment of the target company's digital readiness, digital robustness and digital growth potential, providing a truly holistic perspective on the company, especially when combined with a Commercial Due Diligence.

"Unjustified hype on digital platforms has caused billions of losses in the past. A proper understanding of digital trends and technologies is necessary in order to avoid investing in a burning platform."

Understanding digital readiness

Digital business models cover a broad range of industries and business types, from e-commerce and software to marketplaces, platforms and digital services. The companies adopting such models range from digital pure players to digitally-enabled businesses, and include both "born-digital" businesses and traditional players making the leap into digital. Each of these different business models has different success factors and faces different threats. However, they have one thing in common: Their digital readiness and robustness are integral to their survival and growth.

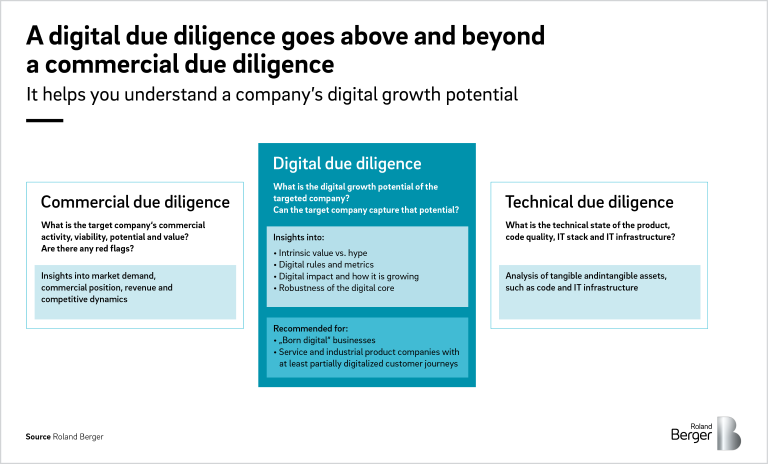

A Digital Due Diligence gives potential investors a comprehensive view of a target company's digital readiness and growth potential, taking into account its competitors and digital market environment. The Digital Due Diligence is closely linked to the company's commercial due diligence and can potentially be accompanied by an additional technical due diligence. To create a full picture, a Digital Due Diligence is vital for both born-digital businesses and other companies with at least partially digitalized customer journeys.

Ensuring a holistic view

In today's digital age, taking a holistic view of a business is crucial. That includes in particular the company's commercial and digital key performance indicators (KPIs) and value drivers. Creating a comprehensive picture involves examining a wide range of external and internal sources of information, from hard KPIs to qualitative feedback from the company's customers, from the company's online marketing performance to its customer relationship management (CRM) along the customer journey.

At Roland Berger, our Digital Due Diligences aim to answer a set of key questions about the target company and derive concrete implications from the answers to those questions. To put the data into context, we look at industry benchmarks and draw on our industry expertise . In addition, we investigate the points at which the commercial analysis ( corporate strategy , cohorts, customer lifetime value) intersects with the digital analysis. A supplementary technical due diligence can further enables deeper insights into the IT stack, IT infrastructure and code quality.

The Roland Berger approach to Digital Due Diligence

Roland Berger offers many advantages as your partner for Digital Due Diligence. We provide a team made up of experts in both commercial due diligence and digital due diligence, ensuring an integrated approach. We have dedicated experts in all areas of digital and IT technology, combined with excellent data and analytics capabilities, including proprietary toolkits. At the same time, we draw on our hands-on leadership experience in startups, scale-ups and private equity portfolio companies. We also have one of the largest and most prestigious alumni and expert networks, including both digital and industry experts, whom we can call on as necessary.

In a typical Digital Due Diligence project, we cover the typical modules of a due diligence with a strong focus on digital drivers, enriched by technological and digital growth considerations. Importantly, we include an investor perspective, both in terms of risks and value creation potentials.

The set of questions we aim to answer can be summarized as follows:

Strategy, business model and organization

- What is the role of digital in the company's business model and strategy?

- How well does the business model and pricing approach fit with the industry's endgame?

Lead management

- How strong is the company's presence in digital channels?

- What is the company's funnel strategy and how efficient is its customer acquisition?

Market

- What is the size and potential of the digital market?

- What areas are open to potential disruption?

Customers

- How aware are customers of digital, and how open are they to it?

- How well is the customer journey equipped for digital?

Competitors

- How well does the company perform from a digital perspective compared to its competitors?

- What is the likelihood of competitive disruption?

Value creation

- What are the recommended value-creation levers during the holding period?

Interested in finding out more? Download our presentation on digital due diligence or contact one of our dedicated expert.

Register now to download the full PDF on “Digital Due Diligence" including key insights, suggestions, and current developments.