By viewing decarbonization as an opportunity, rather than a threat, and taking immediate action on climate change, companies can gain a competitive edge.

A double chance for Europe's industry

The ferocious pressure for decarbonization and digitalization is a golden opportunity – if we are bold enough to take the right steps

As difficult as the last 24 months have been in the face of the global COVID-19 pandemic coupled with advancing climate change, CO2 emissions and numerous geopolitical tensions, they have brought greater clarity for corporate decision-makers in two ways. First, many companies, along with their supply chains and sales channels, have been subjected to an unprecedented endurance test. Those that passed the test can look towards potential future crises with a much more relaxed attitude. And second, out of the multitude of trends, two topics have clearly emerged that will dominate businesses' activity in the coming decade: the drive to combat climate change and the digitalization of all sectors of the economy and all areas of life. Many of the question marks around strategic planning in previous years have faded into the background as a result. Businesses now inhabit a less VUCA world (volatile, uncertain, complex and ambiguous) than they did two years ago.

"Consistent climate action and digital transformation represent an enormous opportunity for Europe's industry."

The decarbonization and digitalization megatrends

Many developments of recent years have been correctly identified as trends that are destined to remain with us: demographic change and the skills gap, the transformation of globalization and the rise of populist political tendencies. At the same time, it has become clear over past months that these developments are overlaid by two megatrends: decarbonization and digitalization . It is these two trends that set the guardrails for all strategic planning.

There is no doubt that the need to decarbonize and to reduce greenhouse gas emissions poses an immense challenge for companies. But we must not overlook the huge business potential that climate action, climate and emission policies, renewable forms of energy and decarbonization offer. The global green tech market, for example, will grow to be worth almost six trillion euros by 2025 – an enormous opportunity for Europe's businesses.

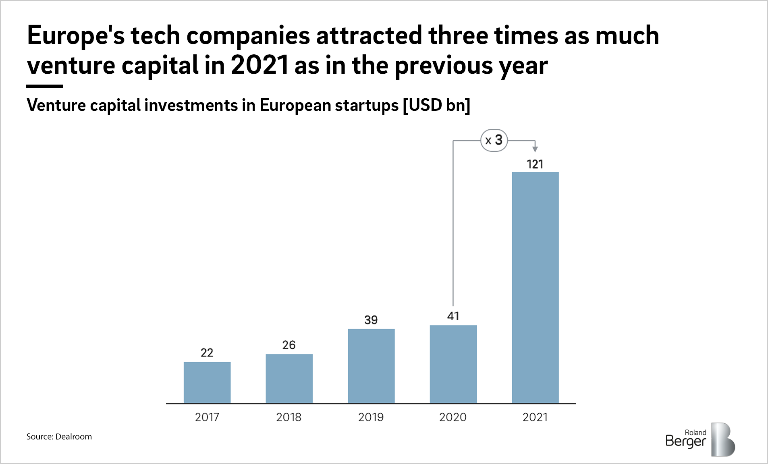

The same is true of the digital transformation and the need to digitize: It is not new, but the events of recent months have made it very clear that digitalization must become the core of the modern business model. Investors are already acting accordingly: Venture capital firm Atomico estimates that a good USD 120 billion in venture capital has been invested in European startups in 2021. And when it comes to early stage investments in tech companies, Europe has even caught up with the United States – a hopeful sign for the future of Europe's startup ecosystem!

So what action should be taken? A vision for the future of Europe's industry

Deep Decarbonization and business digitalization represent an enormous opportunity for the revenues of European companies – as long as they can master the challenges of the upcoming transformation. Digital transformation, a consistent policy regarding climate change and a low-carbon economy can only succeed if the right political framework is created now, if the right business decisions are made now and if the capital needed for the transformation agenda is mobilized now.

Lean and efficient political processes to foster future technologies

The continued fragmentation of Europe's Single Market represents a significant structural disadvantage for companies on the continent. Added to that, the institutional complexity of the European Union has a negative impact on Europe's competitiveness. The European funding landscape in particular suffers from the fact that its resources are not sufficiently focused on key technologies of the future.

Looking at the two parameters of the future relevance of technologies and our current position in them, there are six main areas and future pathways of technology where Europe must focus its investments more sharply going forward.

- Battery technologies, especially for electric mobility

- Digital technologies (cloud, AI, quantum computing)

- Biotechnologies

- Semiconductor technologies

- Power-to-X technologies for the storage of surplus electricity generated from renewable energies

- Digital infrastructure, and particularly forward-looking investments and commitment to defining the 6G standard

In short, Europe's policymakers must act now to set the right course to foster cross-cutting innovation.

Companies as drivers of a long-term transformation strategy

Too many business strategies are currently still based on a static mindset that systematically underestimates dynamic disruptions. New competitors entering the market, for example, is not perceived as a challenge by market incumbents until it's far too late. If they want to safeguard their innovative power and be able to spot disruptive technologies and business models early, companies will have to rely much more on cooperation or partnerships.

The speed of the upcoming transformation also demands a much more active approach to portfolio management than before. To make themselves more competitive in the wake of decarbonization and digitalization, to stimulate the pathway to a carbon-free or carbon-neutral economy, companies will need to be in a position to either restructure or divest business units or buy up new ones, all at the same time.

Because in the end, a forward-looking corporate strategy and business transformation with a long-range outlook depends on the company's business being based on the right performance indicators: not maximizing the return on sales in the short term but increasing the shareholder value and competitive advantage long term.

In conclusion, Europe's industrial companies must put long-range transformation and digital strategies, active portfolio management and the expansion of strategic cooperation and partnerships on the agenda.

Powerful capital markets for innovation and growth

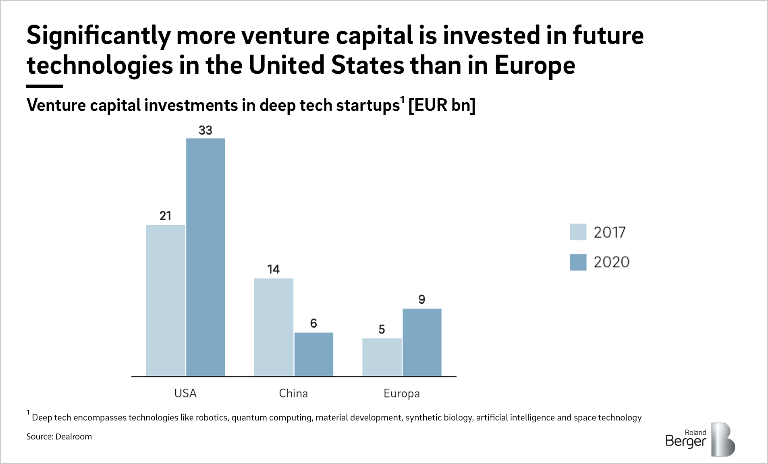

Even though the European market has become considerably more attractive for venture capital investors, there are still some worrying gaps in the funding of significant future technologies, particularly in deep tech innovations in robotics, quantum computing, material development, synthetic biology, artificial intelligence and space technology. In Europe, EUR 9.4 billion was invested in this area in 2020 compared to EUR 33 billion in the United States.

The strong role of debt financing for Europe's companies has major advantages in that it allows firms to maintain successful shareholder structures. Having a high proportion of debt financing can, however, lead to risk-averse portfolio management or a risk-averse innovation strategy. To put it another way: For disruptive changes and new business models, we need a stronger culture of equity financing in Europe and especially in Germany.

In order to have a capital market with deeper pockets in Europe and in Germany in particular, we need a different savings culture that does not penalize investments in equity-focused investment products. Better funded pension schemes are the crucial lever for this.

That is because the traditional savings culture that prevails particularly in Germany means that the returns generated by German companies often do not benefit German savers at all but instead create wealth for investors abroad. In this respect, a savings culture fixated on debt financing is detrimental to prosperity in Europe.

This means we need equity to play a stronger role in Europe – both in the financing of innovations and in pension schemes.

Embrace risk, don't avoid it

Europe's industry is key to Europe's future progress and its future prosperity. It accounts for more than 20 percent of the EU economy and employs around 35 million people, with many millions more jobs here in Germany and elsewhere being indirectly dependent on industry. Europe's industry is responsible for 80 percent of all goods exports and is a key reason why the EU is both the world's biggest source of foreign direct investment and the biggest destination for FDI too.

The upcoming transformation around the decarbonization and digitalization trends brings tremendous opportunities for Europe's industry and the entire continent. At Roland Berger we have therefore focused our consulting portfolio on four clear topics with which we help companies turn these opportunities to their advantage: By creating robust organizations and aligning business models towards the new sustainability paradigm, and by championing smart mobility and Next Generation Manufacturing , we advise our clients on their journey through the digital transformation and towards sustainable business processes.

If we want to capitalize on the double chance offered by decarbonization and digitalization, the outlined measures must be flanked by a new culture of risk taking in terms of digital solutions, digital processes, digital forms, digital business transformations, and digital formats. We as a society must stop leaning on the status quo and avoiding risks and must instead be bolder and more entrepreneurial – and dare to embark on a new era of rapid industrial expansion.