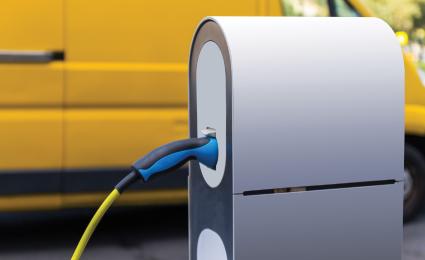

After the energy price shock resulted in a subdued start to the year, the EV and EV charging markets sparked back into life in late 2022. Almost all countries featured in the fourth edition of Roland Berger’s EV Charging Index hit record-high scores, with several leaping up the rankings. Also covered in the edition: customer behavior is changing and OEM's strategy for EV charging infrastructure is showing regional differences.

A model to forecast EV charging demand

By Tim Longstaff and Adam Healy

A toolkit to predict charging demand, supply side response and future opportunities in electric mobility

With the electric vehicle market booming, the need to forecast charger demand is becoming increasingly important for players in the electric vehicle charging market. Meeting future EV charger demand, and identifying EV market opportunities, will be difficult without reliable predictions. Roland Berger has a solution – its EV charging forecast model.

"It is important to retain a long-term view as e-mobility enters its early rapid growth phase: EV adoption and charging infrastructure roll-out will not move in lockstep – it could be a bumpy road ahead."

A growing electric vehicle (EV) market means one thing is certain – the world will need more and more EV chargers in the future. Indeed, demand for chargers is already exploding, and the electric vehicle charging station (EVCS) market is expected to grow exponentially over the next few years.

However, for the EV charging station market to grow successfully, it needs to keep up with and correctly forecast charger demand among electric vehicle users. So how can future charger demand be predicted, and how can market players identify profitable EV charger opportunities on the supply side?

The European charging market

Currently, countries in Europe are at different stages of EV market maturity, as shown by the varying levels of EV penetration in both the existing vehicle parc and new EV vehicle sales. In markets such as France and the UK which are hot on the heels of the leading Nordic nations, there has been significant charging infrastructure build-out in recent years, but major markets such as Spain, Italy and parts of Eastern Europe are a step behind on this journey, creating opportunities for charging infrastructure providers.

Key drivers and trends in charging

The exponential growth in the European market is being driven primarily by the rapid uptake of electric vehicles and public charging. For example, EV penetration in the UK, currently at around 2% of the passenger car and light commercial vehicle parc, is forecast to increase exponentially to around 20% in 2030 and around 70% in 2040. And energy demand for public EV charging is forecast to increase by 50 times between 2023 and 2050.

Another key growth factor is the change in demand in different EV charging use cases, which is shifting from charging electric vehicles at home to public charging. In the UK in 2022, for example, more than 85% of EV owners had private off-street parking and home EV charger access, while we estimate that the future figure will be between 65% and 70%. The main reason behind this shift is the decline in home chargers as EV owners shift to faster, more convenient and increasingly numerous public charging facilities. The number of public chargers in the UK, for example, rose from around 7,000 in 2016 to 37,000 in 2022, with fast chargers or ultra-fast chargers making up an ever-increasing share, and of late, outpacing the rate of growth of EVs.

"We predict that as BEV penetration accelerates and owner profiles shift, public charging modes will gain share from private charging modes."

The challenge

It’s clear, therefore, that to ensure a successful future charging market, EVCS players need to be able to forecast demand and satisfy it. Charge point operators (CPOs), for example, must correctly anticipate demand and deploy the right chargers at the right locations (from fuel forecourts and public car parks to restaurants and shops) for electric vehicles, and maximize their utilization. Indeed, the short- and long-term implications of demand on EV charger economics should be fundamental inputs to the decisions of policymakers and investors alike.

The electric vehicle charging station market is complex and competitive, with various stakeholders, including CPOs, fuel forecourt operators, energy companies, retailers and automotive OEMs all actively pursuing positions within the value chain. But despite its rapid growth, EVCS remains a challenging business; many players are still operating at a loss and achieving uneconomical utilization. So a key question that winners in EVCS will need to address is how the market for EV charging provision across different use cases will shape up as EV penetration growth continues.

Our solution

In many countries, there is no centralized and coordinated view on the required number and type of electric vehicle chargers for different use cases and locations. We have therefore developed a tool to forecast EV charging demand in the nascent public EVCS market, helping our clients to answer the following questions:

- What does the growth of EVs mean for charging demand?

- How many public EV chargers will the market supply to meet the demand?

- And what kind of return on investment can companies get from participating in the EVCS value chain?

Our model is based on forecasting several key underlying market drivers, including growth of EVs in the vehicle parc, and the increasing demand for public EV charging. A full description and results of our modeling are available in the accompanying document. In this, we also lay out the benefits of our toolkit to different sectors of the market, from CPOs and investors to utilities and public organizations.

We have significant experience working with all players in the electric vehicle charging station market, as shown by our client success stories, and would welcome the opportunity to discuss any questions you may have. Please download the document or contact one of our experts for more details.

Register now to download the full "EV Charging Market Forecast" including further details on our findings and insights into the growing need for reliable forecasts to meet the future EV charger demand and about opportunities in the electric mobility market.

_image_caption_none.jpg)