Advanced Driver-Assistance Systems: A ubiquitous technology for the future of vehicles

While Covid-19 has slowed driver-assist features, they will be a common presence in everyday vehicles by 2025. Here’s what the industry needs to know

A new study by Roland Berger reveals that development of Advanced Driver-Assistance Systems (ADAS) was delayed by the pandemic. Here’s where the industry must catch up to meet future regulations and demand.

Management Summary

By 2025, Advanced Driver-Assistance Systems (ADAS) will be a common feature of nearly every new vehicle sold in the developed world. But manufacturers, suppliers, industry analysts, and academia are forecasting very different outcomes with very different, if not unclear, datasets on future penetration of ADAS features. Moreover, even historic penetration rates are being widely disputed by the industry.

In an effort to find more accurate answers, Roland Berger recently surveyed over 80 tier 1 global manufacturers, automotive suppliers , and industry experts — in addition to nearly 3,000 drivers — on the supply and demand of expected ADAS features by 2025 and beyond. To accomplish this, we relied on both market insights and novel analysis, including direct market experts surveys, international consumer surveys, and in-depth desk research such as feature analysis of new car offerings in core markets to clarify the status quo.

For this study, we broadly analyzed a total of 18 ADAS features which are either commercially available or expected to be available by 2025. What we found was this: 85% of vehicles produced globally in 2025 will have some level of driving automation (L1 and above, explained below). At the same time, we do not anticipate L4 (“highly automated”) or L5 (“fully automated”) features to achieve anything more than 1% penetration by 2025.

Due to stricter regulations, however, we expect Europe to lead all other regions in ADAS penetration by 2025. Meanwhile, the US are second before China in ADAS features by 10-20%, especially with higher penetration of both basic L1 features and L3 (“conditional automation) features or higher.

Nevertheless, the ongoing pandemic has negatively slowed global development and demand of ADAS features, in some cases as high as -17%. This is especially true of more advanced ADAS features, but even the world’s largest automobile market (US) reports that development of L1-L3 features has been slowed by lockdowns. Either way, we forecast a marked increase in basic driver assistant features by 2025, thereby making the technology ubiquitous. Consequently, key sensor equipment such as front radars and cameras will become standard vehicle equipment in the next few years.

To prepare for this future, all market players should be ready to consider all opportunities resulting from fast component growth and incoming features. After reading this report, institutional investors, automotive OEMs, and relevant suppliers should better understand the near-term adoption of ADAS, where lower levels are expected, and how COVID has impacted this transformative and fast-growing technology.

"ADAS features will be ubiquitous by 2025 with 85% of vehicles produced globally featuring some level of driving automation, while highly automated L4/5 will still be a rarity."

Defining Features

Advanced driver-assistance systems were invented to reduce human errors, which cause the majority of car crashes. The technology first began 50 years ago after the adoption of anti-lock brakes. Later, ADAS grew to include electronic stability control, traction control, blind spot information systems, lane departure warnings, and adaptive cruise control.

Today, ADAS is one of the fastest-growing segments in automotive electronics . But not all ADAS features are created equal. In fact, there is no standard nomenclature for ADAS features, which makes tracking them difficult. To further complicate the issue, multiple ADAS features are often bundled by OEMs into optional technology packages or only enabled with a paid software update.

Broadly speaking, however, ADAS is defined by one of the following six feature levels (L0-L5):

- L0: “Basic.” Includes front and rear collision warning indicators, blind spot detectors, and lane departure warnings. Many modern vehicles either come standard with these features or make them optional.

- L1: “Driver assistance.” Includes automatic emergency braking, adaptive cruise control, lane keep assist, distance control, automatic speed limiting, interaction assistance, and collision avoidance. Ford’s Co-Pilot 360 Safety Suite is a good example.

- L2: “Partial automation.” This includes adaptive cruise control with lane keep assist in parallel, advanced cruise control (partial eyes and hands free adaptive cruise control with automatic lane change in parallel), automatic emergency steering and braking, and fully automatic parking assist. Ford’s Co-Pilot 360 Assist+, GM's Super/Ultra Cruise, Tesla's Autopilot, and Volvo's Pilot Assist are all examples.

- L3: “Conditional automation.” Highway piloting with automatic lane changes, full environmental monitoring, remote parking, and no human interaction from exit to exit. Examples include Tesla's Autopilot, Audi's Traffic Jam Pilot, Mercedes' Drive Pilot, and BMW's ADS iNEXT.

- L4: “High automation.” Fully automated driving in some situations without need for humans as fallback (aka “chauffeur mode”). This isn’t currently offered or announced in a production vehicle.

- L5: “Full automation.” Fully autonomous, self-driving vehicle with no need for a human driver. Currently unavailable and not expected until 2030 or 2035 at the earliest.

The above levels will be used below for analyzing the current state of ADAS.

Key Insights

After surveying over 80 automobile experts—half of which from OEMs, 40% from tier 1 suppliers, and 5% tech/industry analysts—across the US, Europe, and China, we coupled their responses with surveys of nearly 3,000 prospective buyers who purchased or leased a new car within the last 12 months (or intend to within the next three years). We then cross-referenced both datasets with secondary research from leading analysts and third-party databases, including IHS Market, SBD Automotive, NADA, and JD Power.

What follows is a proprietary forecast of key ADAS insights by region through 2025 and beyond:

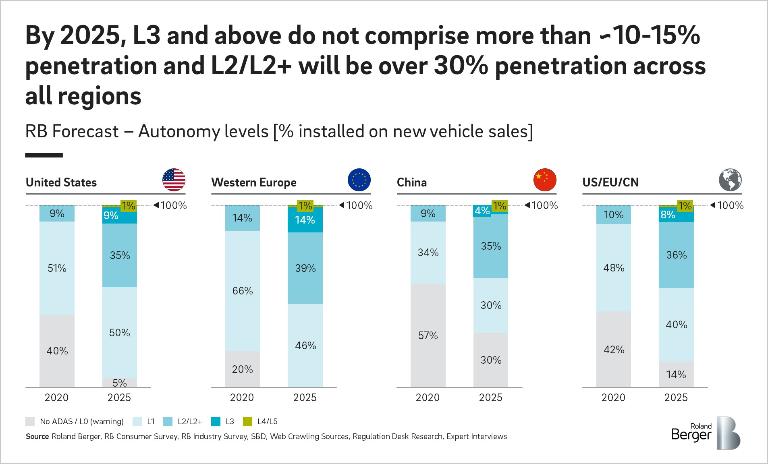

- By 2025, L3 and higher features will account for no more than 10-15% of total ADAS penetration, whereas L2 features will achieve over 30% penetration across all regions.

- Due to stricter regulations, Europe is expected to have the greatest penetration of new ADAS vehicles sold by 2025. Roughly 46% will have only L1 features, and the bloc will lead the world in available features of both L2 and L3 levels that same year, 39% and 14% respectively. Unlike both the US and China, we expect 100% of European vehicles will have at least L1 technology or higher.

- Like Europe, the US market is expected to significantly increase ADAS availability by 2025 across the board, even more so than China. By then, we predict over 50% of new cars sold will have L1 technology, 35% with L2 technology, 9% with L3 features, and just 1% with L4/L5 technology. That same year, we expect less than 5% of American vehicles to have no ADAS features beyond simple warning indicators.

- By 2025, new Chinese vehicles are expected to feature similar growth levels of ADAS adoption, albeit around 25% less overall when compared to the US. By then, we forecast about 30% of new sold cars will have little to no ADAS features; 30% will have L1 features only, one third with L2 features, and the balance (5%) with L3 or higher.

- On a global scale, we expect 14% of the world's vehicles to have no ADAS features by 2025, 40% with L1 features, 36% with L2 features, and 10% with L3 or higher features. All things said, this is a dramatic rise from current levels, as demonstrated in the following graph.

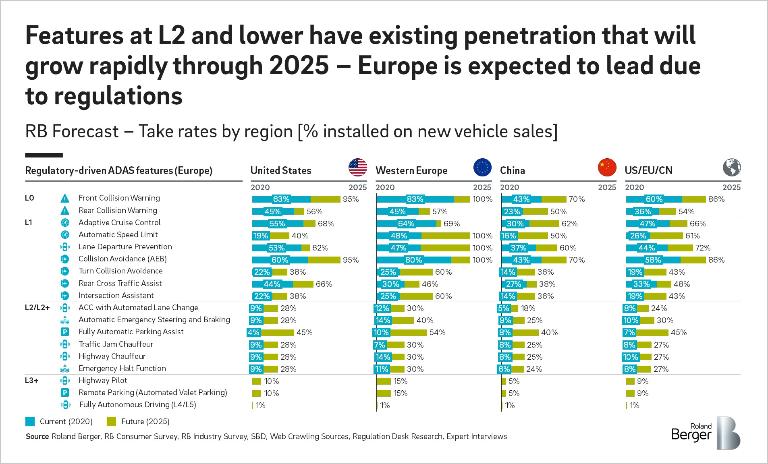

Due to regulatory requirements, we expect Europe to rapidly grow and lead overall ADAS features by 2025. In fact, EU regulations of ADAS features will make front facing cameras and radars standard equipment in all vehicles sold there by 2024. For example, we expect collision warning indicators to rise from 83% today to 100% by 2025. Similarly, auto speed limits will jump from 48% today to 100% for the same period. Lane departure prevention features will also double to 100% by 2025.

As unit volumes increase, OEMs will increasingly seek out sensor designs and suppliers as ADAS features become increasingly standardized and commoditized, especially in Europe. But both US and China will demand significantly more ADAS features in the coming year. In turn, suppliers along the ADAS value chain must rethink their sources of differentiation, either in manufacturing scale or new products and software .

COVID Conclusions

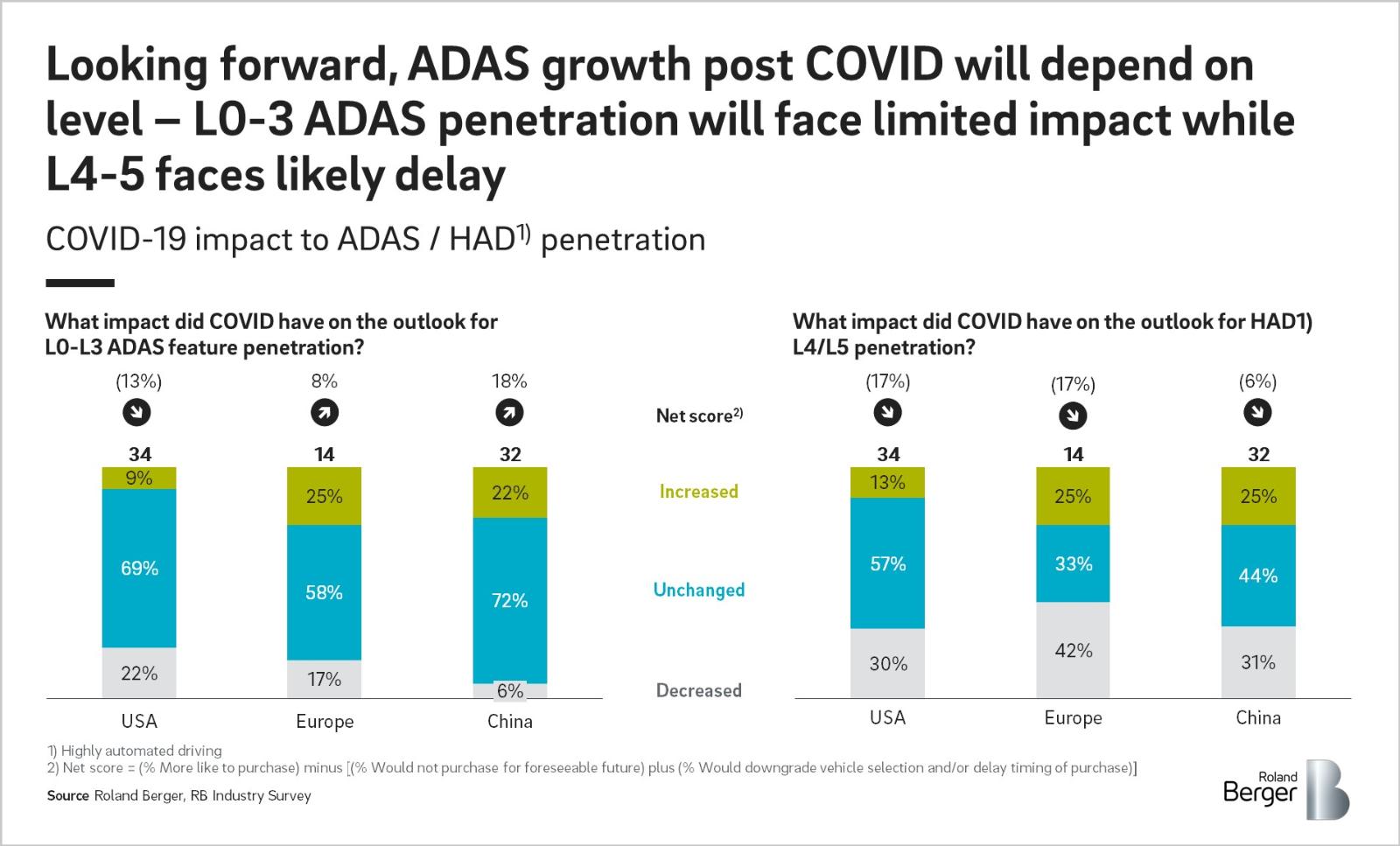

Moving forward, ADAS growth post COVID will depend on the feature level, according to our surveying model. For instance, L0-3 penetration will face a limited impact, while L4-5 will likely face delays as OEMs and their suppliers adjust their strategies to accommodate for downswings and changing demand as the global market moves towards full recovery .

As our study revealed, certain regions will suffer more than others. When asked what impact COVID will have on the outlook of L0-L3 adoption, US respondents reported a net negative impact of 13% of pre-COVID levels. Conversely, China respondents reported a net positive impact of 18%, followed by European respondents with a net positive impact of 8%.

In other words, US consumers plan to limit their ADAS purchases due to economic challenges, whereas both Chinese and European consumers expect to increase their interest in ADAS features as regulations and available technology increase. That said, ADAS adoption is expected to rise considerably in all three regions by 2025.

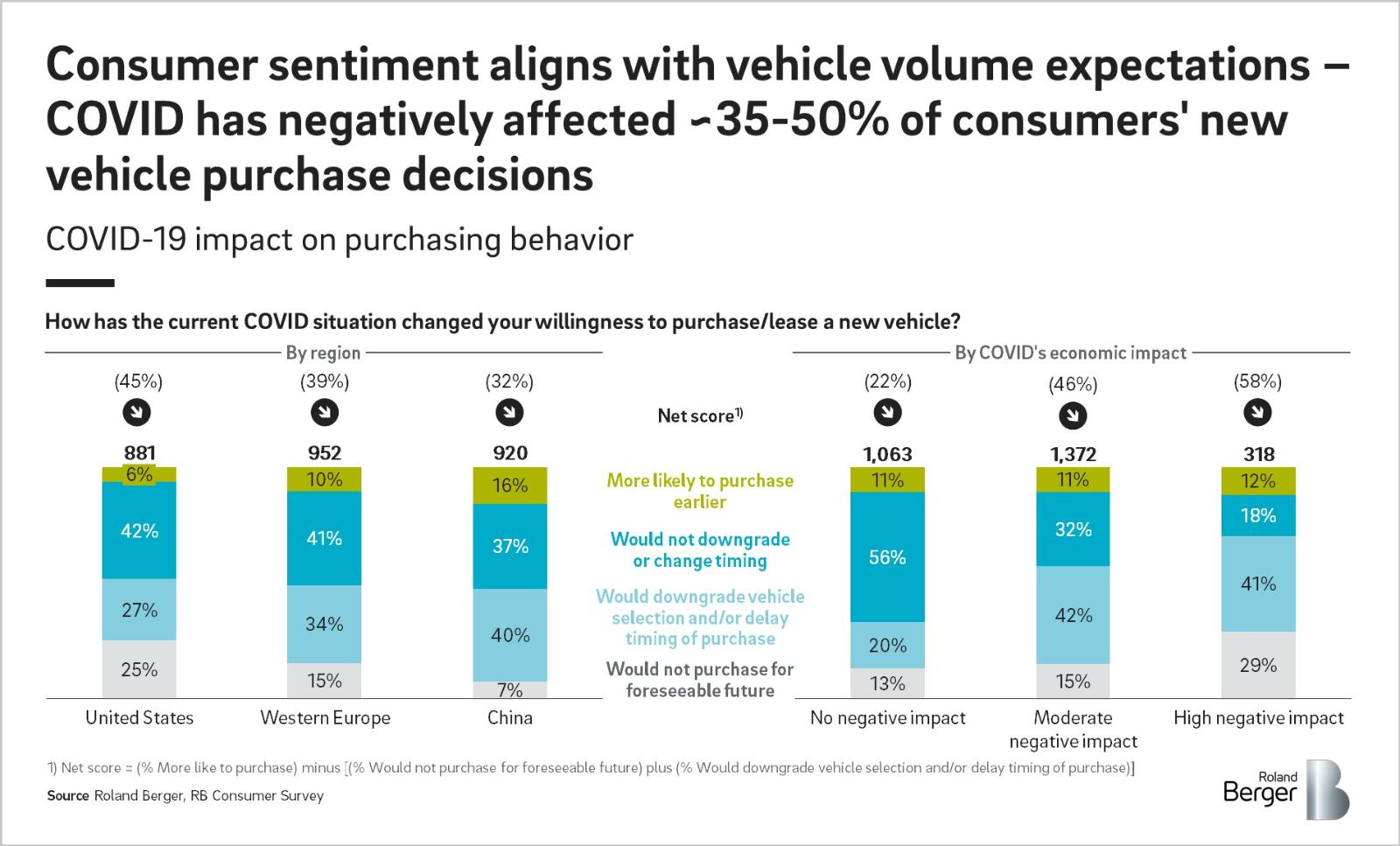

In terms of purchase intent for cars in general, however, consumer sentiment aligns with the slumping effect brought upon by pandemic. Anywhere from a third to nearly half of all global respondents say COVID has negatively affected their intent to purchase a new vehicle by 2025. Regionally speaking, US respondents say COVID has reduced new car considerations by -45%, followed by -39% in Europe, and -32% in China. It’s a concern the automotive market cannot avoid in the coming years.

Although the future of ADAS remains promising, it’s also somewhat mixed, due to the pandemic’s lasting effects. This uncertainty has resulted in a measurable negative impact on US adoption of ADAS, and with total global adoption of more advanced autonomous features. Nevertheless, ADAS features will continue to grow significantly through 2025 and gain even more steam into 2030 and 2035, at which point we expect the first wave of highly and/or fully autonomous vehicles to make their debut.

Sign up for our newsletter and get regular updates on Automotive topics.