Agriculture in Southeast Asia

By Rohit Bhatia

Agriculture in Southeast Asia: investment opportunities

"Private capital can play a pivotal role in the transformation of agriculture in Southeast Asia; supporting the growth in new technologies and routes to market."

As the world’s population has grown, agriculture has found ways to

become more efficient and continue to feed the growing demand with

smaller proportional increase in land used. Driven by the expected demand from higher population and lifestyle changes, current

estimates suggest an additional 600 mn hectares of land is needed to feed the world by 2050. Whilst Southeast Asia has the potential to meet part of this demand, soil degradation and deforestation, and urbanization means that significant amounts of land may not be suitable for agriculture.

Southeast Asia is a major contributor of the world’s food supply –

accounting for over 90% of global rice production – and is set to increase

for most crops, meat, poultry, and fish. The reliance on Southeast Asia’s

agricultural production will drive investment into upstream agri-technology,

services, and sciences.

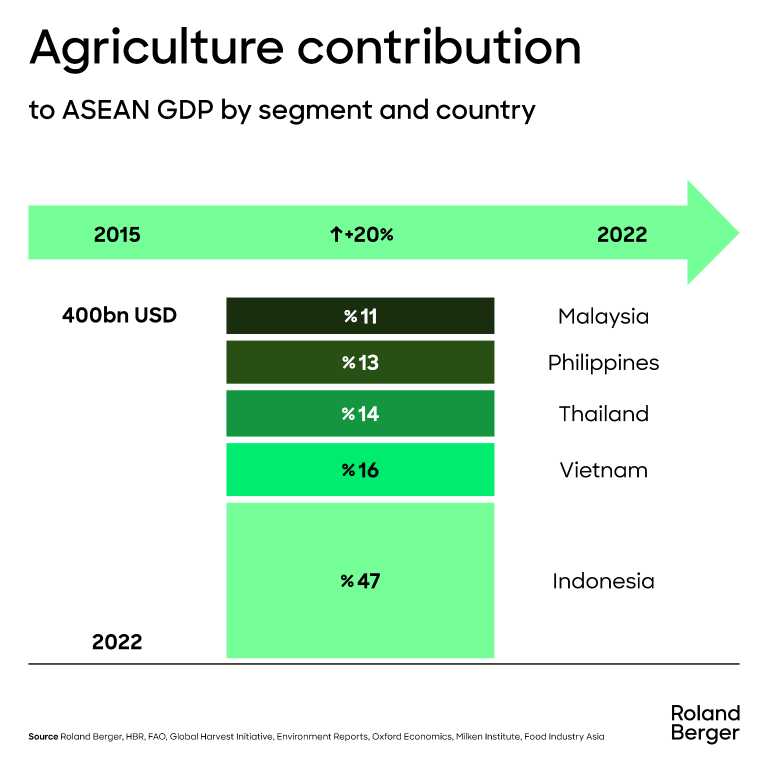

Agricultural production accounts USD 400 bn contributing 12% to the region’s overall GDP (c. USD 3.7tn). Across core markets this contribution to GDP is 25% higher, in real terms, compared to 2015. By 2031 the region’s agri-production is projected to increase by 25% — crop production is expected to account for 62% of total agri-output.

ASEAN’s agricultural landscape

It is estimated that over the next decade economies in SEA require c. USD 800 bn of investment to meet consumer demand. Considering this,

the agri-sector is expected to witness significant and rapid growth

against an ever-challenging landscape for transformational farming

practices to improve production yields and capacity, land usage, and

reduction of emissions.

Trends

Technology and digitalization will further drive agricultural advancements,

boosting productivity and yield. Regional trends indicate a stronger and

more promising trajectory for investment opportunities in the agri-tech

space, surpassing those in downstream (i.e. food processing).

Business models

New business models are emerging across different parts of the agriculture value chain. New entrants are disrupting services typically covered by input companies and distributors/dealer in traditional farming.

Investment opportunities

Based on recent market and investment trends here are some potential investment themes and theses for investors to consider:

The region can play an important role in supporting the growing demand for food while maintaining a focus on doing this sustainably. Southeast Asia is also well positioned to capture the export demand beyond the traditional products (e.g. palm, rice, seafood) with new products and business models. The landscape of the agriculture market in Southeast Asia presents ample opportunities for investors across different parts of the value chain. There has been growing interest in agri-tech, amongst others, which saw significant investments in recent years.

The expected stabilization in agriculture input and output prices from the pandemic, and macro and geo-political induced inflation in soft commodity prices, would support opportunities for investment in 2024.

Register here to get the full ASEAN Private Equity Newsletter.