automotive-disruption-radar.com

Automotive Disruption Radar #9

By Wolfgang Bernhart and Stefan Riederle

Breakthrough: The electric vehicle market finally comes of age, with an almost 5% market share

The ninth edition of the Automotive Disruption Radar is all about electric vehicles (EVs). After years of unremarkable performances, the electric vehicle market jolted into life in 2020 with multiple indicators showing strong growth and record highs. The report also assesses the current high valuations of new players, and how OEMs are striking back.

The EV market finally took off in 2020, with sales, market share and other key industry indicators all hitting record highs. EV penetration more than tripled between 2017 and 2020 to reach 4.7% of total vehicle sales, according to the latest Automotive Disruption Radar (ADR). It also found clear signs that it’s not just trailblazers like Tesla that are pushing the shift towards EVs – traditional automakers also making potentially game-changing advances and investments.

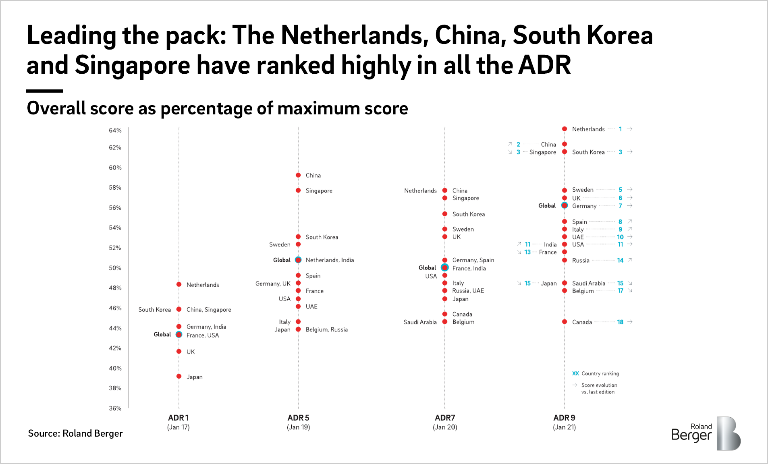

Overall, the ninth edition of the ADR, a twice-yearly report that tracks 26 automotive indicators across 18 countries, recorded the highest average country score to date. It rose from 55% of the maximum achievable score in ADR8 to 56%, likely propelled by the Covid-19 pandemic’s positive effect on disruptive technologies.

"The next 36 months will be very exciting for the EV market: Many OEMs have demonstrated impressive plans and actions in terms of their transformation speed towards electrified powertrains. This will increase the competition around EVs and the new EV OEMs will need to somehow secure the competitiveness of their products."

As it did in ADR8 (September 2020), the Netherlands topped the rankings, with a score of 83 out of 130 points. It secured top spot thanks largely to its position as a leader in electrification for the countries in scope of the ADR. For example, its share of EV sales vs. total vehicle sales hit 22.2%, far above the ADR9 average of 4.7% and behind only Sweden (29.9%). The country also offers the best selection of EV models, with 37.8% of available models now electric.

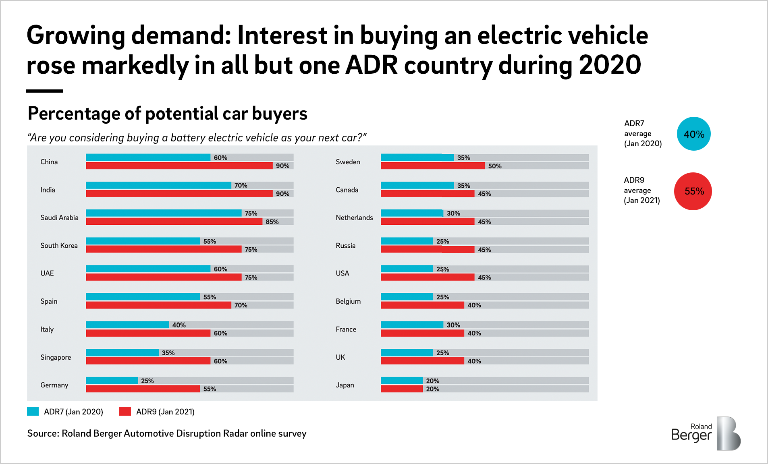

China placed second, with its jump from fourth in ADR8 fueled by a strong desire for EVs. A total of 90% of Chinese are now considering buying an EV (ADR9 average = 55%), against 60% in 2017. EV sales also increased to an all-time high of >1.3 million units in 2020. South Korea finished in joint third with Singapore, again driven by strong electrification scores. Singapore, meanwhile, owed its score to strong performances in a range of non-EV-related indicators, including low use of private cars and a high proportion of shared vehicles in the national fleet.

In the first of its two detailed analyses, the ADR9 report looks at the evidence pointing towards an electric breakthrough. For example, almost all the EV-related indicators show record high scores, with more people buying EVs, more EV models being produced by OEMs, more venture capital investment in EVs and more charging stations being put in place. However, subsidies and Covid-related stimulus programs may be behind the growth.

"The speed of change remains high in the automotive industry. While OEMs seem to have solved the core of the e-mobility puzzle, the next major challenge is already on the horizon: Despite the shortage of semiconductors, OEMs need to strengthen their software capabilities and totally transform the way they work."

More evidence comes in the form of major OEM moves to counter the threat from EV startups, with several major announcements since ADR8.To name only a few examples: General Motors pledged to produce 30 new EV models by 2025, and Volvo committed to produce only hybrid or full-electric vehicles by 2030. Not to be outdone, Volkswagen unveiled big plans to catch up with Tesla’s battery technology by opening six gigafactories before 2030. Undoubtedly, competitive intensity for all the startups, even Tesla, will increase as OEMs ratchet up their game.

In the second detailed analysis, the ADR9 report assesses automaker valuations. Many new players are achieving sky high valuations, with Tesla currently having a higher market capitalization than the top five OEMs combined. One factor of these valuations are often driven by so-called special purpose acquisition company IPOs, which offer a faster, cheaper and less revealing alternative to traditional IPOs. But some SPAC deals involve companies that don’t even have products yet, for example the EV battery firm QuantumScape, and the sheer number of IPOs makes many analysts think the SPAC bubble may soon burst.

Meanwhile, after years in the doldrums, the market capitalizations of traditional OEMs are now on the march thanks to new initiatives such as Volkswagen’s ambitious gigafactory plans. We believe that OEMs should take heart from the fact that markets take notice of such demonstrations of strength, and be encouraged to keep up the good work.