The new article by Roland Berger, explains how airports confront a daunting landscape characterized by COVID-19 challenges, environmental sustainability demands, talent shortages, escalating expenses, and constrained budgets.

Boosting air cargo in the Middle East: strategies for sustained growth and innov

Can the Middle East enhance its air cargo volumes?

After the 2020 COVID outbreak, there has been a significant focus on cargo worldwide. Growth drivers, such as pharma, e-commerce, electronics, etc., have fueled cargo demand. Between 2021 and 2024, worldwide revenue generated in the cargo aviation industry more than doubled, reaching a peak at USD 175 billion in 2021. However, global airfreight traffic only increased by roughly 62% during the same period (Source: Air cargo industry worldwide - statistics & facts | Statista ).

Following a spurt, global air cargo volumes decreased by 6.7% year-over-year (-2.6% versus 2019) to close to 117 million metric tons in 2024. The decline can be attributed to the ongoing geopolitical tensions and disruptions to global trade and supply chains (Source: HKG retains top cargo airport spot amid declining global volumes | Air Cargo Next).

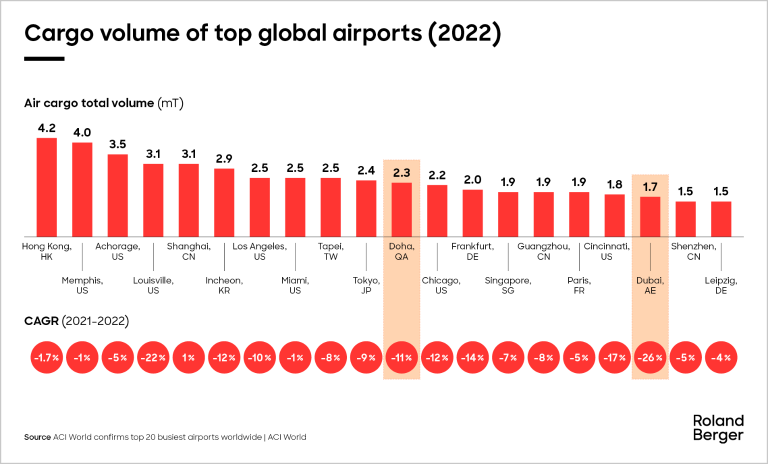

Air cargo traffic is more concentrated amongst the main airports: volumes in the top 20 represent around 42% (49.5 million metric tons) of global volumes.

The top global airports leverage several strengths to attract over 40% of international air cargo volume. Strategic geographic location is one of the key strengths, especially for cities like Doha, Dubai, Hong Kong, and Anchorage. The strategic positions of Doha and Dubai between Asia, Europe, and Africa reinforce their status as a key transit point for global air freight routes, contributing to their high volume of air cargo trade. Hong Kong's strategic location, at the heart of Asia, positions it as a crucial gateway to China and other Asian markets, making it a prime choice for businesses. Lastly, Anchorage's geographic location at the crossroads of air routes connecting North America with Asia and Europe has made it a key refueling and transshipment point for cargo aircraft traveling between these continents.

Additionally, predominant air carriers or postal services significantly influence air cargo trade volumes in cities like Memphis, Louisville, Dubai, and Doha. Memphis's status as the global hub for FedEx, one of the world's largest express transportation companies, has transformed the city into a crucial center for air freight operations. Similarly, Louisville's prominence in air cargo trade is due to UPS's global air hub, which efficiently distributes packages to destinations across the country and around the globe. In Dubai, the presence of Emirates and its extensive network reinforces the city's status as a global hub for air cargo trade, attracting businesses seeking reliable and efficient transportation solutions. Likewise, Doha's Hamad International Airport features modern cargo facilities and serves as a base for Qatar Airways Cargo, bolstering the city's role as a prominent hub for air cargo trade.

Further, world-class infrastructure is crucial in supporting the high air cargo volume and highlighting airports’ key strengths. For example, Shanghai's modern cargo facilities at Pudong International Airport and extensive flight network contribute to its prominence in air cargo trade. In contrast, Los Angeles's modern cargo facilities at LAX, coupled with its efficient logistics infrastructure, solidifies its position as a premier hub for air cargo operations. Similarly, Tokyo, Doha, and Dubai airports boast extensive cargo handling facilities and world-class infrastructure, ensuring smooth operations for air cargo shipments.

The Middle East

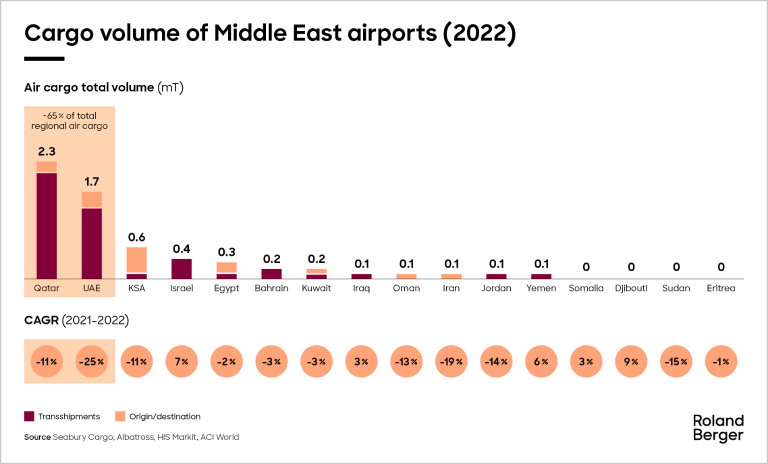

The Middle East comprises approximately 6 million tons of air cargo — 5% of the global air trade. There is competition within the Middle East to be a dominant transshipment hub, with Doha and Dubai handling roughly 65% of the Middle East air cargo volumes.

Doha (Qatar) and Dubai (UAE) airports are strategically located between Asia, Europe, and Africa, increasing their appeal. Further, they possess world-class infrastructure and benefit from a large, dedicated freighter fleet of Qatar Airways and Emirates, positioning them as favorable regional cargo hubs.

At this stage, other airports and the Middle East aviation industry, in general, need to examine global benchmarks and implement tailored best practices to improve airport appeal and enhance air cargo volumes. Moreover, innovative ideas are required to differentiate from the rest of the world.

What do the Middle East countries need to do to enhance their air cargo business? A six-point solution?

Countries in the Middle East need to determine their air cargo positioning relative to key competitors to formulate a strong value proposition and strategically optimize their standing in the region.

- Assets and infrastructure are core conditions for potential growth. Building a global cargo hub requires robust infrastructure, efficient regulations, and landside and airside connectivity.

Middle Eastern countries can develop a robust aviation ecosystem and enhance cargo facilities to attract air cargo volumes. This can include developing large-scale sorting facilities, advanced tracking systems, and streamlined cargo handling and clearance processes. - An airport must grow as a cargo hub with a strong airline network that spans multiple destinations and has a sizeable freighter fleet.

Fostering partnerships with major airlines and logistics providers can expand air cargo networks. This involves enhancing air connectivity by establishing direct flight routes to key destinations, facilitating seamless multi-modal transportation at air cargo hubs, and offering incentives for airlines to operate cargo services through their airports.

Freighters have become and will remain the primary option for carrying freight globally, a key lever to becoming more cargo-focused.

In addition, an air cargo hub needs to work with other stakeholders for efficient multimodal connectivity. - Efficient ground handling is vital for a cargo hub to project a low dwell time.

Ground handling should be the key focus, as it is a vital requirement for a cargo hub to project a low dwell time and increase airport appeal. - A ‘Cargo Community System’ can enhance the overall logistic sector experience.

With air cargo increasingly focused across various verticals, data analytics and data mining technologies have become essential for all the players in the supply chain - shippers, freight forwarders, and airlines.

An Airport Cargo Community System (also called Cargo Community System (CCS) is a neutral and open electronic platform aiding intelligent and secure information exchange between stakeholders. It is a crucial tool in optimizing operational efficiencies and enabling digitalization of the end-to-end air cargo value chain."

Most global airports have CCS for a single-window system to boost trade. A single-window system enables electronic communications in airports between private transport operators (airlines, agents, freight forwarders, stevedores, freight depots), the private vicinity (pre- and on-carriage, usually by road), importers and exporters, the airport authorities, customs, and other authorities. - A smooth and efficient customs and regulatory clearance with clearly defined processes and digitization of paper trail is imperative for a cargo hub.

Efficiency is the heartbeat of modern trade, and adequate customs clearance serves as its accelerator. Streamlined clearance processes minimize bureaucratic red tape and expedite the movement of goods across borders. Imagine a shipment seamlessly transitioning from one country to another, minimizing wait times and unnecessary delays. - Middle Eastern countries can accelerate localization efforts to develop specialized cargo segments and boost exports.

These countries can incentivize the local manufacturing industry to produce goods locally and export to relevant countries. Several countries, such as Saudi Arabia, have already augmented localization efforts, and conducting this practice in a planned manner can boost the appeal of the local manufacturing sector and the aviation industry.

Middle Eastern countries need to build a robust infrastructure, supportive regulations, and strong landside and airside connectivity, as these are crucial enablers to creating a cargo hub. This will help them capitalize on their strategic location between major trading regions, such as Europe, Asia, and Africa. By expanding the air cargo network, developing a solid aviation ecosystem, and enhancing localization efforts, they can position themselves as central hubs for international trade and logistics.

_person_144.png?v=1495835)