Hopes are high for generative AI. It is expected to do nothing less than resolve the productivity crisis in advanced economies. A new study by Roland Berger shows that these hopes are well founded. If properly applied, language models like ChatGPT can open up completely new possibilities for increasing productivity – such as by taking over routine back-office tasks or helping people with complex parts of their job as a digital co-worker.

Bracing for impact – The AI transformation in banking

By Fabian Neuen and Michael Pieper

As the AI transformation gathers momentum, banks need to rethink business and operating models across the value chain

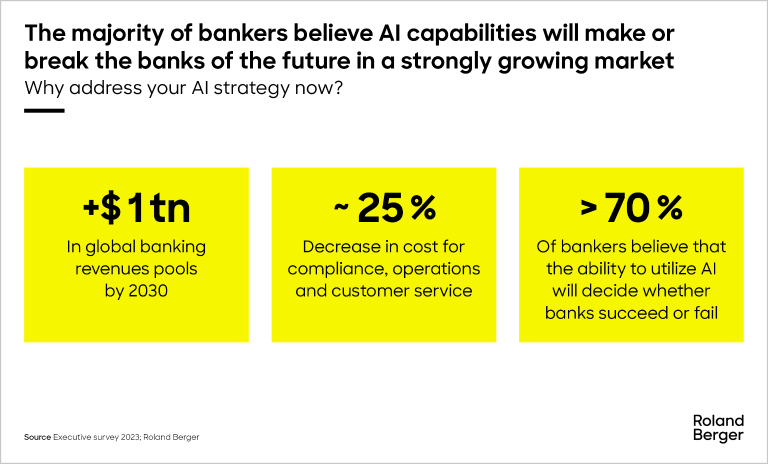

Having developed at an astonishing pace in recent years, artificial intelligence (AI) is now poised to transform every sector of the economy. In the financial services industry alone, the majority of bank executives – as evidenced by a recent in-depth Roland Berger survey – are convinced that the future success or failure of banks will depend on their AI capabilities. We expect to see a transformation towards 'AI-first banks' across the globe – a transformation that will place them on a new efficiency curve.

AI will have a powerful impact on banks’ profitability going forward. This impact will be driven in part by revenue gains resulting from additional business, improved pricing and a greatly enhanced customer experience. We estimate that AI can unlock an additional USD 1 trillion in global banking revenue pools by the end of the decade. In addition, both operating and risk costs will be reduced by as much as 30% between now and 2030.

"When a technology is poised to transform an entire industry, you can’t call that hype. The problem is not that banks expect too much of AI: Most of them still underestimate the impact it will have on business models."

To lead, or not to lead?

Not all financial institutions are turning to AI at the same speed, of course. As the race hots up, leading banks have embraced innovation and moved well ahead of their competitors. Many of them have already developed and implemented a portfolio of use cases to get ahead of the curve in driving forward this ground-breaking technology. This in turn requires them to recruit and develop the right talent, commit to the right partnerships, set up robust IT and big data platforms and build AI factories to give themselves effective delivery capabilities.

So, what are the use cases that hold out so much potential for the banking industry? And what specific benefits are they expected to yield?

Opportunities at every link in the value chain

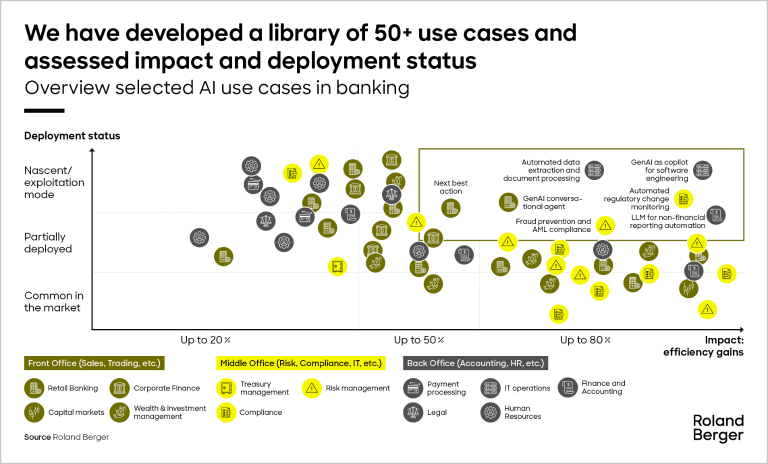

Roland Berger has identified over 50 use cases for AI in banking, inventoried their current deployment status and assessed the potential impacts.

As the figure above shows, essentially every aspect of a bank’s value chain is set to gain from the deployment of AI capabilities.

- Client-facing front-office AI applications hold considerable promise to drive topline growth and improve customer satisfaction in everything from retail banking to wealth and investment management. Banks are working hard to get these applications ready for market and reap the many expected benefits. Generative AI conversational agents are being incorporated in numerous aspects of client interaction, for instance. What are known as next-best-action (NBA) and microsegmentation algorithms will enhance clients’ experience by predicting financial needs and personalizing both products and marketing content. Financial services can thus be ‘hyper-personalized’ and seamlessly integrated in customer journeys and in each client’s digital ecosystem.

- In the context of middle-office applications, AI is delivering excellent results in detecting and preventing cases of fraud in areas such as anti-money laundering (AML) and know-your-customer (KYC) compliance. Cyber-security and cyberresilience are two more areas where AI is already yielding important benefits for banks, alongside more efficient and effective compliance monitoring, credit analysis and loan approval handling, all of which is improving banks’ core risk models.

- Back-office applications such as payment processing and IT operations, but also data extraction, document processing and any other processes that lend themselves to automation, are obvious targets for the use of AI. Many such applications deploy large language models (LLMs) to automate activities such as non-financial reporting (e.g. sustainability reporting and media relations). At the same time, generative AI tools are also increasingly helping software engineers to write and test code.

From a technological and commercial perspective, a number of AI use cases are already solid enough to be integrated in current operations. Very specifically, we expect that a wide array of banks will adapt the seven use cases highlighted in the above chart sooner rather than later.

The sheer scale and breadth of these potential benefits – affecting everything from top line to bottom line to customer satisfaction – highlights the importance of acting quickly and resolutely to secure the advantages of AI. That said, due consideration must also be given to a number of risks and limitations.

"In financial services, it’s hard to think of any application that is not going to benefit substantially from artificial intelligence."

Risks and uncertainties associated with AI

As with all technological advances, the rise of AI systems naturally also creates the need to address a whole spectrum of new risks and uncertainties across financial service organizations. Regulatory and compliance risks, for instance, could see banks failing to comply with industry guidelines, restrictions on the deployment of AI in a banking context and even the requirements of national and supranational supervisory authorities. Governance risks too could pose the threat of serious financial losses. And much work remains to be done to address the many uncertainties surrounding large language models themselves and the biases that may be built into AI systems as a result. Going forward, the emerging risks that artificial intelligence is forcing banks to address must therefore be tackled within a comprehensive target operating model – a model that establishes transparent accountability for the development, deployment and maintenance of AI applications in banking.

Talent shortage

It is an open secret that suitably skilled talent is very much at a premium. Lack of access to the right experts could therefore likewise limit organizations’ ability to deploy and benefit from AI systems. Banking and financial services are not the only economic activities currently being revolutionized by these new technologies. Companies everywhere – even in conventional production and service sectors – are currently scrambling to get ahead in the AI game and recruit top talent that can turn this development to their advantage. Banks too must therefore brace themselves for stiff competition in the battle for AI talent – by developing and building on standard solutions wherever possible, but also by leveraging partnerships to secure a steady stream of suitable skills.

AI in the fast lane

Even the rapid development witnessed over the past two years is now accelerating still further. Clearly, there is no time for financial institutions to lose. The current stage, in which banks have largely been testing the waters in isolated areas but with no real enterprise-wide coordination, should deliver tangible impacts within the next twelve months at most. Traditional financial service providers, fintechs and big-tech corporations alike are all expected to make more concerted moves in the two years after that.

All of which means that, like Kodak, when it belatedly woke up to the threat from digital cameras in the early 1990s, many household names in the banking sector may right now be heading for a rude awakening. Speed, then, is of the essence. But what, exactly, should banks do to get themselves AI-ready?

Roland Berger Survey

An exclusive international Roland Berger survey of bank executives indeed recently revealed that bank managers – across geographies and bank types – expect to see a tipping point reached by the end of 2025, after which AI-first banks will start to realize top and bottom line benefits. To view the full results, download the full PDF.

How can banks prepare for the transformation ahead?

For banks of all types, simulations of AI-first organizations point to very sizable gains in net income alongside huge savings on overall risk costs and a massive improvement in the cost/income ratio.

The starting point must be to create transparency within the organization. Accurately gauging a bank's existing digital maturity and AI readiness is crucial to lay a firm foundation for the far-reaching transformation ahead. From here, it is possible to define and prioritize focus use cases to be rolled out across the organization and stake out a target operating model that is aligned with the bank's vision of its future role and positioning. Our recent survey suggests that bank executives currently put special emphasis on a portfolio of use cases as well as AI and big data infrastructure.

The above chart summarizes the many areas in which Roland Berger can provide you with insightful advice and practical support in applying AI to the needs of your organization.

We are as excited as you are about the potential of this powerful technology to transform the banking sector – and to transform your business. That is why we want to hear from you. Contact us to find out how Roland Berger can help you begin your AI journey.

Register now to access the full study,to learn more about AI in baking. Furthermore, you get regular news and updates directly in your inbox.

_person_144.png)

_image_caption_none.png)