This short study explains how governance functions in automotive companies can support the transformation from hardware to software companies.

Computer on Wheels: Commercializing automotive software

A robust software marketplace can help lead the automotive sector into a new era

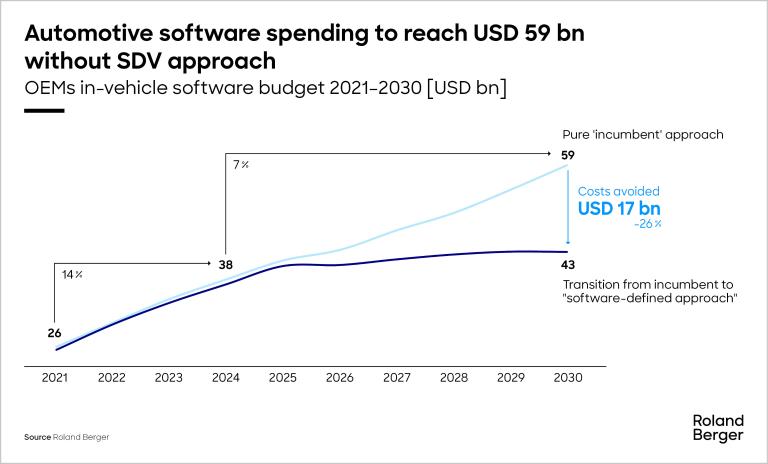

As the automotive industry transitions toward software-defined vehicles (SDVs), software has moved from a supporting role to the core of innovation. However, while vehicle software complexity grows, most of it remains custom-built in-house, resulting in soaring costs—up 14% annually since 2021 and projected to reach $59 billion by 2030. A more competitive software marketplace could lower costs and improve innovation and customer experience.

"A mismatch between supply and demand has led to over-insourcing. Commercial software products are needed to close this gap."

Less than 50 years ago, the first production vehicle to incorporate embedded software was launched. While the 1977 Oldsmobile Toronado had just seven lines of code, most vehicles now leave the factory with 100-plus million lines of code under the hood.

This is just the beginning. Most experts expect much of a vehicle’s key features – from safety and performance to maintenance – to become a function of software rather than hardware. But the automotive industry is struggling to manage this shift effectively . Each OEM currently makes much of its vehicles’ software in house – an expensive process. By the end of this year, in-vehicle software budgets will have risen almost 50% since 2021, reaching $38 billion. By 2030, this could reach $59 billion.

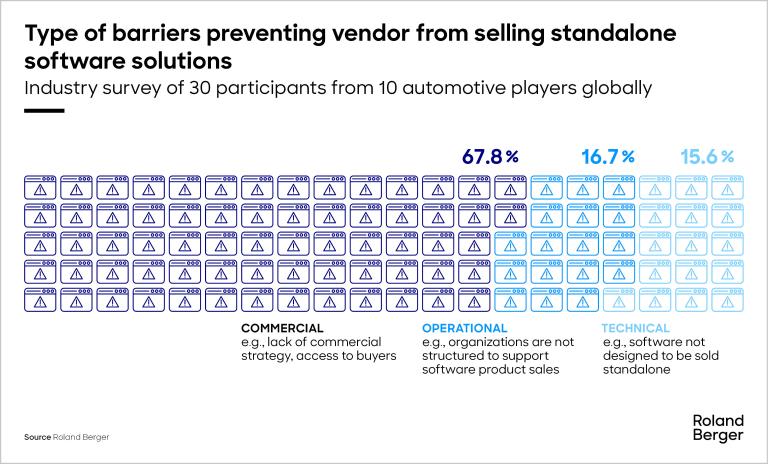

Only 10% of automotive software today is sold separately from hardware. This is a missed opportunity for OEMs and Tier 1 suppliers to tap into new revenue streams. By establishing a competitive software marketplace, the industry can lower costs, accelerate innovation, and offer a superior customer experience through modular solutions.

Turbocharging automotive software development

To bring that day closer, automotive industry software leaders are pushing a range of initiatives, including cloud-native software development, using open-source software, and industry-wide standards.

These steps will bring the industry closer to the era of the SDV, but slowly and at high cost – unless something changes. Our analysis suggests the creation of a third-party software market, something many major industries have had for decades, could accelerate these steps and turbocharge software development.

Building this market means overcoming hurdles among both software vendors and buyers, something we explore in a new joint report with SDVerse, a B2B marketplace for buying and selling automotive software. For vendors, the main barrier is a commercial one; meanwhile, on the buying side, many OEMs find themselves grappling with a lack of in-house capabilities to manage hardware/software integration effectively .

Unlock new value

As cars change, so must production methods. OEMs, Tier 1 suppliers and technology providers must adopt advanced software development methodologies to enhance development speed, security and interoperability. Clear commercialization strategies with transparent pricing and deep customer engagement will be crucial to align products with market needs.

The future of automotive lies in the commercialization of software . At Roland Berger, we’re guiding companies through this transformation—helping them reduce costs, unlock new growth, and accelerate the journey to SDVs.

Ready to turn software into a competitive advantage? Let’s collaborate to drive innovation and success.

Register now to access the full report and explore how commercializing automotive software drives innovation. Furthermore, you get regular news and updates directly in your inbox.