EV Charging Index: Expert insight from Indonesia

![{[downloads[language].preview]}](https://www.rolandberger.com/publications/publication_image/23_2077_ART_EV_charging_index_deep_dive_Indonesia_Cover_2_download_preview.jpg)

Indonesian e-mobility is in its infancy but state involvement is starting to drive strong growth. Discover more in Roland Berger’s EV Charging Index 2023.

EV adoption in Indonesia is in its infancy but growing fast. State involvement is driving rapid growth in charging infrastructure, while the country also hopes to use its rich nickel supplies to become a local manufacturing hub for both two- and four-wheeled EVs.

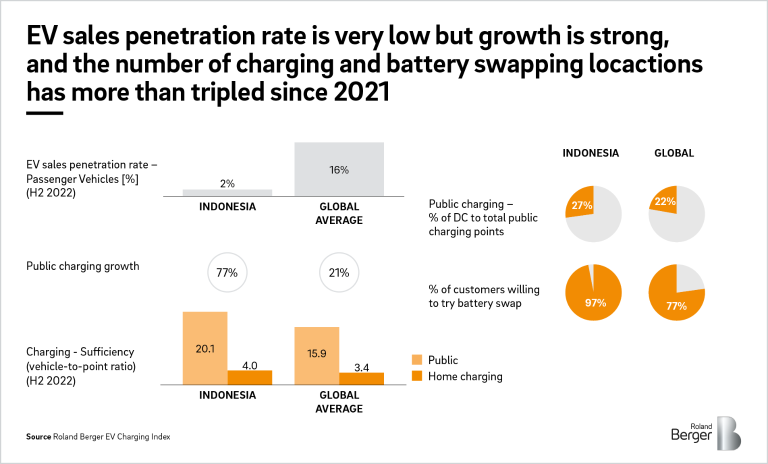

At 2%, the EV sales penetration rate is very low – well below the global average of 16%. But growth is strong, with the EV parc approximately 10 times larger at the end of 2022 than it was halfway through the year. The government has introduced fiscal incentives to encourage EV adoption, such as tax exemptions for certain battery electric vehicles (BEVs). Electric two-wheelers are also subsidized up to a price of IDR 7 million.

Indonesia has set ambitious manufacturing targets to play a greater role in e-mobility. Its abundant nickel resources are crucial for EV batteries and by 2025 it aims to sell 1.8 million domestically produced electric two-wheelers and 400,000 four-wheelers. The government has also granted the private sector access to state-owned BEV technology to encourage expansion in this area.

The ratio of vehicles to public charge points (20.1) is above the global average (15.9) but growth in Indonesia’s charging infrastructure is strong – at 77% this is well above the global average of 21%.

Overall, the number of charging and battery swapping locations has more than tripled from 2021 to 2022. Despite most infrastructure being concentrated around the Greater Jakarta area for now, this should soon spread elsewhere.

The Indonesian government has pushed the formation of the Indonesia Battery Corporation (IBC), a new subsidiary between state-owned enterprises PLN, Pertamina, Mind ID and Antam. IBC will focus on developing and investing in key supporting infrastructure for the local EV ecosystem. PLN, the national electricity company, will also lead the development of charging infrastructure. It has already collaborated with numerous OEMs to expand trials for fast and ultra-fast charging in key cities. The government aims to have 31,000 public charge points in place by 2030.

There are currently seven key charge-point operators (CPOs) in Indonesia, although PLN dominates the market. EVCuzz and Starvo are the only pure CPOs, with the other market participants either state electricity firms, auto OEMs or oil and gas companies.

![{[downloads[language].preview]}](https://www.rolandberger.com/publications/publication_image/23_2077_ART_EV_charging_index_deep_dive_Indonesia_Cover_2_download_preview.jpg)

Indonesian e-mobility is in its infancy but state involvement is starting to drive strong growth. Discover more in Roland Berger’s EV Charging Index 2023.

Sign up for our newsletter and get regular updates on Automotive topics.