The electric vehicle and EV charging market enjoyed a surge in late 2022 despite continued high energy prices.

EV Charging Index: Expert insight from Italy

Italy consolidates its position as a solid e-mobility performer, but EV penetration is stagnating

Italy’s overall score improved in 2023, after a decline the previous year. EV sales were up, but the penetration rate remained unchanged, still well below the global average. Greater clarity on government incentives is needed to address this. Progress remains solid in public infrastructure development.

"EV sales grew 40% in 2023, but Italy’s EV sales penetration is below average, with poorly designed incentives a major factor."

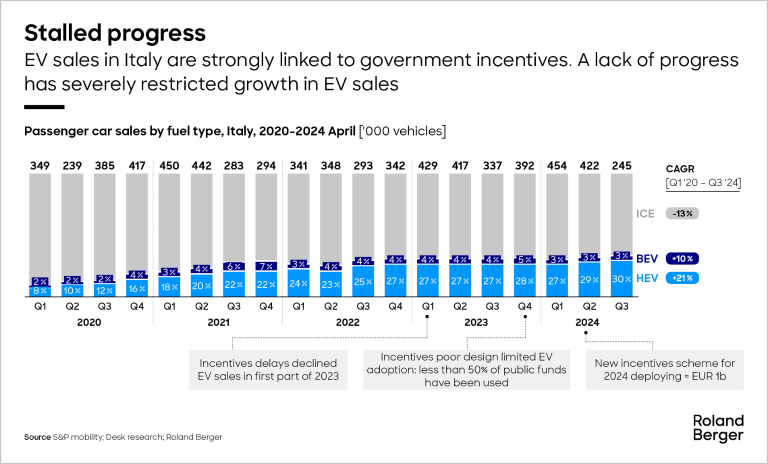

EV sales penetration rate stagnates

Italy’s EV parc grew a healthy 40% in 2023 but the overall sales penetration rate for EVs remained at 9% - well below the global average of 19%. This meant the market failed to hit decarbonization expectations.

Poorly designed government incentives are a major factor. And this trend has continued into 2024, with new EV registrations at their lowest point since 2021 as consumers await confirmation on the renewal of EV purchasing incentives.

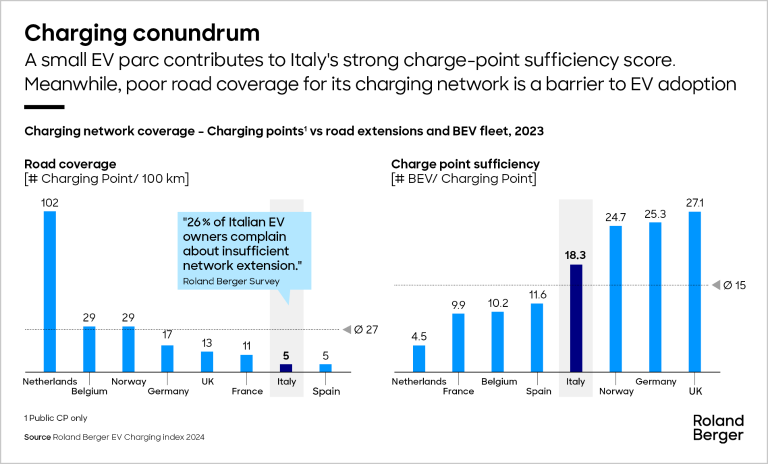

Mixed story for public charging infrastructure

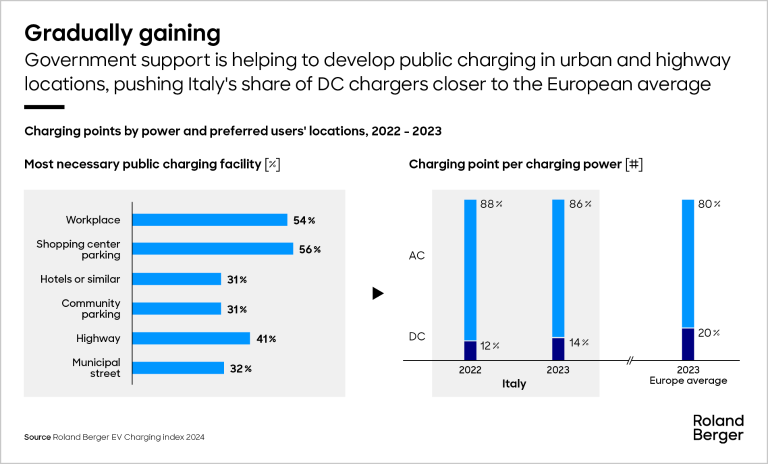

Italy’s public charging infrastructure grew by more than 30% in 2023, reaching more than 26,000 charging points. Government incentives have proven more effective at growing charging infrastructure than EV sales. Consequently, Italy has a vehicle-to-charge-point ration of 18.3, putting it ahead of the likes of Germany, Norway, and the UK, which all have a larger EV fleet. Road coverage remains limited, with less than 10 charging points for every 100 km of road, putting it behind other European markets such as Germany, France, and the UK. A third of motorway service stations now have charge points, but growth has stalled due to a lack of public funds being allocated.

In terms of public charging speeds, Italy has room for improvement, with just 14% of its public chargers DC – some way below the European average of 20%.

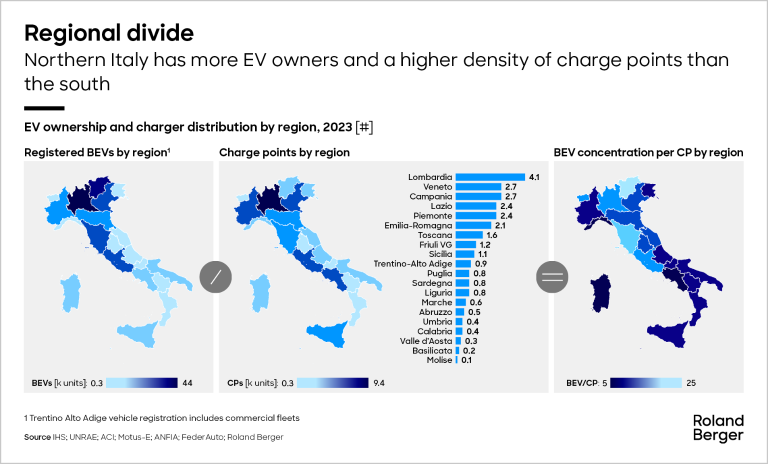

There is still some regional variation in Italy’s charging network, with more charge points in the north, although there are signs the southern cities are beginning to catch up.

"Just 14% of Italy’s public chargers are DC – some way below the global average of 24%."

Financial incentives still driving Italian market

Government subsidies have been a key driver for e-mobility growth in Italy. Incentives from PNRR, the National Recovery and Resilience Plan, which is part of the NextGeneration EU plan, are still in place. Its main objectives are the development of urban and highway (toll-free) charging stations.

Home charging subsidies remain in place, covering 80% of the total installation cost up to EUR 1,500 for single dwellings and EUR 8,000 for shared areas of apartment buildings.

On the EV side, despite some delays, public incentives are coming back. The 2024 ‘ecobonus’ funds were launched in June and have already been allocated. Expectations are that they will accelerate slow start in the EV registrations slow start.

Italian-powered technological innovation

Battery swapping in Italy is still limited to a pilot project between Eni and XEV, an Italian EV maker.

Meanwhile, another Italian player is fostering innovation both domestically and across Europe: E-gap has been deploying E-Gap fast, an off-grid battery-powered charging station that can be deployed independently from the main grid.

Charging provider market set for a shake up

Italy’s charge-point provider landscape remains highly concentrated, with EnelX and Becharge responsible for approximately 80% of the market.

However, this is expected to change as new players such as Fastned enter the market and more private investment flows in, such as the recent joint venture between IP and Macquarie to electrify 500-plus service stations. In 2023, there were seven major transactions, compared to just one in 2022, as smaller players such as Powy and Atlante attracted extra capital.

Register now to to discover the latest insights, emerging trends, and upcoming challenges in the EV and EV charging markets.