The electric vehicle and EV charging market enjoyed a surge in late 2022 despite continued high energy prices.

EV Charging Index: Expert insight from South Korea

By Soosung Lee, Andrew Yi and Kwangho Kim

Despite a slight drop in EV sales, South Korea still shows solid progress in e-mobility

South Korea's EV sales dropped slightly in 2023, but solid scores elsewhere helped it maintain its above-average ranking. The government is adjusting its subsidy policies for EVs and charging infrastructure in a bid to take Korean e-mobility to the next level.

"With South Korea's early-adopter pool depleted, e-mobility must now appeal to a broader consumer range."

Decline in EV sales penetration rate

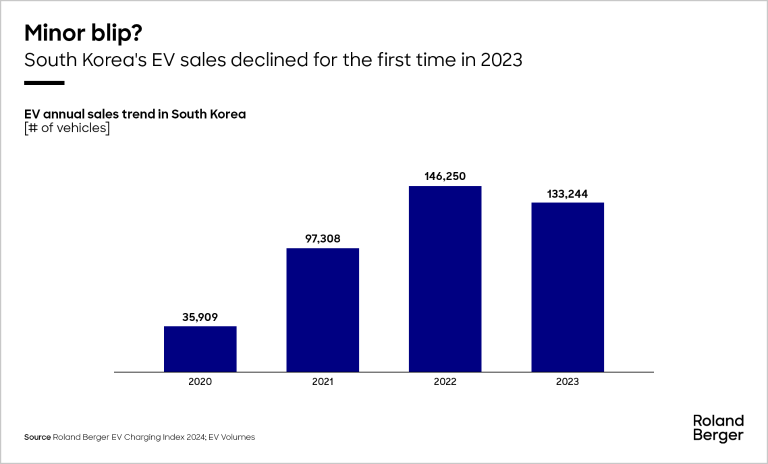

For the first time, South Korea's EV sales decreased slightly in 2023, with its sales penetration rate falling from 10% to 9%. Despite this, its overall score increased slightly and it maintained its position of 10th in our rankings.

There are several connected factors behind the decline in EV sales penetration. With the early-adopter pool now depleted, e-mobility must appeal to a broader consumer range. However, subsidies for EV purchases are decreasing and charging prices are on the rise. Some charge point operators (CPOs) raised prices by more than 30% in 2023. For drivers who are unsure about the switch to e-mobility, these are important barriers. As a response, Korean EV brands are releasing more EV models in lower price ranges during 2024.

More focus on charge point management needed

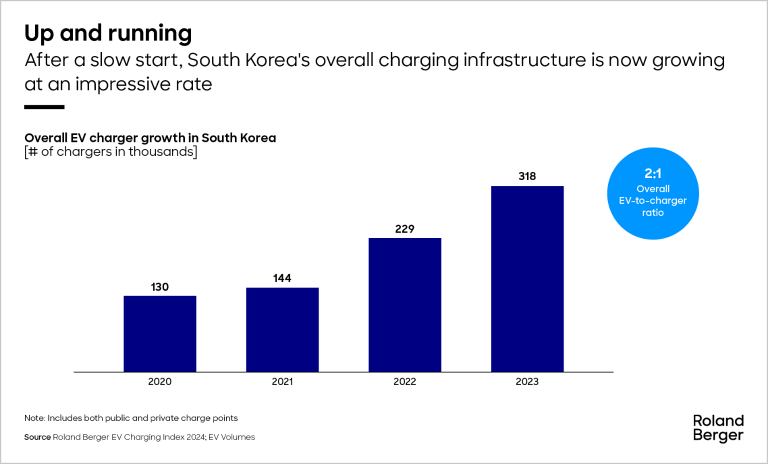

South Korea's vehicle-to-public-charger ratio and its ratio of DC to AC chargers are both better than the global average – but its EV users still state that charging infrastructure is a challenge. Potential customers also cite it as a deterrent to purchasing an EV. With the government and CPOs concentrating mostly on expansion, there remains an inadequate focus on charge point management and operation to monitor reliability and availability.

Policy adjustments to promote e-mobility

Despite the decrease in South Korea's EV sales penetration rate, the government has maintained its ambitious net-zero targets. By 2030, it aims to have 4.2 million EVs – up from 1.37 million today – and a total of 1.2 million public and private charge points.

To help meet this target, the Korean government has lowered the subsidy amount for purchasing an EV but widened the eligibility scope. As part of this move, test and research vehicles are now eligible and consumers can receive subsidies for multiple EV purchases.

Meanwhile, subsidies for charging infrastructure are following a similar trend, with the government raising its subsidy budget in this area by 60% but decreasing the subsidy amount per charger.

Elsewhere, the government has lifted restrictions on building EV chargers closer than six meters from gas pumps, meaning they can now be installed at urban stations with limited space.

Korean conglomerates dominate the CPO network

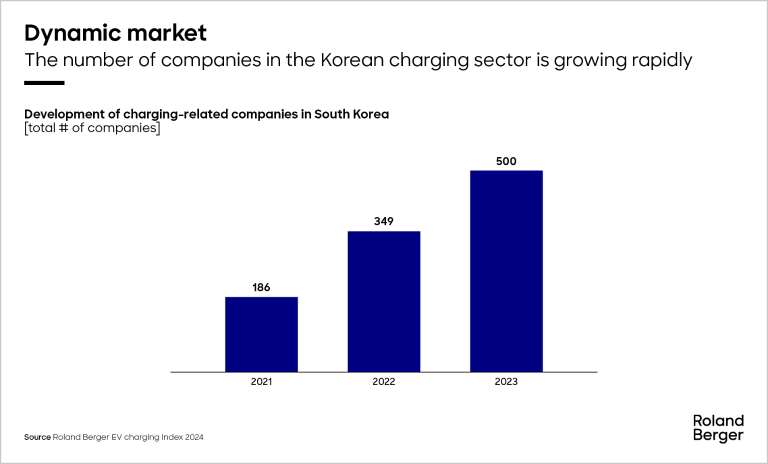

The charging market continues to grow, with the number of market players increasing from 350 to approximately 500 in 2023. There are three pools of competitors emerging: overseas companies, Korean conglomerates, and local SMEs.

Korean conglomerates have been the main drivers of growth in the country's charging infrastructure. They have been utilizing subsidiaries to expand along the value chain and create synergies within their respective groups. SK Signet, for example, manufactures chargers, while SK Networks operates as a CPO through their SK Electlink brand, and SK E&S provides charging solutions integrated with its parking services.

A major advantage for many of these conglomerates is their dominance of high-traffic locations, which restricts opportunities for SMEs. Shinsegae can install its chargers across its many department and grocery stores, for instance, while Hyundai Engineering can install chargers as a built-in solution to the apartments it helps construct.

Large Korean companies also have the resources to acquire promising SMEs to further boost their own charging businesses. SK Networks' acquisition of SS Charger and GS Energy's acquisition of ChargEV are just two recent examples.

That being said, SMEs still have an important role to play in the Korean charging segment as they are increasingly inclined to focus on differentiation through new technologies and services.

Register now to to discover the latest insights, emerging trends, and upcoming challenges in the EV and EV charging markets.