The electric vehicle and EV charging market enjoyed a surge in late 2022 despite continued high energy prices.

EV Charging Index: Expert insight from the GCC region

By Santiago Castillo, Arvind CJ and Smriti Priya

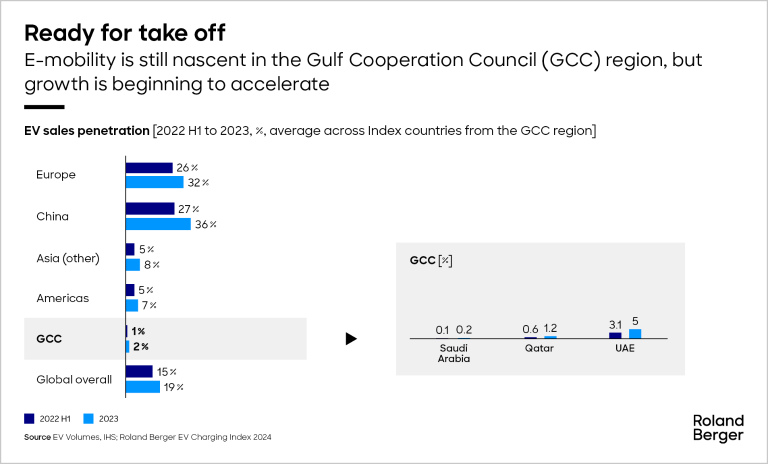

E-mobility is still nascent in the GCC region, but the market is becoming increasingly dynamic

In the GCC (Gulf Cooperation Council) region, the UAE leads the way for e-mobility, ahead of Saudi Arabia and Qatar among the countries covered in this Index. There is still much to do to boost EV adoption and charging infrastructure, but a growing number of private and public stakeholders are boosting market dynamism.

"More partnerships in the charging space could help enhance network availability, accessibility, and reliability."

Most GCC countries have integrated sustainability and environmental goals into their national visions, with an emphasis on reducing their carbon footprints and diversifying energy sources and economies away from a reliance on oil. Nevertheless, incentives such as subsidies, direct purchase benefits, and EV user privileges are yet to be announced for major GCC markets.

The UAE is at the forefront of the EV transition in the GCC, with Dubai and Abu Dhabi leading the way in EV adoption and charging infrastructure development. Both customer awareness and the range of available EV models are increasing, while its strategic location and advanced infrastructure make the UAE a key player in the regional EV market. The UAE also has ambitions of becoming a hub for EV manufacturing and innovation.

In Saudi Arabia, the Public Investment Fund is cementing the Kingdom's commitment to e-mobility. It is backing American EV start-up Lucid Motors as well as Ceer, Saudi Arabia's first EV manufacturer, and EVIQ, Saudi Arabia's first Kingdom-wide EV charging company.

Long road ahead for EV sales targets

The UAE aims for at least 10% of all vehicles and 30% of all new vehicles on the road to be EVs by 2030. For 2050, its ambition is for half of all vehicles to be EVs. In 2023, the UAE's EV sales penetration rate was 5%.

Saudi Arabia has a less mature EV market, with a sales penetration rate of just 0.2% in 2023. The local government wants 30% of vehicles in Riyadh to be fully electric by 2030. We can expect a steep rise in EV sales in the coming years with the rollout of vehicles at local manufacturing sites from the likes of Ceer and Lucid. Lucid has already started production at its assembly factory in the Kingdom.

There are a variety of macroeconomic and geopolitical factors influencing local market development, including economic recovery, oil prices, regional stability, and global environmental commitments. Strategic moves by automakers, energy companies, and tech startups will also have an effect.

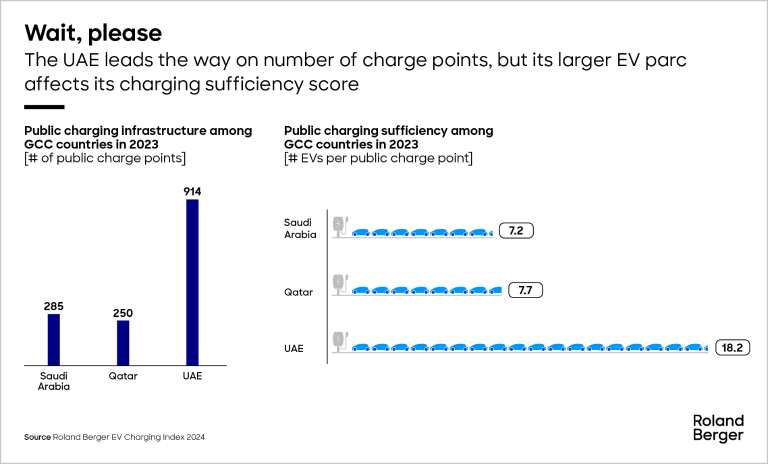

Charging infrastructure varies

Charging sufficiency is mixed across the GCC states. Saudi Arabia and Qatar both have less than eight vehicles per public charge point, albeit with very low EV numbers. The UAE has the most public charge points but a much larger EV parc, giving it a worse charging sufficiency (18.2 EVs per public charge point).

There are growing efforts from both public and private stakeholders to expand charging infrastructure in the region. In the UAE, for instance, Abu Dhabi's national oil and energy companies have set up E2GO to establish charging stations and services for EV users. DEWA and Etihad WE have also launched EV charging initiatives. And the government's Global EV Market policy has set targets for charging infrastructure goals, among other things. We expect demand for fast public charging to be at around 23,000 charge points by 2030 in the UAE.

Meanwhile, in Saudi Arabia, EVIQ aims to set up 5,000 charging points across 1,000 strategic locations throughout the Kingdom by 2030. We expect demand for fast public charging to be at around 5,000 charge points by 2030 in Saudi Arabia.

What next for e-mobility in the GCC region?

For EVs to really take off in the region, there are numerous steps for stakeholders to take. More partnerships in the charging space could help enhance network availability, accessibility, and reliability. Robust mobility services around payment, mapping, and user support will enhance the consumer experience. Governments could boost EV adoption by looking at ways to lower purchase costs, expand financing options, or reduce tolls, for instance. Making charging more affordable would also help. Technological solutions such as V2G bi-directional charging and increased integration of renewables will also contribute to a more rounded e-mobility ecosystem.

Register now to to discover the latest insights, emerging trends, and upcoming challenges in the EV and EV charging markets.