For making the right investment decisions investors can rely on the decade long profound industrial and functional expertise provided by our global transaction team.

European Private Equity Outlook 2025

By Martin Weissbart and Björn Schubert

Our latest assessment of the private equity space explores trends, concerns and expectations for 2025

The insights and experience of private equity (PE) experts from across Europe were channeled into the latest iteration in Roland Berger’s annual European Private Equity Outlook. Taken together, their findings reflect the market’s expectations surrounding key investment themes of relevance to the private equity industry in 2025.

The Outlook is the 16th consecutive publication in a series launched by Roland Berger in 2010.

Investment backlog and brighter conditions to drive more PE deals

With many exits having been deferred in recent years, the vast majority of respondents (more than 90%) believe that more conducive financing conditions will fuel a noticeable increase in M&A activity involving private equity in 2025. This upbeat outlook naturally varies from region to region, however, with the most significant shifts anticipated in the Nordic countries and on the Iberian Peninsula (Spain & Portugal). The outlook for France is notably more subdued, despite expectations of growth here too.

"The outlook is brighter, obviously. But with the world as volatile as it is, you can’t rule out a downturn, so you have to focus on resilient investment targets. It’s a bit of a balancing act."

The study also examines the prospects for PE involvement in different sectors, with pharmaceuticals & healthcare and technology, software & digital solutions expected to see a busy year. The reasons for this preference are discussed – in sharp contrast to a lackluster outlook for the automotive sector.

An examination of different size classes indicates that small caps and mid-caps will be PE investors’ vehicle of choice in 2025.

PE investment models and transaction drivers

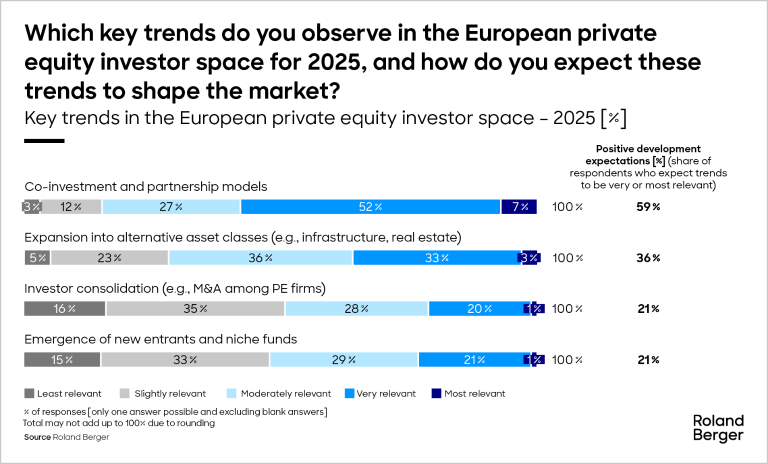

Digging deeper, the study explores how PE investors will tend to operate in the year ahead, identifying co-investment and partnership models as key trends to watch in the European space.

"In times of higher interest rates, investors are constantly looking for additional ways to create value beyond mere capital gains. If interest rates normalize – as we expect – then the focus on value creation will become more diversified."

While many expects clearly anticipate a less tense economic situation overall, it is noteworthy to note that they are still looking to invest in businesses that are perceived to be resilient. Evidently, despite the overall improvement, there are underlying concerns about a potential economic downturn in the future. This view is substantiated by experts’ perception that valuation multiples in general are no longer as (excessively) high as was the case a year ago, but that these multiples could continue to increase in resilient sectors such as technology, software & digital solutions and, once again, pharmaceuticals & healthcare.

An upbeat mood, but still a balancing act

Almost all the PE professionals surveyed expect targets coming onto the market in 2025 to be more attractive than those in 2024. Optimism is particularly high for mid-cap targets, for which they anticipate better debt financing conditions, and they see secondary buyouts as probably the best address for attractive acquisition candidates.

The latter half of the study details what is expected to be the main focus of PE activity, anticipated obstacles to debt financing and the part that value creation initiatives will play in 2025. Three areas – digitalization/data analytics, add-on acquisitions and commercial excellence – are seen to be the key drivers of value creation in the coming year.

The most promising exit channels are discussed, as is the observable decline in deal volumes in some European regions – especially in German-speaking Europe. Also, no analysis would be complete without addressing the role of artificial intelligence (AI), which is expected to deliver significant benefits for PE firms and their portfolio companies. Overall, the study provides invaluable guidance for any private equity players keen to avoid pitfalls while making the most of emerging opportunities in the PE space going forward.

Country Insights

Register now to access the full publication “European Private Equity Outlook 2025 - The balancing act continues” and dive into the latest trends and projections for European Private Equity in 2025. Furthermore, you get regular news and updates directly in your inbox.

![Change in M&A activity with PE involvement in major countries, 2025 vs. 2024 [%]](https://img.rolandberger.com/content_assets/content_images/captions/Roland_Berger_24_2599_PE_Outlook_2025_GT01_image_caption_none.png?v=1263977)

_tile_teaser_h314x380.jpg?v=929329)