From abnormal to new normal

An updated assessment of the economic impact of Covid-19

Corona Economic Impact - Part 1

Corona Economic Impact - Part 2

Corona Economic Impact - Part 3

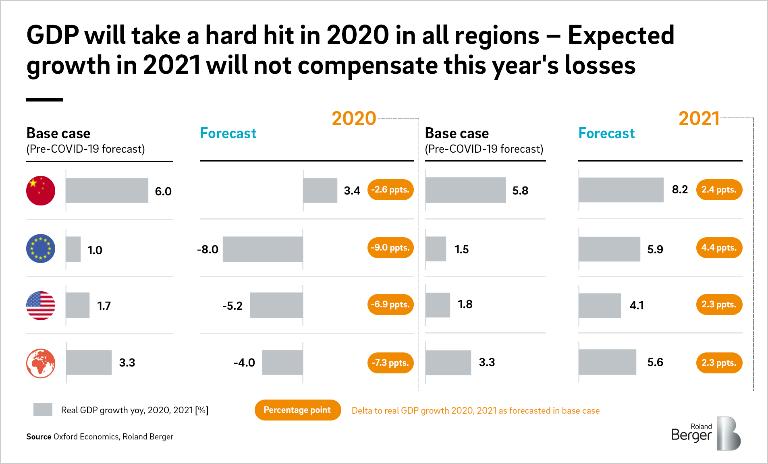

Although the infection rate remains high in the United States and is once again rising in many European countries, the world is finding ways to deal with Covid-19. Keeping physical distance and wearing masks in public spaces has become the norm almost everywhere. Are we back to (a new) normal and ready to resume the pre-Covid growth trajectory? A quick look at forecast global GDP reveals the severe impact of the biggest crisis since the Great Depression.

We have updated our estimates to reflect recent developments and find that global GDP may take a hit of more than seven percentage points in 2020 – a bigger drop than in any previous crises since the Great Depression. While the situation remains fragile and the probability of a second wave of infections increases, major economies are showing signs of recovery, with rising business and consumer confidence in the third quarter.

Global roundup

After the growth curve for Covid-19 infections initially flattened in most Western countries, the infection rates have increased once again during the last weeks. The number of new infections in the United States remains worryingly high and India, Brazil, and Russia are major hotspots next to the US.

We estimate that China, where new confirmed cases are almost non-existent by now, will see a drop of 2.6 percentage points in GDP in 2020, from the pre-Covid-19 forecast of six percent growth down to 3.4 percent. For next year, we foresee 8.2 percent GDP growth in China, indicating a partial recovery post-crisis.

Despite massive fiscal stimulus packages, Europe will see strong negative growth rates for GDP. Consumer demand has been severely dented and levels of short-time work and unemployment are high. We currently forecast negative growth in real GDP of 8.0 percent in 2020. Social and economic life will be disrupted for some time to come and we expect only a partial recovery in 2021, with GDP growth of 5.9 percent.

The United States is still in the middle of the coronavirus crisis and its economy will be hard hit in 2020. Lengthy disruptions to production and extensive lay-offs despite governmental relief packages will result in negative real GDP growth of 5.2 percent in 2020. This will be followed by forecast growth of 4.6 percent in 2021.

The global figures are no more optimistic. Prior to the crisis, global GDP growth was forecast to grow by 3.3 percent in 2020; we expect the actual figure to be -4.0 percent. This represents a decline of 7.3 percentage points – a bigger drop than in any previous crises since the Great Depression of the 1930s. The base case for 2021 forecast before Covid--19 was 3.3 percent GDP growth. We now expect the figure to be closer to 5.6 percent as the global economy slowly adjusts to the new normal.

Understanding the new normal

In previous updates we analyzed the short- and mid-term impact of the Covid-19 crisis on different industry sectors and their ability to recover. In order to understand the new normal, we now take a closer look at the longer-term impact of the current crisis on a number of different sectors.

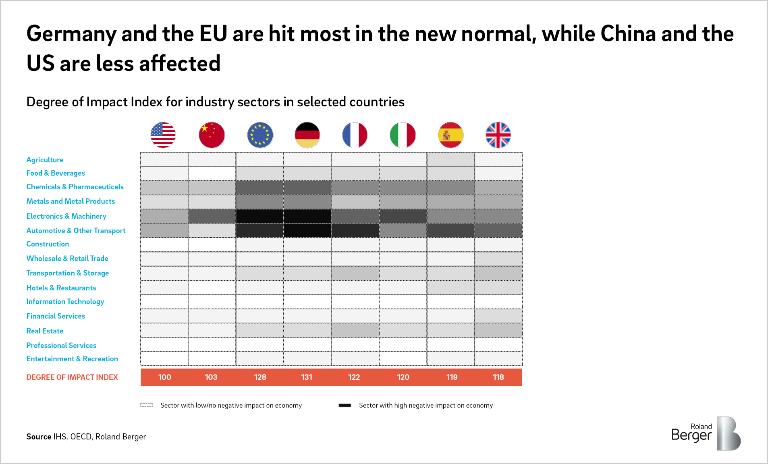

For agriculture, food and beverages, construction and wholesale and retail trade the impact will likely be small. For example, long-term demand for new office space may be dampened due to increased remote working but negative long-term effects on the construction of residential real estate is unlikely. Information technology and professional services, by contrast, stand to benefit from the crisis: With more people working from home, digital tools and services will be in demand, while the need for professional services will increase due to greater uncertainty in many areas of life.

Other industries may be somewhat more impacted. The pharmaceutical sector may suffer due to regionalization and localization of the production of critical goods. Financial services could be affected by the increase in the number of defaults and the decrease in demand for financing for large-scale capital investments. We are likely to see less demand for corporate real estate services, but private demand will remain unaffected. Entertainment and recreation is suffering in the short term due to health-related restrictions, but is likely to largely recover longer term.

Worst hit in the long term, however, will be automotive, transportation and storage, electronics and machinery, metals and hotels and restaurants. For example, decreased purchasing power and increased personal economic uncertainty mean that people will be less likely to buy automobiles in the new normal, just as companies will be less likely to invest in machinery. De-globalized supply chains will disrupt the metals industry – and also reduce the amount of business travel. This, in turn, will have a negative impact on spending in hotels and restaurants.

By combining our outlook for specific industries with our forecasts for different regions, we can calculate a "Degree of Impact Index" for selected countries. We express this as a score for each country, indexed to the impact of the crisis on the United States (= 100). Countries with a high share of manufacturing sectors and a high degree of trade openness, such as Germany, are particularly affected and thus have a higher score. Those with a large domestic market and therefore less global interconnectedness, such as China and the United States, have a lower score.

Recommendations

Governments can play a fundamental role in helping business adjust to the new normal. Many countries have been able to calm their economies in the short term by means of huge financial aid. In the long term, this is not financially viable. Measures to safeguard the economy can include pushing the development of future-oriented sectors as a means of diversifying the economy. Similarly, where countries have been highly dependent on exports in the past, domestic demand must now be strengthened.

The Covid-19 crisis has proven that populations can accept radical change where necessary. But they also expect the economic and business models of the future to be greener, fairer, more circular and more sustainable. This is a call to action for governments, and also for businesses. The key for companies will increasingly be adaptability and flexibility, be that in the form of smart networks for collaborations, learning through experimentation or thinking beyond traditional sector borders.

As the world starts adjusting to the new normal, Roland Berger is monitoring the impact of the spread of Covid-19 on a daily basis.

The projections in this article were updated in September with slightly revised numbers.