2. Demand response and load balancing

Dynamic customer involvement in balancing short-term power supply and demand is a megatrend in the utilities sector. As both the share of fluctuating renewable energy sources and demand for electricity increase, flexible tools are becoming increasingly important.

Rather than adding new supply resources to meet peak demands, it is often less costly to recruit customers who are willing to reduce their electricity usage at certain times in return for a discount or payment. This form of "demand response" saves money for both the utility and its customers.

Crypto mining can take demand response to a new level, enabling large loads to quickly be curtailed for a fee. It can help provide a seasonal balance in hot climates, where energy-hungry operations like air conditioning units and water desalination plants create seasonal load patterns. Innovative utilities such as Black Hills Energy are already developing flexible tariffs to accommodate this new use case.

3. System control and planning

Crypto mining also has the potential to assist local utilities with distribution management. Given the locational flexibility of crypto miners, a utility can strategically place a mining operation where it benefits the system most. Crypto mining can help balance distributed generation by absorbing excess power and enabling a grid to operate more smoothly.

The potential challenges of embracing crypto mining

The intense power usage of crypto mining can cause reliability and equipment problems for grids that don’t have the capacity to handle increased loads. Some countries have already banned or significantly regulated crypto mining, including China, Iran and Turkey.

If servicing crypto miners requires grid operators to invest significant amounts in new infrastructure, this could also affect other utility customers. Cryptocurrencies can be a volatile market, and miners are likely to be reluctant to commit to long-term purchase obligations. In other words, the utility and its other customers risk stranded generation or transmission costs should the crypto miners leave before their cost responsibility is discharged.

Utilities can mitigate these risks via prepayments or obligations from crypto miners before investing on their behalf. A staged interconnection process with growing levels of financial commitment could improve the credibility of new service requests.

In-depth industry knowledge can bring positive results

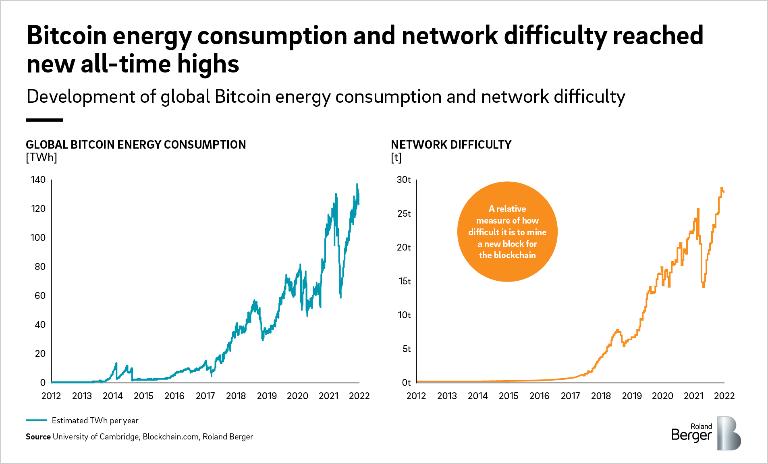

The rise of the crypto economy and proof-of-work mining activities undoubtedly hold major implications for global energy systems. It is worth noting that the challenges mentioned above are much smaller if a system already has capacity to serve the new crypto mining loads, or if the mining operations are not connected to the grid.

Handled with the right regulatory and commercial approach, crypto mining can lead to positive opportunities for governments and utilities, including an indirect acceleration of renewable energy growth. An in-depth understanding of the industry’s mechanics is vital and must be connected to national energy strategies.

![{[downloads[language].preview]}](https://www.rolandberger.com/publications/publication_image/roland_berger_publication_1_download_preview.png)