Green transformation in South-East Asia

How private equity can create value in the Southeast Asian green transformation

"Private equity firms are in a strong position to play a pivotal role in the green transformation in Southeast Asia. Not just from a compliance or risk management perspective, but especially also as a growth opportunity."

To address climate change, jurisdictions worldwide have put new regulatory schemes in place. With the Green Deal, the European Union aims to transform its economy towards decarbonisation. The Biden administration has followed suit with the US Inflation Reduction Act, which is driving an investment boom in the US in clean energy sectors, from renewables, hydrogen, and clean fuels to manufacturing equipment, such as solar panel cells and modules. Southeast Asia has fewer regulatory schemes and incentives in place, and investments in the green economy are lagging. Nevertheless, countries in the region are developing their decarbonisation roadmaps with increasingly ambitious policies and incentives.

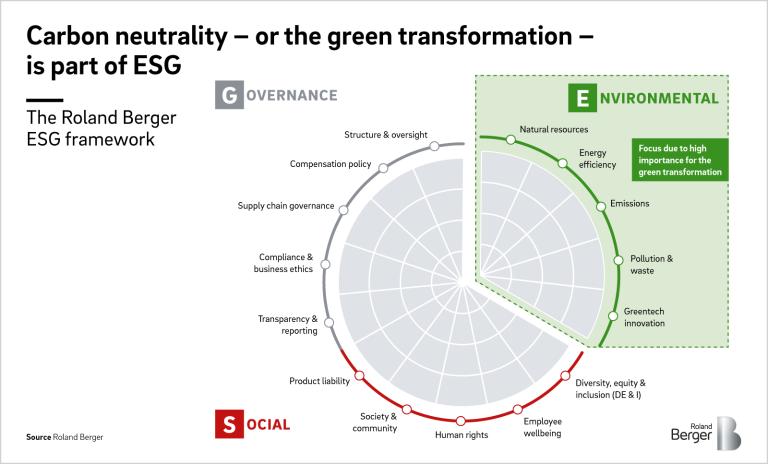

We believe private equity can act as a catalyst for the green transformation, which plays a major role in transforming companies from gray to green. For regulators, rating agencies, and limited partners, the various aspects of the green transformation – in other words, achieving carbon neutrality – are embedded in ESG frameworks. Thus, a careful balance must be struck between striving for carbon neutrality and meeting social and governance requirements, increasing the complexity even further. We consider all three dimensions below.

In recent years, ESG investing has become a significant force in the investment arena to the extent that green-rated assets have become essential to asset allocation. To meet market needs, limited partners require returns from green assets. Several ways exist for funds to generate green returns – for example, using asset selection, proactive reporting, or transforming companies from gray to green. However, at present, no single framework for ESG exists. Companies must grapple with varying terminologies and navigate different regulations and frameworks for ESG issues.

Green transformation opportunities

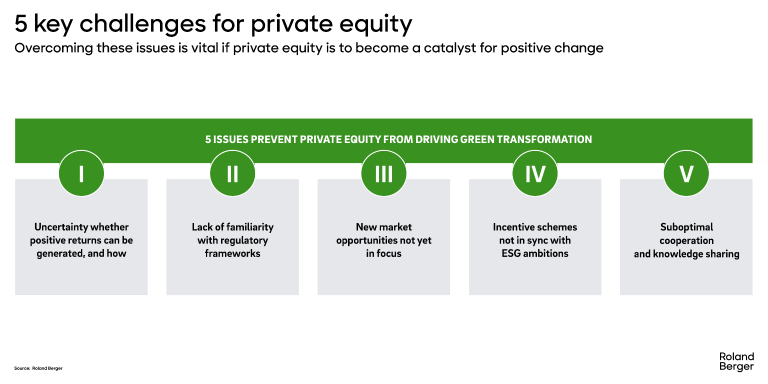

For decades, the private equity industry has driven corporate transformations. Now, it is poised to assume a significant role in transforming companies from gray to green. Thanks to their mid to long-term investment horizon, general partners are in a unique positioned to act as a driving force for carbon neutrality and meet society’s collective responsibility towards future generations. We have examined in detail at the five key factors currently hindering private equity from playing a more significant role in green transformation. We are convinced that by actively addressing those challenges with value creation concepts, companies can turn them into opportunities – with the help of the strategies outlined here.

We expect strong growth for biofuels and biogas/biomethane. South-East Asia is blessed with large agriculture and food sectors – with opportunities to convert feedstock such as used cooking oil, rice husks, sugarcane bagasse, bamboo, food waste and other sources to biofuels and biogas/biomethane. For example, such biomethane can then be used for industrial applications and in the power sector, replacing natural gas in both cases. With the region increasingly relying on LNG imports for its gas demand, partially replacing this with biomethane also increases energy security and provides additional income for the agriculture sector. We have seen a rapid increase in valuations in Europe and North America for companies involved in biomethane production and transport. We expect this sector’s demand (and valuation) to also take off in South-East Asia.

Register here to get the full ASEAN Private Equity Newsletter.