Roland Berger advises the aerospace, defense and security industries. We support OEMs, suppliers, agencies and investors.

How the Covid-19 crisis is expected to impact the aerospace industry

By Robert Thomson and Manfred Hader

Latest update: The coronavirus pushes the airline and aerospace industry into the era of "new normal"

With its rapid global spread, massive death toll and resultant lockdowns and border closures, Covid-19 has devastated demand for travel globally. Indeed, Covid-19 is a "perfect storm" for the travel sector due to a combination of changes in passenger behaviour, government restrictions on travel, and the broad economic downturn which it seems to have triggered globally.

In our April 2020 study on Covid-19's impact on aerospace , we elaborated on "How we will need to rethink the Aerospace industry", formulating 3 key scenarios for the industry through the crisis and how it may recover.

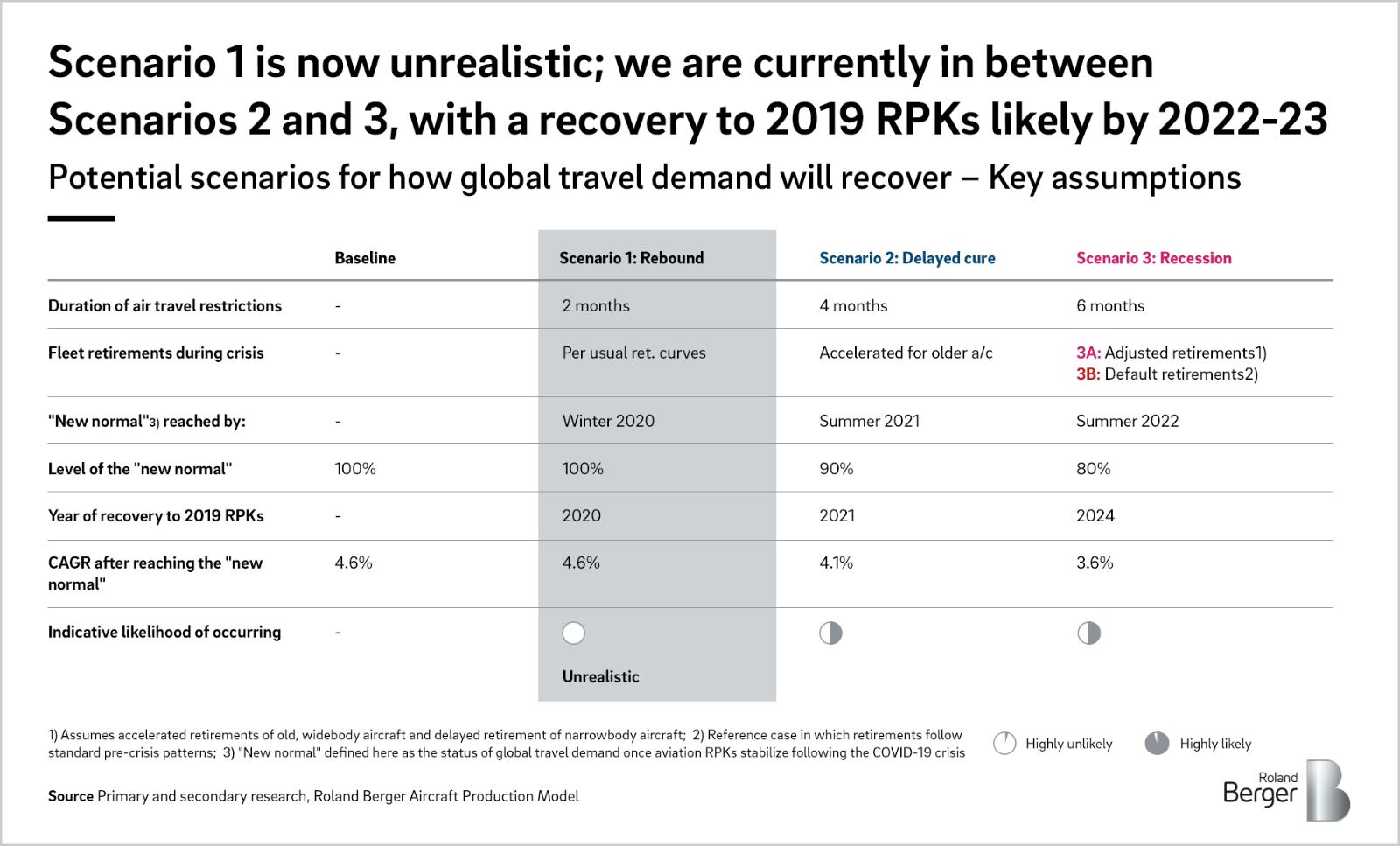

In this May 2020 update, we can confirm that Scenario 1: Rebound is not considered realistic any longer. Even though Europe and China have begun to relax domestic lockdowns, countries in Africa and South America are increasing travel restrictions, while the US travel remains tightly restricted. Considering new flight bookings in China as a leading indicator, given the improvement of the overall situation in that country, new flight bookings by Chinese travellers remain ~65% lower than this time in 2019. Globally, >60% of aircraft are grounded, and airlines and airports have begun implementing amendments to standard operating procedures for whenever travel does resume.

A full recovery to pre-crisis expected levels of demand is thus unrealistic. Our latest analysis suggests that we are likely to be somewhere in between Scenario 2: Delayed Cure and Scenario 3: Recession, with a recovery to 2019 RPK levels expected no earlier than 2022-23. One way or another, we will face a "new normal" after the Covid-19 crisis is over.

These latest findings not only have implications for immediate travel, but for the long-term outlook for the sector, with significant ramifications for not only aviation but aerospace manufacturers, too. Indeed, with airlines applying for government bailouts, deferring new aircraft orders and curtailing aftermarket spending, the impact on the aerospace sector has already been significant.

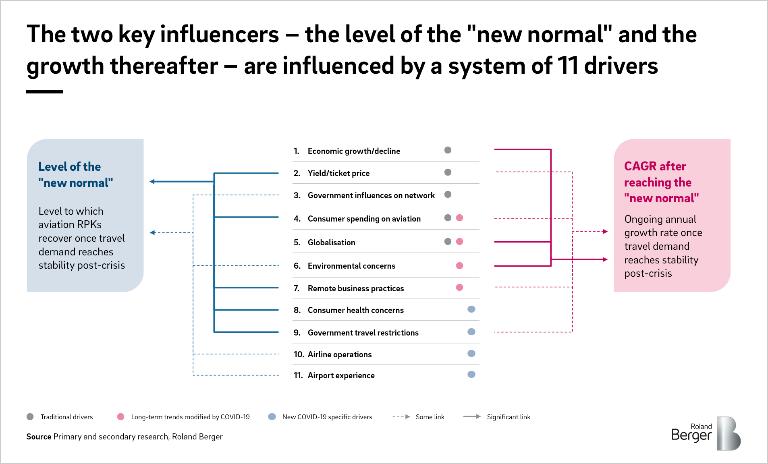

Fundamental influencers for the shape of the recovery are (1) the level at which RPKs resume when the crisis ends, and (2) the ongoing growth in travel demand thereafter. These measures are influenced by 11 drivers – some traditional, some long-term trends which have been modified (accelerated or decelerated due to Covid-19), and some which are unique to the Covid-19 crisis.

Regarding the level of the "new normal", we expect health concerns to dampen consumer demand, while business travellers take to more remote working, driven by cost reduction as much as having become accustomed to remote business practices through the crisis. At the same time, after a potential period of competition when demand returns, we also expect an increase in average ticket prices, driven by increased costs borne by airlines due to measures taken to prevent further spread of the virus, such as onboard social distancing. Furthermore, if government restrictions require quarantines for arriving travellers, connecting travel through major hubs could be severely disrupted.

Regarding ongoing growth after the crisis, we expect reduced RPK growth, driven by slower GDP growth linked to the likely global economic slowdown. We also do not expect travel restrictions to lift simultaneously around the world, but rather go through a staged series of re-openings (and in some cases re-closures if countries experience second waves), causing less resolute growth post-crisis. The long-term trend of globalisation may also slow down or potentially be reversed by the crisis, further causing a reduction in long-term growth.

What does this imply for the aerospace sector?

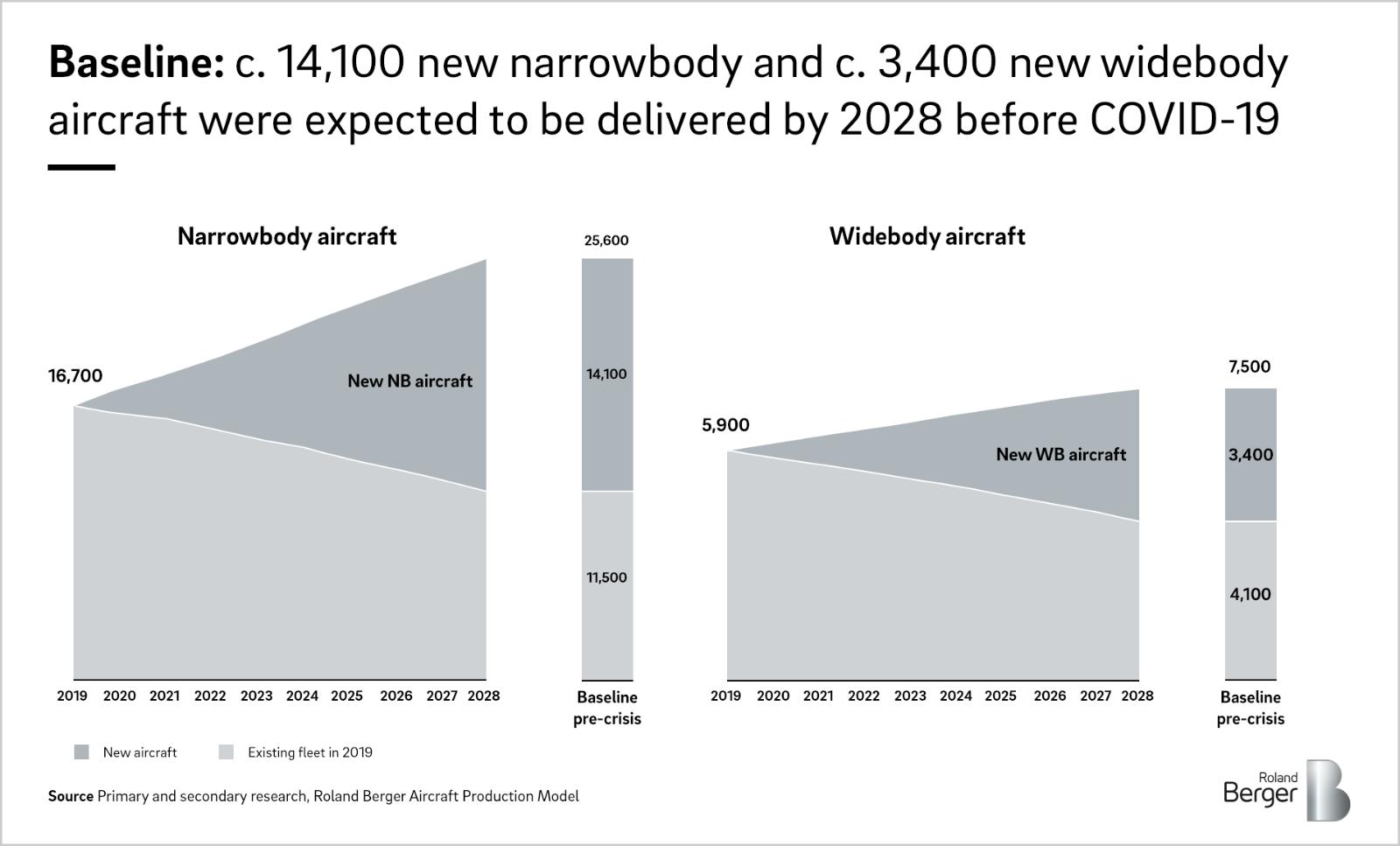

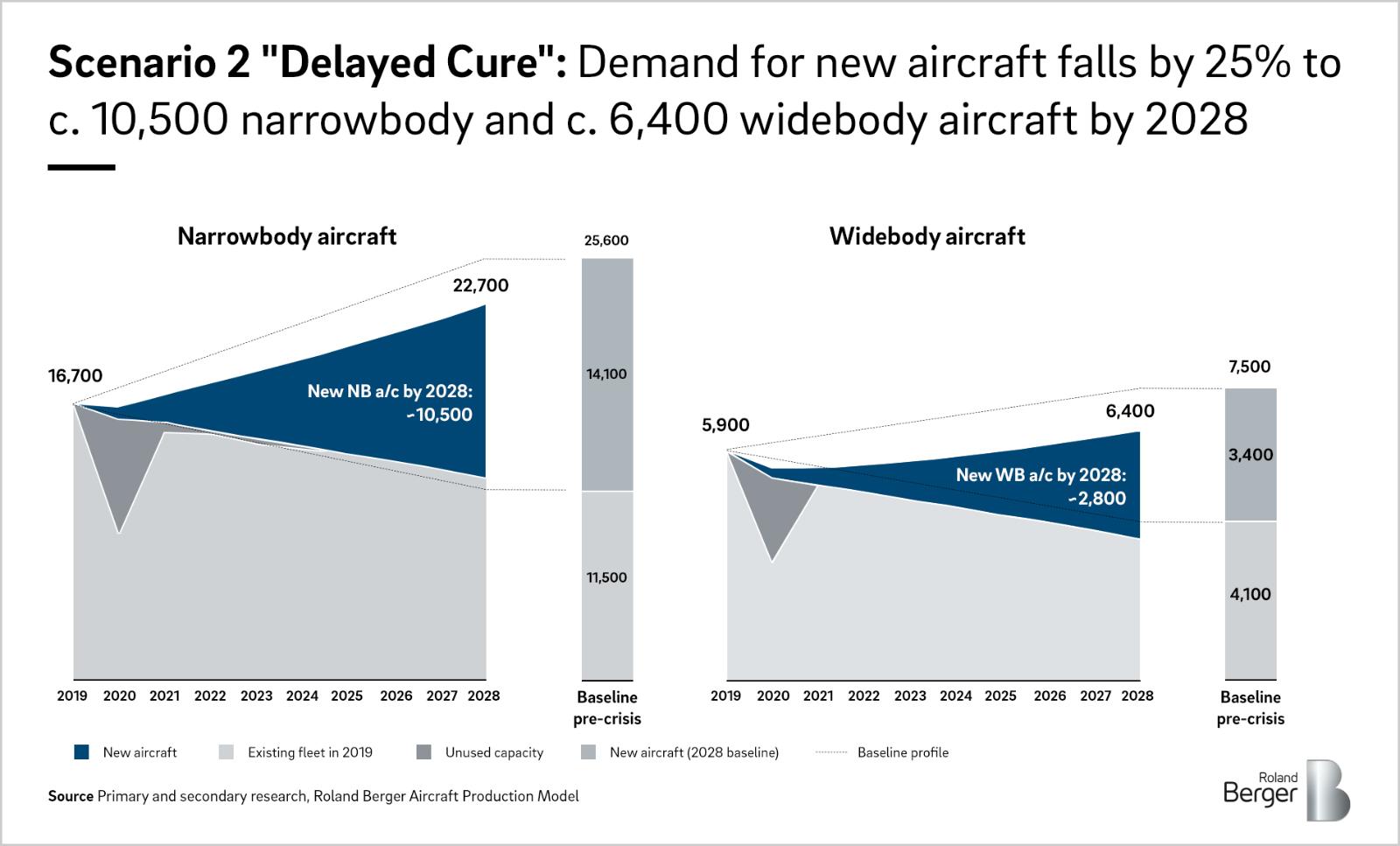

With our latest intelligence, updated through deeper research, and interviews with airlines and aerospace suppliers , our estimates suggest a 25-50% reduction in OE demand over 2020-28, depending on which scenario comes to pass.

From an OE production demand perspective, how airlines choose to ground or retire their fleet is a critical driver. When grounding aircraft for the medium- or long-term, airlines consider how relevant the aircraft is for their long-term strategy, the value it could fetch on the secondary market, and the cost of retiring the aircraft versus the cost of grounding it. Today, there are two distinct behaviours we have seen in the market:

(A) airlines accelerating the retirement of older widebody aircraft which are relatively expensive to operate and don't fit well with their long-term fleet strategy, while delaying retirement for narrowbody aircraft by a few years, and

(B) airlines retiring aircraft based on age on a standard S-curve, in much the same way as before the crisis

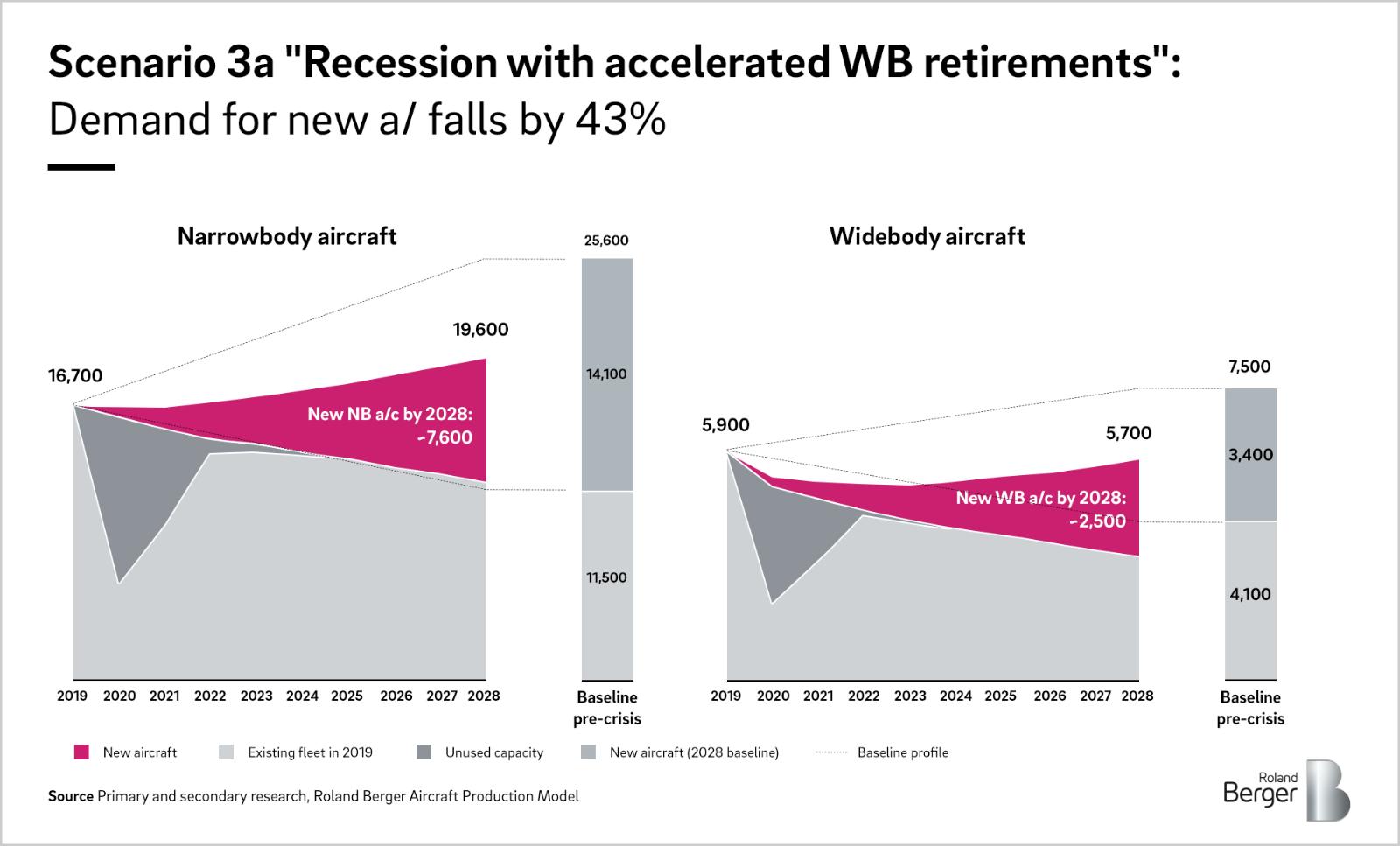

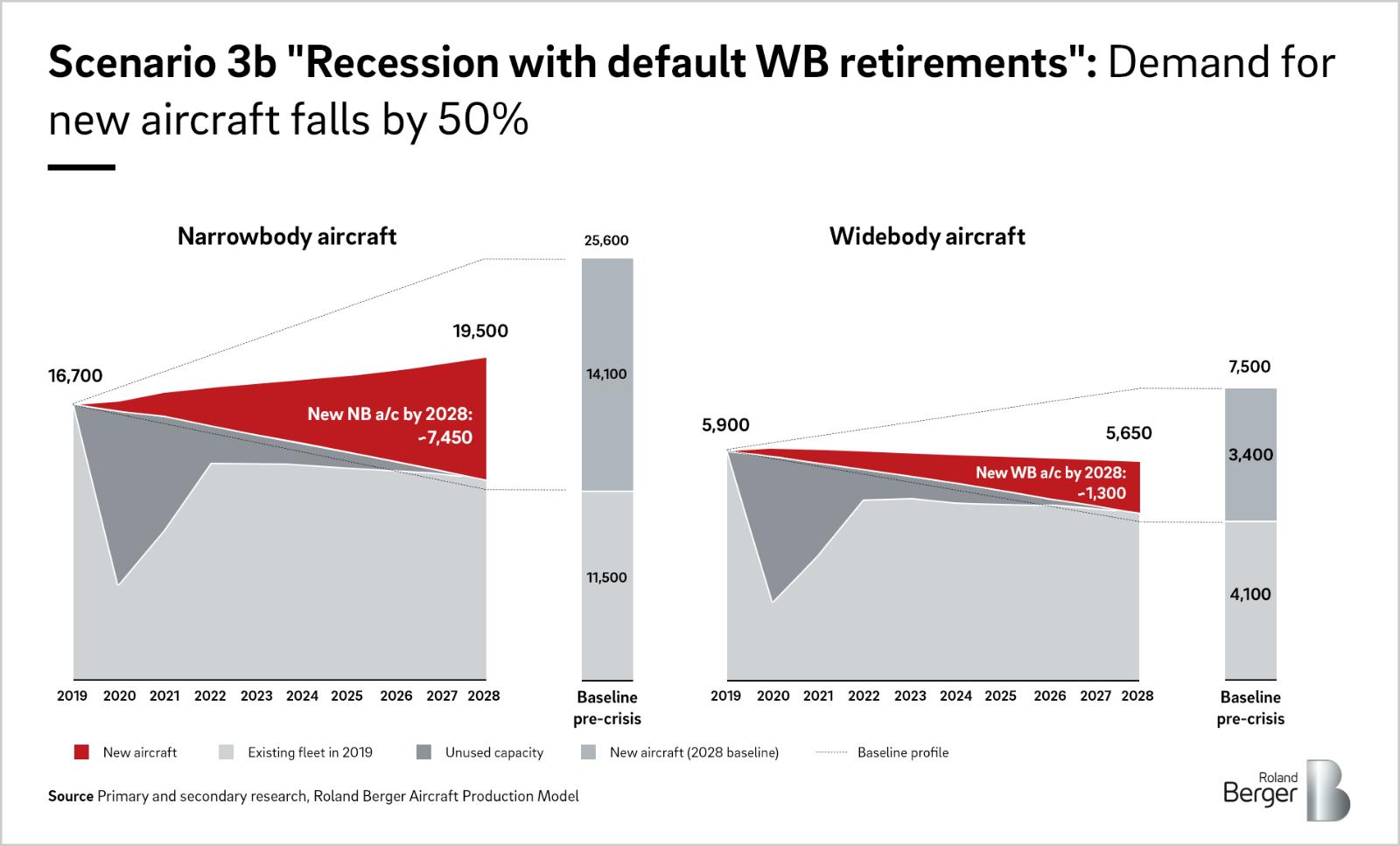

It is not yet clear which of these two strategies will dominate the market, but the choice is highly sensitive for aircraft deliveries. We modelled both as variants on Scenario 3.

Relative to the baseline, Scenario 2 represents a reduction of c. 25% in new aircraft demand over 2020-28. The majority of the pre-crisis growth would have been served by narrowbody aircraft – thus, unsurprisingly, the reduction in deliveries also skews towards narrowbodies. Scenario 2 forecasts c. 30% reduction in narrowbody demand and a c. 20% reduction in widebody demand.

Scenario 3A, which assumes somewhat faster retirement for widebodies and somewhat slower retirement for narrowbodies sees a demand reduction of c. 50% for narrowbodies and c. 30% for widebodies, with an overall OE demand reduction of c. 40%.

Scenario 3B is worse again. If the retirement of old widebodies is not accelerated, the demand for new widebodies collapses by c. 60% as airlines continue flying old aircraft for as long as practicable. At the same time, narrowbody demand falls by under 50%, giving an overall OE demand reduction of c. 50% over 2020-28.

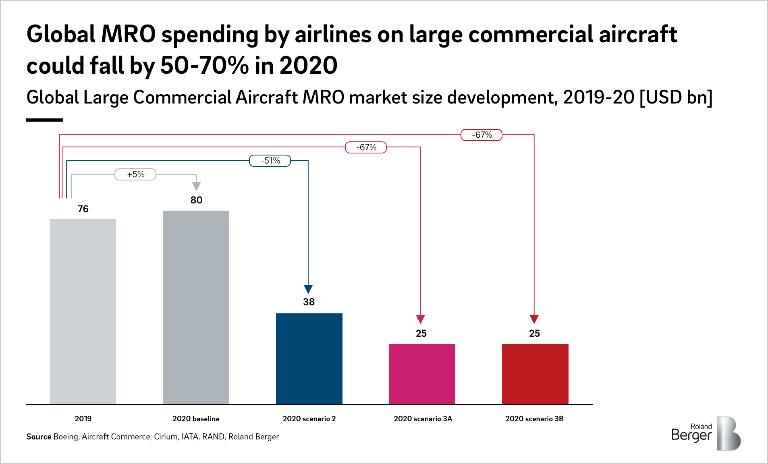

MRO spending by airlines – and thus aftermarket revenues for aerospace suppliers – is an equally gloomy picture, crashing 50-70% in 2020 (with much deeper quarterly and monthly reductions through 2020).

MRO spending, heavily driven by flight hours and cycles, does recover faster than OE production as RPKs eventually recover to pre-crisis levels, and achieved 2019 levels broadly in-line with when RPKs do.

We also considered several other sensitivities and variables, computing annual build rates, retirements, expected differences by manufacturer and platform – the impacts vary widely across the industry.

What can aerospace suppliers do to thrive through the crisis?

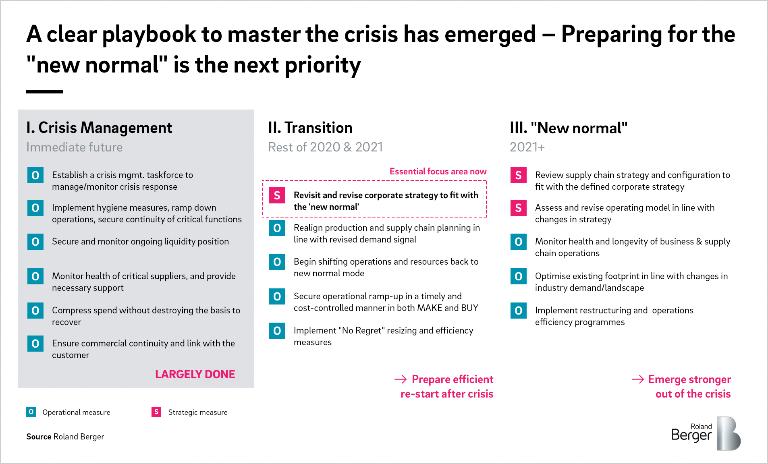

Over the past few weeks and months, most suppliers have managed to secure liquidity, manage their workforce, and undergo an effective production ramp-down.

Next, while companies must of course continue managing the key operational basics – keeping an eye on cash flow, tracking demand signals (such as airline operation continuity announcements and order cancellations) to revise supply chain planning, supporting sub-tier suppliers to remain afloat – it is now time for suppliers to re-think their strategy and ensure it is fit-for-purpose in the "new normal".

As an initial step, suppliers should ensure readiness to support their airline customers to ensure aircraft can return to service quickly as and when pockets of demand return – this is essential for the industry to recover and heal.

Another major avenue for aerospace suppliers to explore is whether they can influence local and central governments to incentivise faster aircraft retirements. As demonstrated by the distinction between Scenarios 3A and 3B above, an acceleration of aircraft retirements in the near term (to retire relatively old and costly widebodies, for example) partially mitigates the damage to the aerospace sector as OE demand eventually recovers more strongly. This also has potential benefits for the environment also as cleaner new aircraft replace less efficient older aircraft faster than expected. Indeed, a similar scheme was applied to the automotive sector ("Cash for Clunkers") in which governments compensated car owners to retire old cars – something similar in aviation may be a win-win-win for airlines, aerospace manufacturers and the environment, alike.

The "new normal" will mean less spending by airlines on both new aircraft and the aftermarket – but it will also mean a re-balancing of the aviation fleet, with some platforms losing out more than others. Further, after years of globalisation, Covid-19 is also true shock for the aerospace supply chain, which will offer major structural risks but also opportunities. Companies should thus re-evaluate their product portfolio, breadth of operational capabilities (engineering, service delivery, platform-specific expertise, etc), as well as their manufacturing footprint.

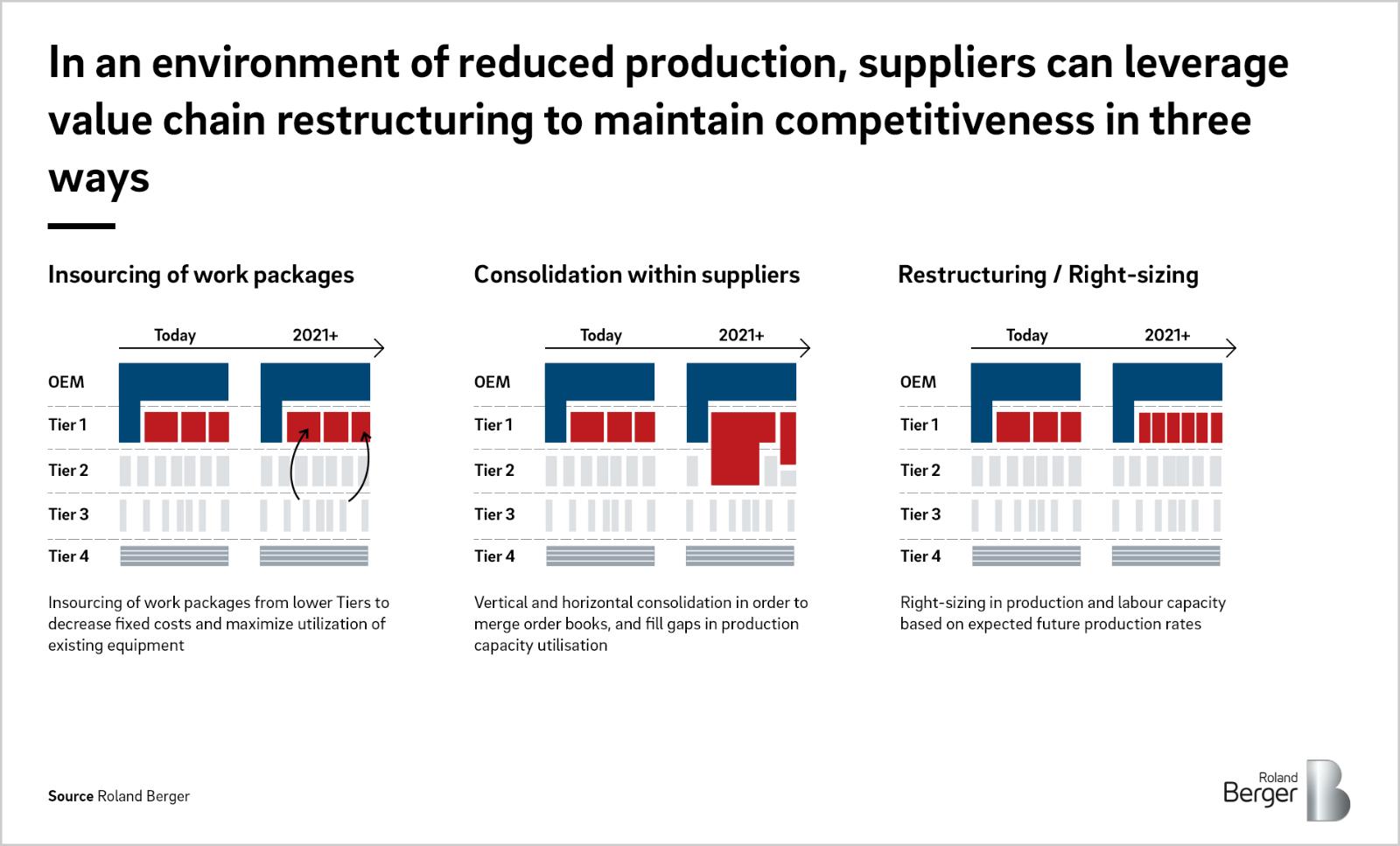

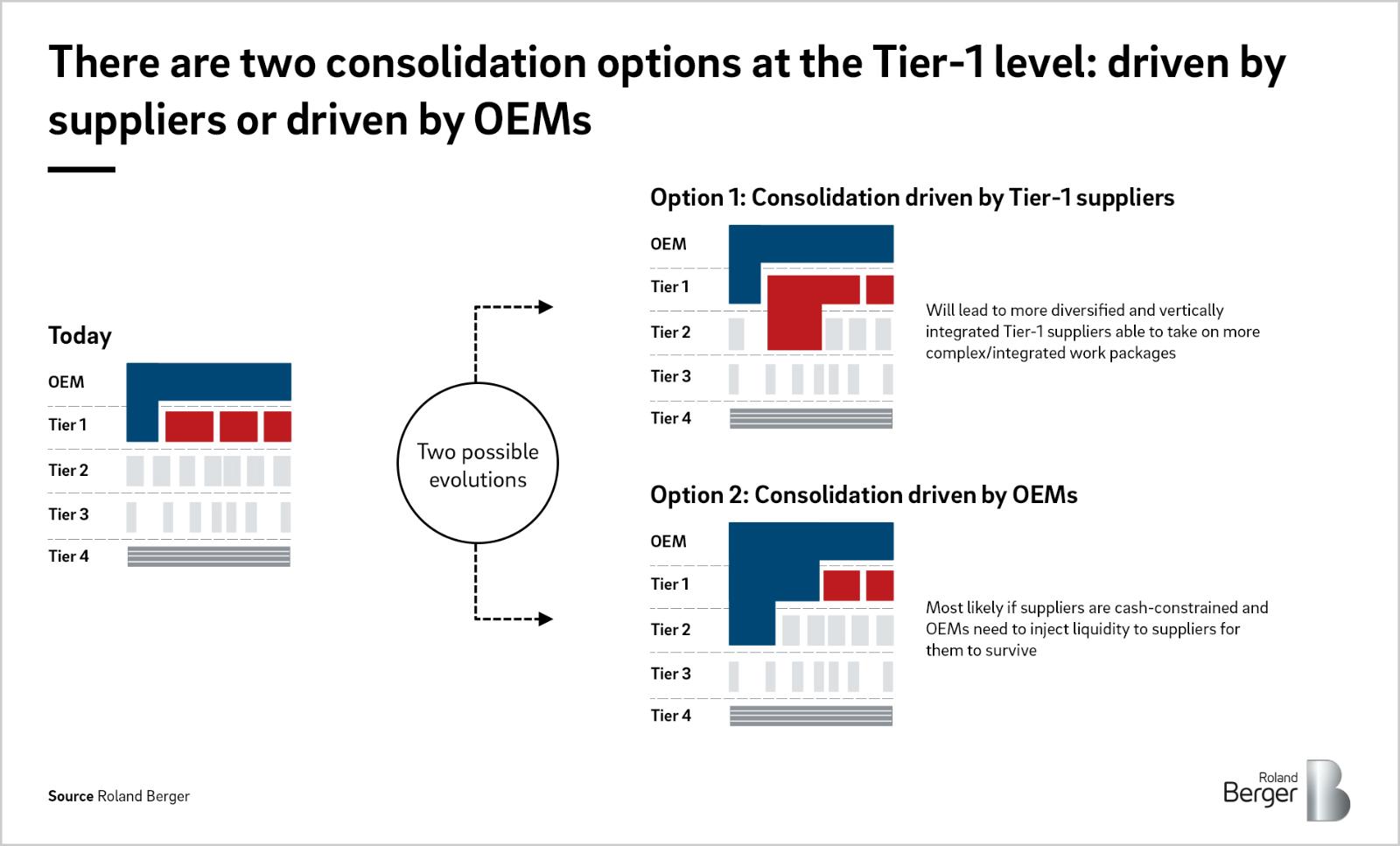

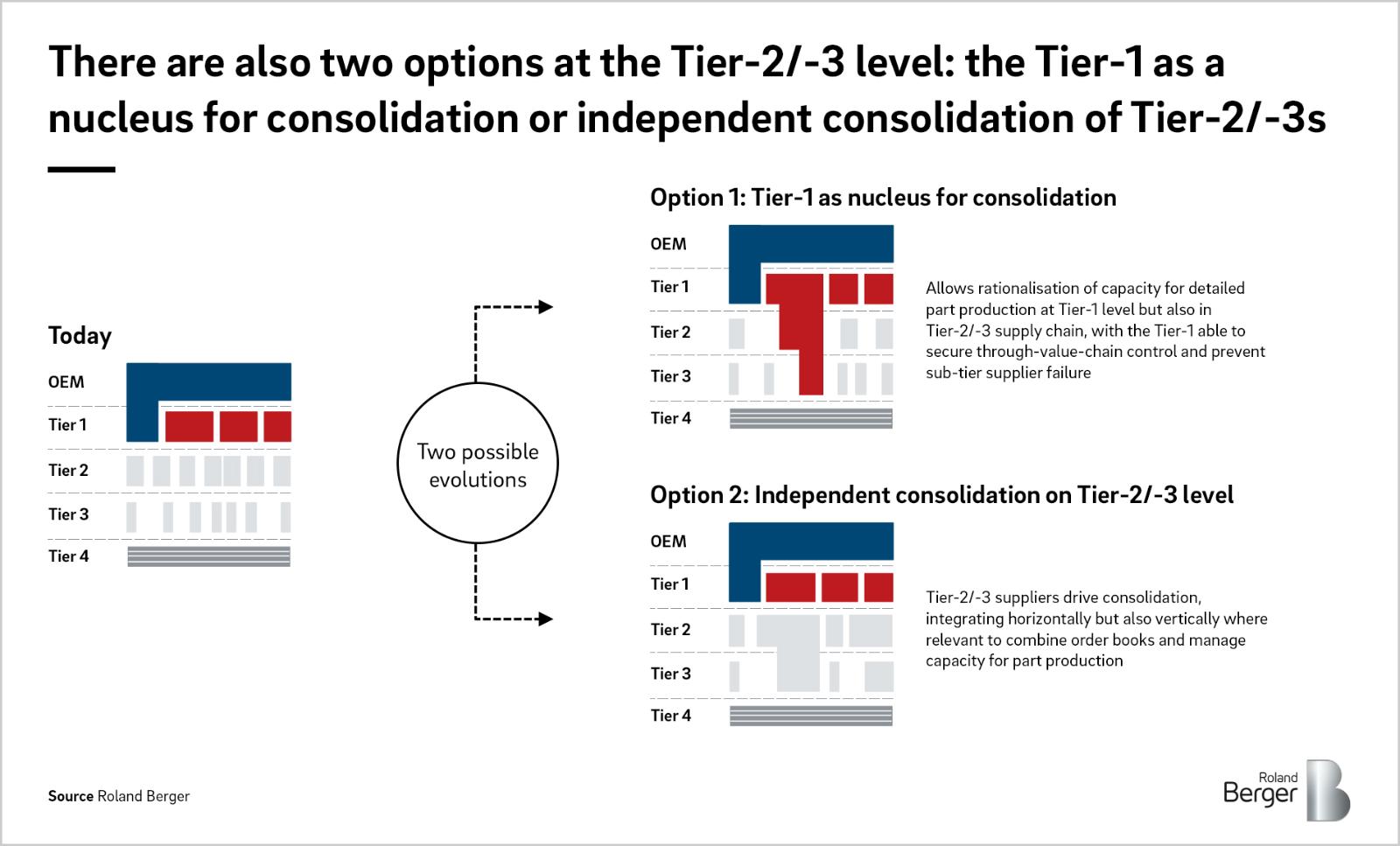

With respect to the supply chain, balancing supply-side over-capacity with reduced order books will necessitate degrees of consolidation, vertical integration and "right-sizing", varying by technology and value chain positioning. There are several distinct ways the structure could evolve, and suppliers must evaluate which is optimal for their business.

Scenario thinking and war gaming will also serve suppliers well as significant uncertainty remains in which scenario will unfold as we begin to recover from the Covid-19 crisis.

We at Roland Berger will continue tracking and analysing the crisis and reporting on its impact on the aviation and aerospace sectors. If any elements of the analysis above are relevant for your business, please reach out to us to organise a discussion where we can delve deeper and work to develop more bespoke insights.

_image_caption_w1280.jpg)