Influenced by several drivers, the automotive landscape is transforming. Roland Berger outlines how to capitalize on these trends to achieve resilience.

Inflation turns up the pressure on automotive suppliers

Why suppliers must act fast to share the cost of rapid inflation with vehicle OEMs

Rampant inflation is disrupting established pricing models in the auto industry, placing serious pressure on suppliers. To weather the storm, they must act quickly by creating sustainable new pricing solutions and working closely with OEMs.

In recent decades, the relationship between suppliers and vehicle manufacturers has been a fairly simple one: OEMs would issue a call to tender and then use an auction system to select the most competitive offer that met certain technical and quality expectations.

These contracts often come with a twist: OEMs typically demand annual price reductions as they assume manufacturing processes will become more efficient – and cheaper – over time. But, in reality, the efficiency gains are much smaller than any price reductions, which often reach 5% per year for the first few years of production. To compensate, suppliers raise their initial prices, enabling them to break even over the course of a contract.

"It will be impossible for suppliers to counter cost rises with efficiency gains alone."

Tough luck, suppliers?

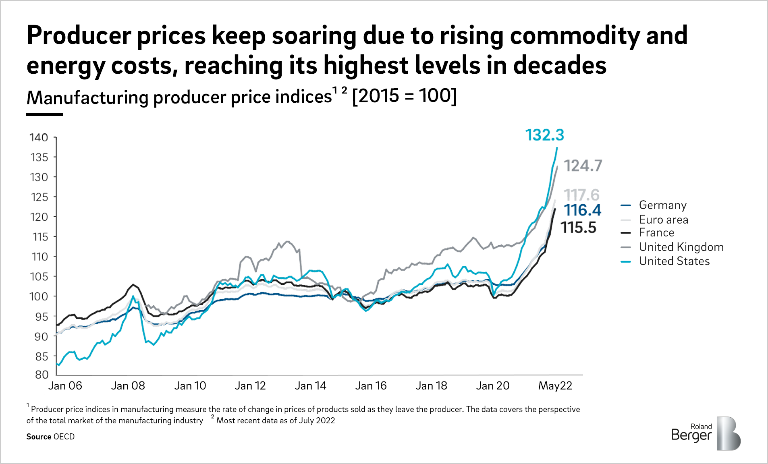

Rampant inflation is now demanding an urgent rethink in the way suppliers price their products. Between 1999 and 2021, eurozone inflation was just 1.6%, with the US inflation rate only a fraction higher. These low rates have formed the basis for parts supply contracts for some time, which often last six to eight years. The majority do not include the option to raise prices should anything drastic occur.

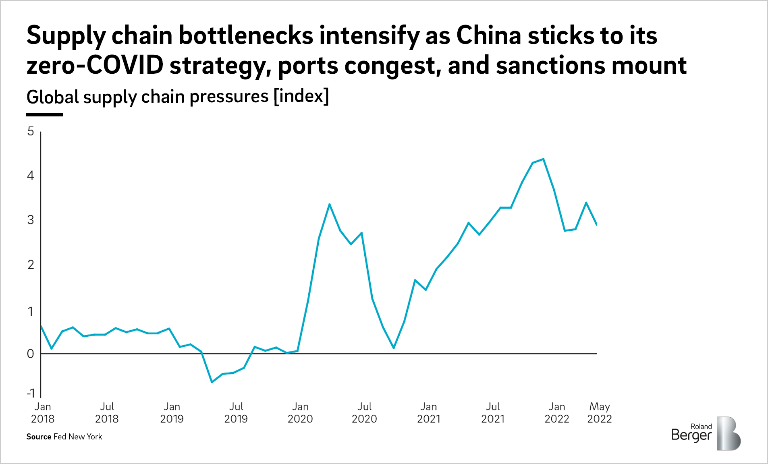

But things are changing fast. Inflation now exceeds 8% in both the eurozone and the United States. Inflation for fossil fuels, a crucial part of the automotive supply chain, has reached double digits. Unfortunately for suppliers, these cost increases are not easily passed on to OEMs. While price rises for some raw materials like steel and copper are automatically covered in many agreements, most other materials and, crucially, labor costs are still considered entrepreneurial risks. “Tough luck, suppliers,” the OEMs say.

A vicious circle of inflation

And the bad news is – things are getting worse. The rise in energy prices may turn out to be transitional, but most indicators currently point to persistent inflationary pressure. According to recent surveys, many people expect higher inflation to last. This leads to higher wage demands, which then lead to increased production costs – a vicious circle that is hard to stop. Expect double-digit price hikes for years to come.

It will be impossible for suppliers to counter these cost rises with efficiency gains alone. Their only solution is to raise prices for OEMs – and quickly.

But many suppliers seem yet to fully grasp the extent of this paradigm shift. A one-time price increase will bring limited benefit if inflation levels stay high for several years. Suppliers need to adjust their contracts to automatically cover future price rises across a range of areas, not just the traditional commodities of steel and copper. They must also consider the impact of higher interest rates. Automotive parts supply is a relatively capital-intensive business – increased borrowing costs will add further pressure to suppliers’ balance sheets.

Four steps for supplier action

So, with stable prices unlikely to return anytime soon, what can suppliers do about it? We have compiled four key steps to alleviate the pressure and improve both short- and long-term prospects.

- Don’t forget sales

All too often, sales teams are reluctant to even start discussing price changes, which have mostly been unnecessary for the past 20-30 years. Ensure they understand this new reality. - Permanent price changes

A one-time price adjustment will soon require renegotiation. Instead, opt for automatic price escalation clauses. Traditionally, these have only covered standard commodities traded on large exchanges, but OEMs are increasingly willing to accept more complex price adjustment clauses that include rises in things like average labor costs and oil prices. - Cross-functional teams

Repricing clauses must be a group effort. You’ll need sales for the customer interface; purchasing to cover the right materials; engineering for materials and labor insights; and controlling to focus on numbers. - Start negotiating

OEMs recognize the problem and are willing to work on solutions. They are often surprised at how easily many suppliers are turned down. Complex price adjustment clauses may still be viewed with some skepticism, but early successes show that OEMs actually have considerable flexibility if their supply is at risk.

Do not underestimate the speed and magnitude of the problem – rapid action is paramount. Double-digit inflation could put some suppliers out of business faster than they think.

Sign up for our Roland Berger newsletter. You will get regular updates on newest publications across all our expertises.

_person_144.png)