Infrastructure Investment Outlook 2024

![{[downloads[language].preview]}](https://www.rolandberger.com/publications/publication_image/Roland-Berger-Infra-Investment-Report-2024_COVER_download_preview.jpg)

A turning tide?

By Hrishikesh Potey and Siongkoon Lim

2023 was a challenging year for the infrastructure segment of the alternatives universe. After a resilient performance in 2022, infrastructure deal activity suffered a blow in 2023. Challenging financing conditions led to a more pronounced decline in deal count and deal size than was anticipated by fund managers and advisors.

"The sentiment differs significantly across sectors, being more upbeat for Transport, Energy, Digital and Hybrid Infrastructure than for Social Infrastructure and Utilities."

This decline is still less pronounced and delayed when compared to the decline seen in private equity buyouts. A wave of consolidation that started in 2022 continued well into 2023 and 2024 reaching a peak with BlackRock acquiring GIP and General Atlantic acquiring Actis. Notwithstanding the headwinds to deal count and fundraising continuing into the first quarter of 2024, the near-term outlook appears more optimistic than what we saw a year earlier.

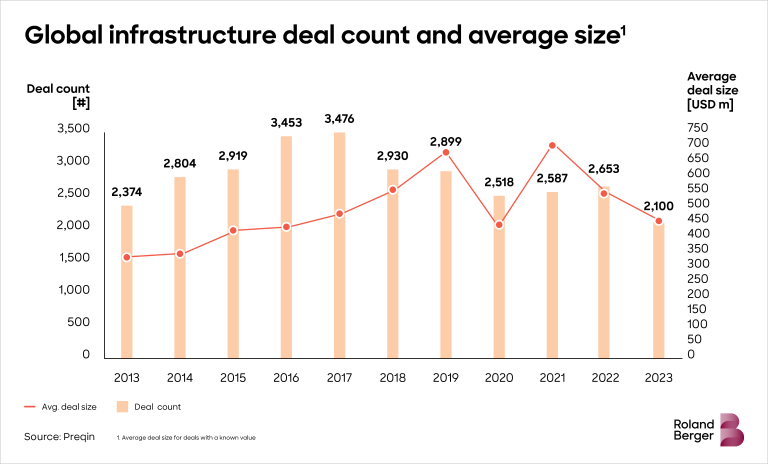

Macro headwinds that started blowing in 2022 continued well into 2023 significantly affecting infrastructure M&A activity. In 2023, global infrastructure M&A deal count declined 21 % y-o-y, while average deal size dropped 16 %. This decline is stronger than what most respondents of our Infrastructure Investment Outlook 2023 survey expected as of Jan 2023. Worsening macroeconomic situation as the year 2023 progressed was the reason. It is also the first time since 2013 that average deal size declined for two years in a row (2022 and 2023).

"Europe and North America continued to account for over 2/3 of the global deal count. Their share in the global deal count grew by 5% over 2022."

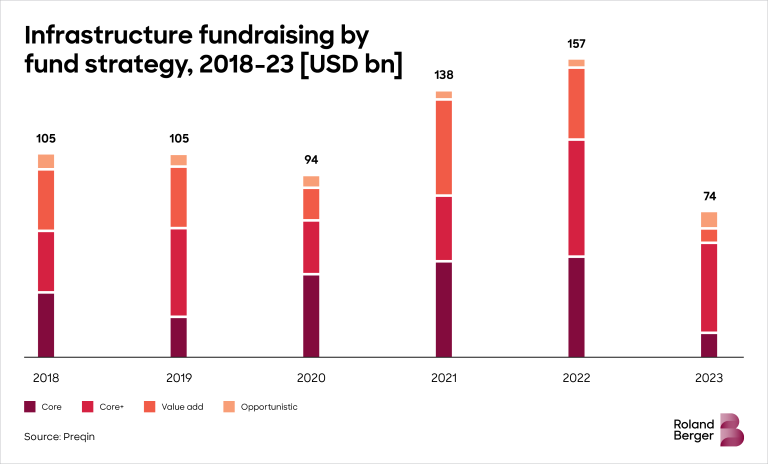

The most pronounced impact of the slowdown has been on new capital. Infrastructure fundraising declined by >50 % in 2023 from its 2022 peak of USD 157 bn. Fundraising for the Core strategy experienced the steepest decline, while that for the opportunistic strategy doubled, albeit from a small base. Allocation to the Core+ strategy declined in 2023 y-o-y, but remains significantly above historical levels. Since 2018, the share of North America in global fundraising has grown significantly, especially for the Core+ strategy.

Energy continues to be the largest infrastructure sector, despite a decline in deal count in 2023. No sector was immune to the macro headwinds, but M&A activity declined steepest in Transport and Social infrastructure (-48 % and -73 %, respectively).

"Despite headwinds to deal count and fundraising in early 2024, the outlook is more optimistic."

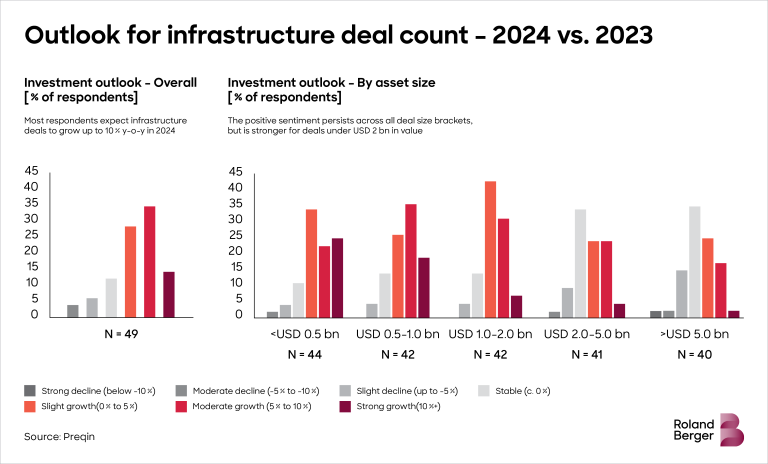

To gauge investors’ expectations for infrastructure investments in 2024, we surveyed experienced investment bankers and fund managers. 60 % of the respondents expect infrastructure deal count in 2024 to grow slightly or moderately over 2023, while 14 % expect it to grow strongly. This sentiment is the strongest for deals below USD 2 bn in size. The outlook for larger deals is less optimistic but has improved when compared to that from our 2023 survey results.

The need for capital to develop long term sustainable infrastructure is larger than ever, and fund managers are responding in many ways. Thematic investments in energy transition, transport decarbonization, and circular economy are expected to continue, and so is the focus on hybrid infrastructure assets. In this report we start at a macro level, dissecting the broader investment and fundraising trends, before moving to sector-level analysis, where we address key frontier topics by sector.

![{[downloads[language].preview]}](https://www.rolandberger.com/publications/publication_image/Roland-Berger-Infra-Investment-Report-2024_COVER_download_preview.jpg)

A turning tide?

_1906x1152px_image_caption_none.jpg)