Our latest study examines the opportunities and the challenges of ecosystems for insurance companies.

Insurance sales strategy in 2028: "One size fits all" has had its day

By Julian Gulden and Oliver Riedel

Scarcer distribution resources, shrinking volumes and changing customer needs put increased pressure on insurance companies to rethink their strategy

Insurance distribution is currently experiencing the fastest and most extensive transformation in decades. Numerous developments that will shape the "new normal" in insurance distribution in the year 2028 have accelerated significantly in recent years. Many of the resulting impacts will be felt simultaneously and, taken together, they will lead to a more diverse distribution landscape.

What options do insurers have now? What role will new distribution channels play and how will insurers be able to differentiate themselves in the future? Answers to these questions are offered in the white paper "The future of insurance distribution" authored jointly by Roland Berger and InsurTech Hub Munich (ITHM) .

Declining capacities, shrinking commission volumes in traditional channels, differentiation through new technologies

The paper describes how insurance distribution in 2028 will be shaped by independently minded customers, a smaller number of ambitious distribution partners and new cooperation partners, and numerous technologies that are embedded in the distribution processes across all channels. This constellation harbors both opportunities and risks.

Indeed, the authors expect demographic change to shave 25–30% off distribution capacity in the coming years. At the same time, ongoing consolidation will increase the size – and with it the negotiating power – of individual distribution entities.

Furthermore, a decline in new life insurance business and a shift to other lines of business and (digital) distribution channels will combine with the wider proliferation of commission sharing models to cause commission volumes in existing channels to shrink. As a result, traditional insurance sales will likely become an even less attractive job prospect for young talent. That will make distribution resources even scarcer and place them at a premium.

At the same time, technologies such as artificial intelligence (AI) and data analytics are opening up new opportunities. They are also a good way for insurers to provide targeted support for partners' distribution activities. In the tied agency business, they could be deployed in everything from lead generation/conversion to the preparation of customer meetings with next-best product/action recommendations to digital/phone-based efforts to generate more business from intermediaries' existing customer portfolios. In the broker channel, interface optimization, the dynamic pricing of modular products and broker support in the form of digital avatars are just some of the possibilities. Essentially, insurance companies will need to align the way they collaborate with and service their distribution channels and distribution partners much more closely with the varying needs of the different distribution channels. Outsourcing parts of the value chain to specialist providers and InsurTechs could also be an attractive way to make sure the right services are delivered through the right channels.

Eight positioning options for the future

Faced with this situation, insurers need to rethink their strategic positioning across the distribution channels and come up with a clear focus. They could opt to distribute their products through their tied agency network, through their own distribution channels with or without the involvement of aggregators, in partnership with external insurance experts such as brokers, banks or independent financial advisors, or in conjunction with third-party platforms in the form of affinity or embedded insurance solutions .

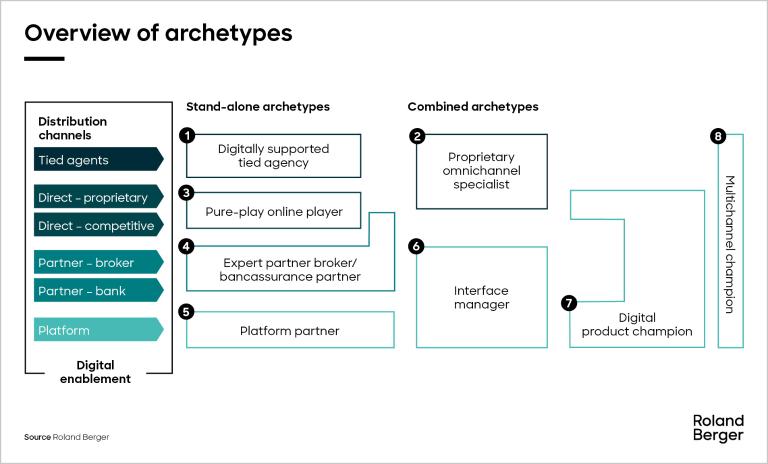

A future strategic positioning can be based on any of eight archetypes:

While tied agencies with digital support are a stand-alone distribution channel, proprietary omnichannel specialists link various channels together and offer customers an excellent end-to-end experience. Pure-play online players pursue direct distribution via digital channels, focusing on achieving a good price ranking. Expert partner brokers and bancassurance partners distribute the product through brokers and partner banks. Platform partners can develop new business potential via seamlessly connected primary products, among others. Interface managers use all the competitor channels, from brokers to partner banks to platforms, and are very efficient thanks to standardized processes and efficient data exchange. Digital product champions possess outstanding expertise in product development, both for their own digital product portfolio and to adapt products for platform business models. Multichannel champions use all of the distribution channels to provide a nuanced product and service offering. With their large corporate structures, they can reach partners and customers across all channels with a differentiated range of products and services.

Positioning in relation to the customer interface remains crucial

Most important for choosing one or more archetypes is the desired positioning in relation to the customer interface. Insurers must ask themselves: Do we intend to occupy the customer interface ourselves, leave it to partners or abandon it altogether? Choosing or rejecting one of these three options will either point directly to the most suitable archetype for them or indicate which archetypes are out of the question for their future positioning.

The authors also discuss the importance and the potential of artificial intelligence (AI) , with avatars being one particular tool. A broker pool can, for example, provide its affiliated brokers with a personal avatar trained on the insurers and the products in the portfolio and familiar with the way the contracts between pool and brokers are designed. The avatar acts as an assistant to the broker and as an interface to the pool – it can answer questions about the physical connection and tech support. Based on its product knowledge, the avatar also serves as a mirror image of the broker toward the customer and is able to take on a support role and handle sales activities. The broker thus becomes more effective and can generate additional business with the help of the avatar. The pool benefits from the added business going through its platform, and the need for personal interaction with the brokers is reduced.

The authors conclude that the days of one-size-fits-all insurance distribution are over. Future-proof distribution models must be geared closely to the expectations of distribution partners and customers, which is why we will see a process of increasing differentiation in the years ahead. It is thus vital that insurers set themselves on the right course now.

Register now to access the full study, to learn more about the biggest and fastest changes to insurance operations in decades.

_person_144.png?v=770441)