From sustainability to digitalization, businesses in consumer goods, retail, and agriculture face a variety of challenges. Discover how Roland Berger can help.

Is the Tide Turning for Retailers?

By Apratim Sarkar and Shantanu Verma

While inflation remains high, signs are indicating some commodity prices have peaked. Could retailers stay ahead of this cyclical game?

Over the past two years, the Covid-19 pandemic and geopolitical tensions have turned the global supply chain into chaos. Supply shortage, rising costs, and longer delivery lead time have pressured retailers’ already thin margins. While retailers could pass some portion of the inflated costs to consumers, this is not a sustainable strategy.

As inflation in U.S. hits a 40-year high, measures to curb inflation such as higher interest rates will also restrain consumer demand. The National Retail Federation (NRF) projects that U.S. retail sales will grow 6-8% in 2022, a 4-6% drop from the 14% growth in 2021. If we factor in the 8.5% inflation rate, the retail industry is expected to shrink in 2022 in real terms.

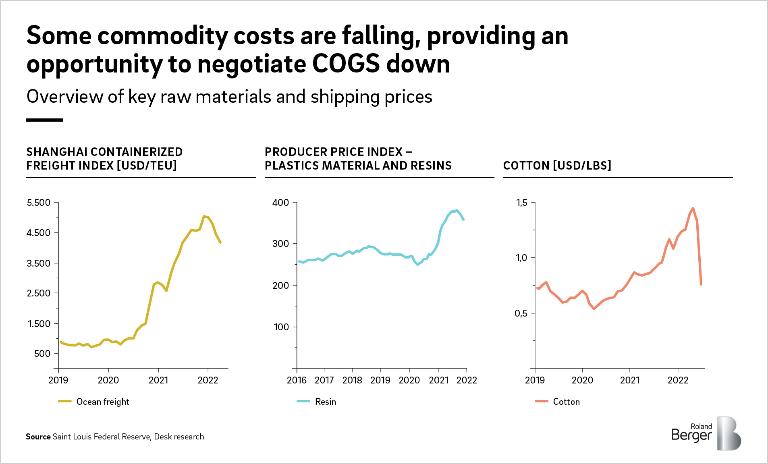

The silver lining of this bleak story is that we see some early indications that inflation has peaked, and some commodity costs are falling, which means that in theory retailers should start to enjoy lower costs. However, the question is how retailers can effectively capture those cost benefits now, before they suffer from sales loss.

The Turning Cost Tide: Some Early Indicators

"Retailers need to be laser focused on ensuring that they optimize their cost structure as we head into the next phase of the economic cycle. "

By tracking the costs of major commodities for the retail industry, we noticed that some commodity prices have peaked and started to fall in 2022:

Lumber: Lumber future prices dropped by around 52% since early March 2022. More and more dealers are reporting extra inventory available, indicating a reduced demand and increased supply.

Copper: Copper prices reached its historical high in 2021 at $4.7 per pound, and have fallen by around 9.5% in 2022.

Resins: Resin prices peaked in Oct 2021 and have dropped by around 2% in the first half of 2022.

Global ocean shipping: Retailers rely heavily on ocean shipping to transport their products globally. Ocean shipping cost more than quadrupled for some major lanes during the pandemic. However, since early this year (February 2022), it has shown a dip in average ocean shipping cost. We also expect the rate will continue to normalize as more capacities are available and overall demand drops.

Lumber, copper, and resins are all major raw material inputs for retail products such as furniture, electronics, toys, etc. As raw material and freight costs decline, a decrease in product costs should be expected.

What Retailers Should Do to Stay Competitive

With these early indications, we have seen “peak inflation” in the commodity and supply chain markets, and retailers now face the challenge of more expensive inventory, ongoing geopolitical uncertainty, and lagging consumer demand. In this environment, companies need to be more vigilant than ever to remain competitive. In our assessment, companies should focus on the following fundamental pillars .

1. Monitor commodity market trends. For most companies, raw material costs could account for 20-50% of retailers’ product purchasing cost, followed closely by supply chain costs. . Companies should prioritize developing capabilities around tracking and monitoring critical commodity prices. It is essential for retailers to develop scenarios to understand how changes in commodity prices will impact their business and develop purchasing strategies accordingly.

2. Product cost modeling. Retailers should develop cost modeling capabilities for their key spend categories. They need to understand not only raw material costs, but also other key input factors, such as labor, equipment, margin, etc. Development of cost models can serve as a key vendor negotiation lever, drive product design changes and predict cost/margin performance.

3. Leverage index-based pricing contract. For commodities with strong cyclical nature, It is useful to put in place a cost structure that rises and drops with commodity markets, so when commodity index prices fall, retailers could realize the cost savings. Best practices such as implementation of a price increase cap and most favored nation clauses mitigate the risk of cost spikes and maintain competitiveness. But retailers might have to commit more volume to certain suppliers to get that favorable deal. Again, retailers need a holistic review of their category purchasing strategy to decide what type of contract is best fit for them.

4. Track retailers’ purchasing cost performance. Retailers should track at least five years' purchasing cost performance and have a system to conduct periodic spend analysis either using ERP systems or more exotic tools. Retailers will receive reminders from the tools regarding which categories' costs need to be further reviewed and negotiated.

5. Set up a task force to drive all manner of cost down, with senior executive support. On the direct material side, schedule strategic vendor review discussions. It is important that companies reach beyond a transactional relationship with their vendors and consider a joint business planning/strategic review approach to improve transparency. On indirect spend, use strict budget discipline and all available spend reduction levers (consumption, commercial and efficiency) to drive down overall enterprise costs.

Retailers need to be laser focused on ensuring that they optimize their cost structure as we head into the next phase of the economic cycle. Rigorous discipline on indirect spend and a focus on product cost trends is critical for a company to maintain their competitive advantage. For many categories, the holiday season is typically regarded as a “make or break” period. It is essential for retailers to focus on these key pillars and ensure they are ready to face what promises to be an unpredictable fourth quarter.

For more details on how to do this in a systematic and cost-efficient manner, reach out to Roland Berger to discuss further.

Walmart, the leading retailer in U.S., has reported a significant decline (11 to 13%) in its expected operating profits for its fiscal year 2023 (FY23), while sales are projected to grow faster at 6% in FY23. This means both inflation and higher cost of borrowing are starting to impact consumer sentiment. It is reasonable to expect that retailers will continue to face constrained consumer demand and significant margin pressure in the coming quarters. As all these challenges continue, pricing and promotions will again be the key for retailers to navigate through this tough time.

Future insights from Roland Berger will focus on how retailers can manage their product pricing and promo strategy more effectively.