Logistics: resilience delivered

Capturing the resilient supply-chain opportunity

The logistics ecosystem is changing, driven by global economic shifts, growing calls for sustainability and the Covid-19 pandemic. Customers now want more secure, flexible and predictable supply chains, while ensuring efficient logistics are maintained. Logistics service providers must adapt to these new demands. To be successful in the future, they need to provide resilient, customer-focused logistics services that can overcome supply-chain disruptions and ensure tailormade end-to-end solutions.

For decades, international supply chains have fed and nurtured world trade. Globally integrated supply chains and production streams have brought about unprecedented levels of efficiency, specialization and workforce changes, altering the face of the world economy. A successful and high-performing global logistics industry has evolved to support this model, providing a backbone for the global economy.

While this remains the case today, times are changing. Issues such as growing protectionism, social pressure for more sustainable production and the Covid-19 pandemic are forcing a move away from globalization towards supply chains that are more locally or regionally focused. As a result, companies are now demanding more adaptable, durable and flexible logistics services – in short, resilient logistics. But what does the shift towards resilience mean for logistics service providers, and how can they exploit its opportunities?

The trend towards resilient logistics

The past few years have shown that global supply chains are prone to disruption, increasing risk for highly interconnected global companies that rely on safe and uninterrupted logistics flows. There are four main causes:

Growing protectionism:

Trade wars and the sudden introduction of new trade barriers have become increasingly common across the globe. The dispute between the US and China has had a particularly large impact, with both countries shifting towards new partners in the European Union and Southeast Asia. Other policy shifts, such as the UK’s departure from the EU, have added to near-sourcing trends.

Rising incidence of natural disasters:

Natural and weather-related events can disrupt production and transportation, adversely affecting downstream industries that are dependent on supplies. For example, a 2018 Resilinc survey of supply-chain disruption found that extreme weather was the single-most impactful event type.

Sustainability pressures:

Environmental, social and governance (ESG) sustainability issues now play an important role in corporate behavior and operations. Production shutdowns due to issues such as labor rights violations or environmental concerns can leave firms without critical supplies at very short notice. Scrutiny of globally active players is only increasing; "supply chain laws", for example, are being discussed at both an EU-level and in individual countries such as Germany. These seek to hold companies legally accountable for issues, such as human rights, in their upstream supply chain.

Covid-19:

The coronavirus pandemic has severely impacted international trade, highlighting the susceptibility of global supply chains to crises. The World Trade Organization estimates that world merchandize trade volume fell by 9.2% in 2020, compared to 2019. One result is that balancing supply and demand has become far more challenging, creating havoc at warehouses. We expect Covid-19 lockdowns, as well as similar “disrupting” events caused by other global crises, to be features of the future landscape.

The net effect of the first three disruptive trends is a global economy that is growing faster than international trade, signaling a shift towards localization, or so-called glocalization. Covid-19 has accelerated this process. This has substantial implications for logistics.

As companies have woken up to the inherent vulnerability of globally integrated supply chains, they have sought to recalibrate their approach to better manage the risk. Put simply, building a resilient supply chain that protects their operations has become a key strategic concern.

What customers want from resilient logistics

The trends outlined above are driving a shift in demand. Companies now want logistics providers to offer an even higher level of transparency, flexibility and security for their deliveries, with end-to-end digitalization and integrated steering of logistics operations. Indeed, industrial producers and other large firms now consider supply-chain security as a CEO-level issue, rather than an operational one. In a 2020 survey by the market research company Dimensional Research, logistics managers cited reacting quickly to disruptions in the supply chain as the most important supply-chain issue in the next two years.

The logistics ecosystem will have to change as a result, and become more flexible, sustainable and integrated. We expect several shifts in value pools towards more resilient supply chains. First, companies will move from “just-in-time” deliveries to stock building. Second, supply chains will become more “glocalized” and less international to minimize regulatory risk. Third, manufacturers will reassess their current logistics and warehouse network. Fourth, there will be a shift to more proactive supply-chain management, with transparency, real-time visibility and sophisticated forecasting capabilities becoming a core part of logistics. Lastly, the market will be increasingly willing to pay a premium for more resilient services.

How logistics service providers can meet the changing demand

What does this mean for logistics service providers? They, too, are having to adapt. Most are already reorienting their services from a strong focus on cost efficiency (just-in-time deliveries) to a broader, more resilient approach, one that maintains efficiency while providing adaptable, durable and flexible services to meet customer demand. To achieve a successful balance of both, we recommend prioritizing three key areas:

- Rethink the current offering: Growing “glocalization” will likely mean less demand for long-distance (intercontinental) freight forwarding. Providers should therefore adjust their offering to better fit the changing demand, e.g. by covering first- and last-mile transportation.

- Promote integration: The role of logistics service providers will probably shift further towards 4PL (or even 5PL) supply-chain management, incorporating oversight of transport processes. A detailed understanding of customer needs is key to tailoring solutions to these roles. This may require the provider to refocus its business model and reduce verticals. Strong communications that treat the customer like a strategic partner will help to predict demand.

- Invest in digital: Investment in digital infrastructure, including the two key digitalization levers of artificial intelligence and automation , is key to providing the expected levels of resilience, transparency and predictability. Seamless integration with customer IT to enable real-time updates is also crucial.

How to implement resilient logistics

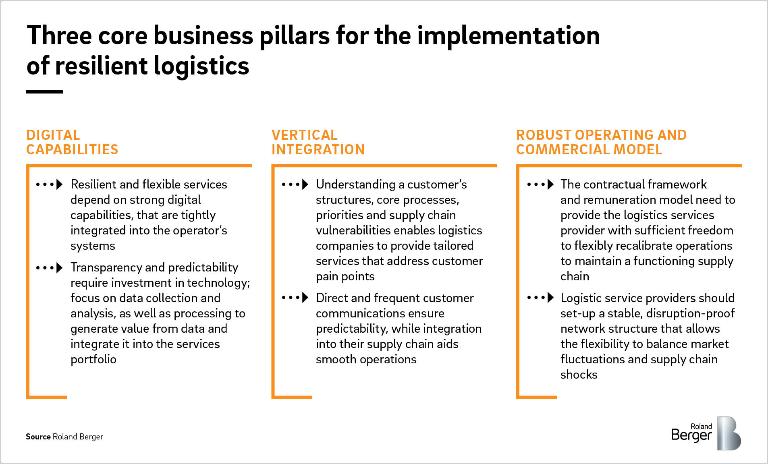

As well as offering increased transparency, flexibility and predictability, resilient logistics service providers react quickly to, and minimize the impact of, disruptions, thereby ensuring secure supply-chain processes. To achieve this level of service, providers need to focus on three core business pillars, paying particular attention to customer needs:

Why the future looks bright for early adopters of resilient logistics

Logistics service providers that adapt early to resilient logistics can expect significant benefits in the future. Long term, we see providers becoming strategic, integrated partners of their customers rather than mere external suppliers.

In this model, the role of logistics service provider will be upgraded to that of core player in a customer’s internal and external supply-chain processes, seamlessly cooperating with their in-house operations. Customers will therefore contract just one universal provider (or group of providers) whose main function is to secure and control the client’s supply chains, ensuring transparency and flexibility.

This will make contracts harder to win, as customer requirements will be more complex and individual, and, given the strategic importance, potential providers will be vetted more closely. But on the other hand, contracts will also be more captive. Once on board, providers will play a crucial role and become closely integrated into the customer’s operations, raising the cost of switching providers and laying the foundations for long-lasting relationships.