Roland Berger's study "Future of health 4" examines tomorrow's patients – their attitudes to innovation, trust in healthcare participants and willingness to pay.

M&A opportunities in biotechnology

Pharmaceutical and biotech companies should act now to make the most of favorable market conditions

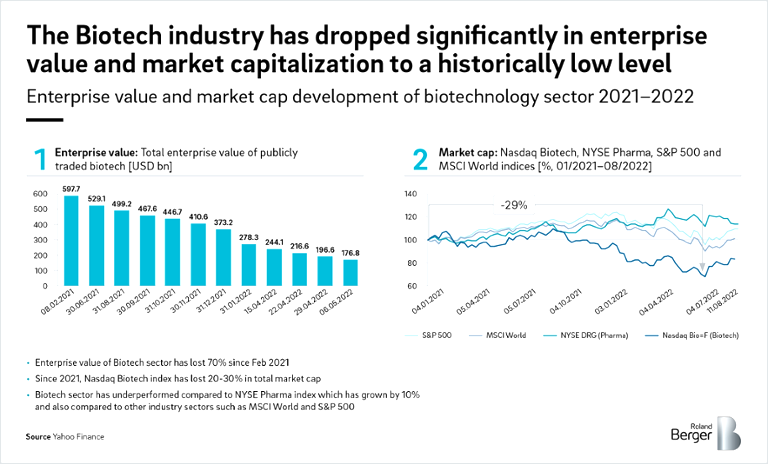

The biotechnology industry is seeing historically low enterprise values and market capitalization – indeed, macroeconomic factors have driven down total enterprise value by 70 percent since February 2021. This indicates an overreaction in the market, resulting in a tenfold increase in the number of companies with negative enterprise value. As sustained high interest rates and inflation drive further divestment due to a more challenging refinancing environment, a golden window of opportunity is opening up for mergers and acquisitions (M&A) by larger pharmaceutical and biotech companies. These companies should now be on the lookout for attractive targets – an area where Roland Berger offers comprehensive support.

"Biotech valuations have suffered across the board to an extent that we can find numerous assets that trade below their actual cash reserves – this is clearly a sign for a current negative hype decoupled from economic fundamentals."

Biotech companies are by their nature research-driven. With increasing innovation, a growing number of specialized research organizations have entered the market recently, attracting an estimated USD 46.9 billion in startup financing in 2021. However, this financing environment is likely to become less optimistic going forward. In particular, inflation and rising interest rates means that there will be less capital in the market and debt will become more expensive – a significant problem as most of these startups are not yet generating revenues or profits.

Larger pharmaceutical and biotech companies are already taking advantage of these market circumstances. Many are successfully maintaining a dynamic, attractive portfolio while keeping capital expenditure low by "outsourcing" their early-stage specialty R&D and innovation to small startups. In addition, rather than expanding their own R&D departments, many have acquired younger, more innovative companies: The ten biggest M&A deals in 2021 alone had a value of USD 53 billion.

A golden opportunity

Enterprise value and market capitalization are at historically low levels in the biotechnology industry. Total enterprise value has dropped by 70 percent since February 2021 due to a combination of macroeconomic factors. Cheap capital and bullish assumptions that small startups would be a game-changer in the industry have given way to high interest rates, inflation and the threat of recession. Confidence in the market has evaporated.

As of August 2022, the Nasdaq Biotech index had fallen by 16 percent compared to January 2022, hitting a low of -32 percent in June 2022. At the same time, however, other sectors have seen growth – the NYSE Pharma index grew by 14 percent, the MSCI World index by ten percent and the S&P 500 somewhat more moderately at two percent.

"The low evaluations offer a highly attractive window of opportunity for strategic investors – identifying the right targets and platforms is key for success."

Within the life science sector, biotech has experienced the sharpest decrease in total enterprise value, with a decline of around 61 percent from April 2021 to April 2022. A growing number of companies now have negative enterprise value, where the company's market capitalization is less than its cash on hand. Firms involved in specialized drug development represent a significant share of players now in this dangerous territory. Other sectors, such as API (active pharmaceutical ingredient) production, services, devices, CDMOs (contract development and manufacturing organizations), diagnostics and healthcare IT have seen a less drastic decline, ranging from -11 percent for API production to -46 percent for healthcare IT. The shrinkage in total enterprise value for traditional pharma, by contrast, has been just 3.2 percent.

The sharp drop in total enterprise value in the biotechnology sector indicates an overreaction in the market, resulting in a tenfold increase in companies with negative enterprise value. By August 2022, 250 companies in the sector around the globe had negative enterprise value. These companies will face difficulty when it comes to refinancing in the future, especially in the context of high (and still rising) interest rates – creating an attractive window of opportunity for M&A by larger firms.

As of August 2022, some 56 percent of companies with negative enterprise value were breaking even, with zero revenue, while 42 percent were generating less than USD 100 million in revenue. These are generally early-phase research companies that are not engaging in commercial activities as yet, including large numbers of specialized drug development companies. A total of 84 percent of companies with negative enterprise value had negative EBITDA, the lowest level identified being USD -389 million. Three-quarters of these companies with negative total enterprise value are headquartered in the United States, compared to just eight percent in the European Union and four percent in China.

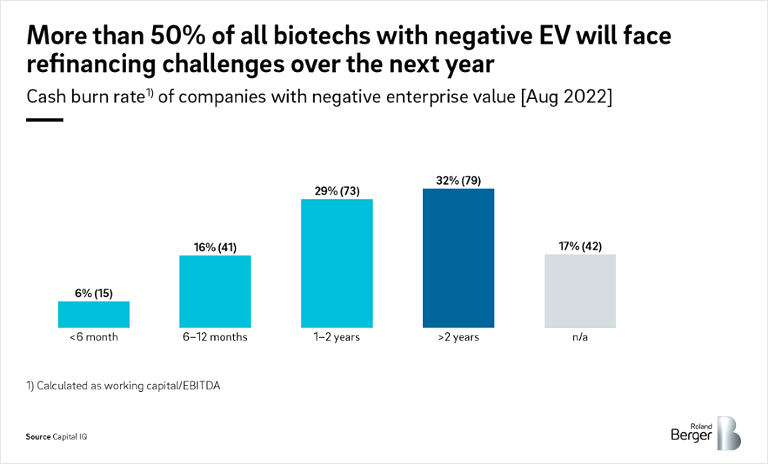

To assess companies' financial stability and future outlook, we can look at their "burn rate" – how fast they will use up their existing capital. Our calculations show that more than half of all biotechs currently with negative enterprise value will require additional funding over the next two years, and a further one-third will need refinancing after that. These companies may well be open for new external investors and M&A partners, especially as their operational expenses and costs for late-stage development increase. Just 17 percent of biotechs currently showing negative enterprise value will likely be able to survive without an extra cash injection.

Identifying targets – our approach

Roland Berger offers comprehensive support to larger players wishing to take advantage of this golden opportunity. With the help of our tried-and-tested approach, we can identify suitable targets for potential M&A within two to four weeks. Having established strategic cornerstones, we first draw up a long-list of biotech companies for evaluation in terms of their R&D capabilities, relevant technology and likelihood of clinical success. We then narrow this down to a short-list of targets using customized screening criteria. Over the following one to three months, we can support you as you approach the target and carry out the necessary preparations on the buy side. This is followed by the commercial and operational due diligence and, where appropriate, support right up to closing.

![Breakdown of companies with negative enterprise value [August 2022]](https://img.rolandberger.com/content_assets/content_images/captions/Roland_Berger_INS_935_opportunities_in_biotech_GT02_image_caption_none.png)

![Cash burn rate of companies with negative enterprise value [August 2022]](https://img.rolandberger.com/content_assets/content_images/captions/Roland_Berger_INS_935_opportunities_in_biotech_GT03_image_caption_none.png)

_image_caption_none.png)