The independent automotive aftermarket deserves greater recognition for its vital contribution to European society and the EU economy. We present the evidence.

Navigating the future: B2B & B2C consumer insights in the automotive aftermarket

Our new Automotive Aftermarket Pulse edition shows independent repair shops are thriving amid changing consumer preferences

Between 2023 and 2024, consumer spending on automotive repair and maintenance continued to increase, making independent shops an even more attractive channel. More consumers than ever are buying parts online, although the user experience continues to frustrate. Meanwhile, non-branded parts are becoming more popular in many regions. These are some of the main findings of this year's edition of the Roland Berger Aftermarket Pulse.

"Vehicle owners and workshop technicians are gaining confidence in the quality of non-branded parts, viewing them as better value."

Our annual survey captures input from both B2B and B2C customers around the globe on their preferences and how these affect their choices for vehicle repair and maintenance. The report enables more data-driven decision making for key stakeholders throughout the automotive aftermarket value chain.

Spending increases, outpacing inflation in key regions

Car owners worldwide are spending more on the upkeep of their vehicles, with increases often outpacing inflation. Germany and France saw 10% growth in average consumer spend, roughly four times the average rate of inflation, with UK consumers upping their spending by 5%.

The proportion of consumers in the United States, Germany, and France spending less than USD 330 or EUR 300 annually decreased by roughly a third (~23% in 2024 vs. ~32% in 2023), while the proportion of medium and high spenders increased. In the UK, the proportion of consumers spending less than GBP 250 fell from ~40% to ~22%, while the proportion of medium spenders increased and that of high spenders remained stable.

"Amid the shift toward private label parts, branded parts suppliers should strengthen their value proposition."

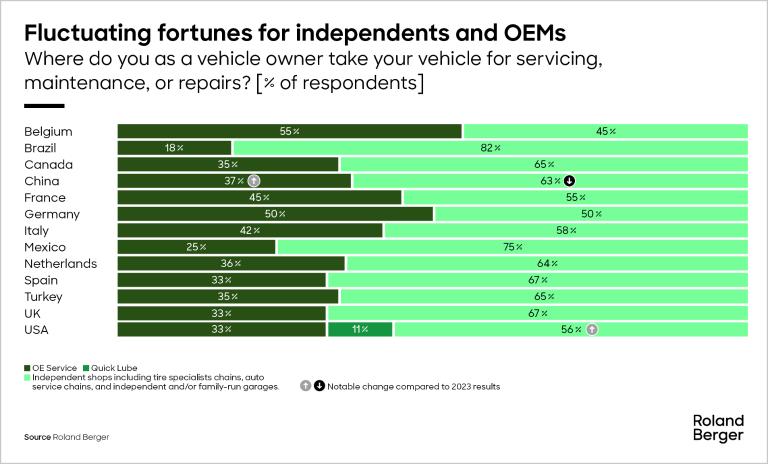

The shift of US consumers from OEM to independent repair shops continues to gain momentum. This trend is driven by lower prices and shorter waiting times offered by independent operators.

By contrast, the popularity of OEM repair shops in China is rising, driven by EV owners and the efforts of Chinese EV OEMs to optimize customer experience and convenience at their workshops. ICE vehicle owners in China are still behaving like those in other regions.

OEM aftermarket penetration remained relatively unchanged in Germany, France, and the UK, ranging between 33% and 50%. In contrast, Brazil, a new addition to the Aftermarket Pulse, shows a much lower penetration rate of just 18 %. The preference for independent workshops in Brazil is due to high levels of trust in local garages, lower value of vehicles, and limited disposable income.

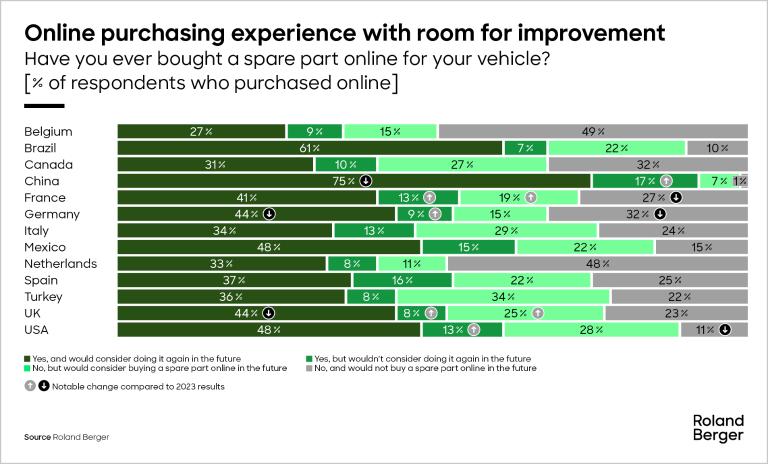

Just over half of car owners now buy parts online, with accessories being the most popular category in this channel. However, dissatisfaction with this channel is on the rise. Consumers report negative experiences, and the share who indicate they would not buy online again rose significantly. Product compatibility issues and limited customer support are the main reasons for concern.

Consequently, there is plenty of room for retailers to improve the online shopping experience and for suppliers and distributors to strengthen their digital channels. Consumer dissatisfaction with the online channel means aftermarket players that can significantly improve the online experience and overall customer journey are poised to benefit.

"Balancing sustainability and affordability will be critical to meeting demand – an opportunity for remanufactured parts."

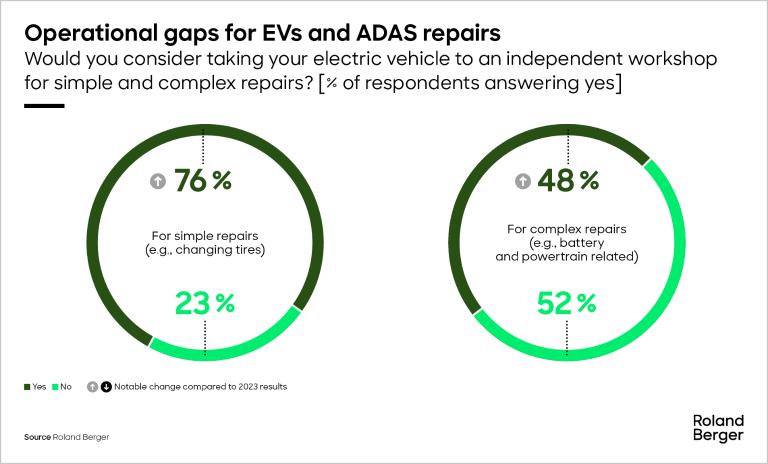

A growing majority of EV owners would consider independent workshops for simple repairs – up from 60% in 2023 to 76% in 2024. In contrast, repair shops were less comfortable servicing EVs in 2024 than in 2023, as car owners increasingly demand services such as error diagnostics, software updates, and repairs that require specialized knowledge and equipment.

There is also still a degree of discomfort among repair shops with fixing advanced driver assistance systems (ADAS), although this is improving. Chinese repair shops are the most comfortable, and workshops in the US, UK, and France are gaining confidence. German workshops are the exception, having experienced a decline in confidence.

We see a major opportunity for repair shops to transform operational gaps with EVs and ADAS into competitive advantages. Suppliers and distributors that invest in supporting these workshops will also be better positioned for long-term success.

“Yes” to sustainability – an opportunity for remanufactured parts

Most consumers in all regions say they would be willing to buy more sustainable parts. Meanwhile, more than half of workshops across all regions are either somewhat or very interested in using sustainable parts.

However, consumers are still not willing to pay a premium for sustainability. The biggest concerns regarding used, recycled, and remanufactured parts are safety and durability, which, if mitigated successfully, creates a significant opportunity for aftermarket suppliers.

For more information on the most important aftermarket developments, including a full geographic breakdown of the results, download the Aftermarket Pulse 2024 below.

Register now to access the full publication and delve into the key findings of this year's edition of the Roland Berger Automotive Aftermarket Pulse. Furthermore, you get regular news and updates directly in your inbox.

_person_144.png)

_person_320.png)