New benchmark index for shareholder engagement

Activist investors: How companies adapt to the "new normal"

Shareholder activism has become a widespread phenomenon. For companies, the "new normal" is less a threat than an opportunity. A new benchmark index from Roland Berger shows where the need for action lies.

Yes, this post is about activist shareholders. And no, it is not about the usual alarmism, the threat to companies from aggressors, string pullers and "rioters". It has always been wrong to equate "activism" solely with hedge fund activism – and to narrow a business's options to going on the defensive. The 2019 Annual General Meeting season demonstrated this once again. It was not the activist hedge funds that led the criticism, but rather those that were discredited years ago for aiding and abetting the board in getting their resolutions passed at all costs.

AGM outcomes are only a reflection of major upheavals

Companies are well advised not to simply get on with the business of the day in the face of the cumulative AGM criticism and the negative press coverage. If Bayer's Board of Management can't get their actions ratified at the AGM in spite of the company's decent business figures, or if RWE is challenged over the damage to its reputation for digging up Hambach Forest, then these are not singular events, but a reflection of revolutionary movements on the investor side.

Driven among other things by societal expectations like Fridays for Future and regulatory pressure (SRD II), institutional investors have extended their view of performance even further to take in long-term and non-financial aspects. Sustainability risks, involvement in controversial issues or even a need for improvement in corporate purpose and culture are just as much grounds for criticism today as the classic issues of dividends, earnings and remuneration ever were. The fact that more and more investors are using the escalation tactics of activists in order to voice this criticism or organize voting majorities is also an element of the new normal .

From tactical voting to reasoned voting

The scope for attack has thus increased accordingly. Any conceivable aspect of a company's performance that might elicit some finger pointing increases the firm's vulnerability to attack from activist investors. Nevertheless, there are still more opportunities than threats here: the requirements of SRD II mean that investors have to base their voting behavior on a reasoned investment strategy that is geared towards a sustainable value contribution. Simply nodding through management motions is therefore just as inexpedient as supporting activist counterproposals or the recommendations of proxy holders for purely tactical reasons. "Comply or explain" brings increased transparency and a higher level of distinctiveness at the same time. Companies that address all investor-relevant aspects through active shareholder engagement and systematically work on their weaknesses have the opportunity to build a strong line of defense against short-term oriented shareholders who have the potential to be disruptive.

New benchmark index makes shareholder engagement comparable

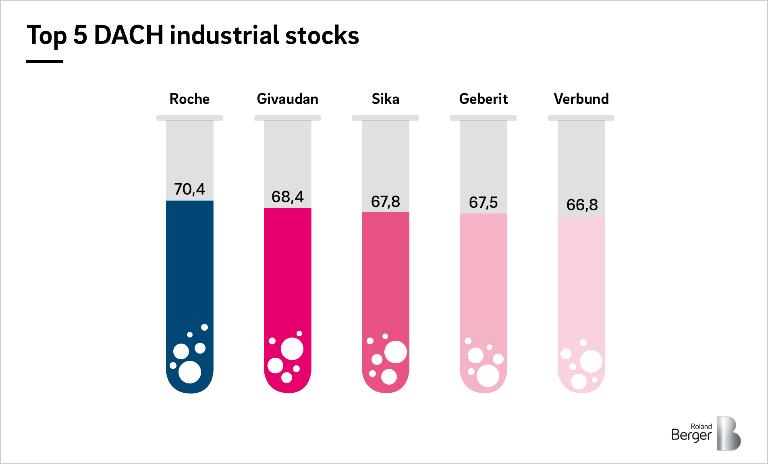

How are companies in the German-speaking region of Europe currently positioned? Where do they have strengths, where are they vulnerable? And who is best able to convince activist investors? To find this out, we have developed a benchmark index that puts stock-issuing companies to the test on the basis of the relevant investor criteria and makes them mutually comparable. We analyzed the major industrial companies listed on the DAX, MDAX, SMI and ATX – a total of 68 stocks – and compared their earnings and financial position, share price performance and valuation, ESG and governance standards, investor sentiment, shareholder structure and voting behavior. More than 200 data points per company, drawn from stock exchange portals, company reports and media reporting, were included in the evaluation – condensed into six indices and then into a total score.

The overall result: 26 percent of the companies achieve a total score of more than 60 percent and can therefore be regarded as well prepared or less vulnerable. With a score of 55 to 60 percent, 24 percent of issuers are in the upper midfield, while a further 26 percent are in the lower midfield (50 to 55 percent), which already indicates the presence of significant weaknesses in various clusters. The remaining 24 percent of companies are very vulnerable in terms of the criteria important to investors (scoring less than 50 percent).

Stock price losses and profit warnings – sentiment couldn't be lower

Analyst and investor sentiment is extremely weak. For 79 percent of companies, analysts have been forced to lower their 2019 earnings outlook in the last twelve months – and by more than 20 percent in the case of 27 percent of firms. Profit adjustments for 2020 are similarly negative. At least 60 percent of the region's industrial stocks are performing significantly worse than their international peer group in terms of growth expectations and profit adjustments. The comparatively wide spread of analysts' estimates is also an indication that not all companies are successful in strategically managing expectations through analyst guidance and their equity story.

Of course, share price performance also contributes to the negative sentiment. 56 percent of the companies gave their investors a negative total shareholder return, while 43 percent of the issuers had a negative total shareholder return that was higher than 10 percent. This is accompanied by the fact that the fundamental valuation of companies in comparison to benchmark indices and the sector comparison group often indicates entry-level share prices.

Remuneration remains an Achilles' heel

Governance and in particular remuneration standards also remain an Achilles' heel for many businesses. Almost 30 percent of the companies increased their variable remuneration component despite destroying shareholder value. In addition, the non-variable components were raised by around five percent.

Looking at their shareholder structure, only 40 percent of companies can feel reasonably safe. In these firms, strategic shareholders hold the majority of the voting rights, measured by their presence at the last Annual General Meeting. By contrast, one in five companies has a 100 percent free float. Despite the spectacular failure to ratify the actions of Bayer's Board of Management, the results of the votes at the last two Annual General Meetings do not yet indicate that majorities are becoming unstable. The actions of the Management Board were approved with an average of 2.3 percent of the votes against, and in the case of the Supervisory Board it was 3.4 percent against. However, if strategic investors' votes are excluded, the proportion of shareholders who refused to approve the actions of the Management Board averages more than 5 percent. Management remuneration, when put to the vote in the last five years, was not approved by 18 percent of the shareholders on average.

Media criticism indicates potential trouble spots

In addition, investors went to the media to criticize the business development, share price performance or corporate management of more than 40 percent of companies. More than one in four companies was also the subject of reports on premature changes to management board composition and/or difficulties in filling vacant management positions. Such potential trouble spots in the interaction between corporate management and corporate control could be exploited by activists.

Switch to active shareholder engagement

Our analysis shows that companies have every reason to work systematically to eliminate weak points. Indeed, the increased level of engagement shown by investors themselves actually requires companies to switch to a policy of active shareholder engagement. Doing so gives companies unprecedented opportunities to focus on enhancing their value long term rather than optimizing their quarterly figures – and to strategically manage their shareholder structure with a high degree of transparency.