New ways of transformation in Asia's retail sector

![{[downloads[language].preview]}](https://www.rolandberger.com/publications/publication_image/CGR-Article-pic-0_download_preview.jpg)

We are looking into possible ways of transformation and digitalization of CGR sector on Asian markets comparing to China's path.

"China's pace of innovation in omnichannel retail might influence other fast growing consumer markets in Asia,… but will they necessarily adopt the Chinese "new retail" models?"

With the rapid development of Alibaba's "new retail" (among many other innovations), the Chinese retail market has become a point of reference for retailers and brands across the globe. China was already a priority market to many brands for its number of consumers, it has become one of the most innovative and dynamic retail markets in the world during the 2010 decade – and to many retailers, a source of inspiration.

However, as Chinese consumer markets are going through turbulent times on the back of the Covid pandemic, the attention of global brands, retailers and investors is poised to grow on alternative consumer markets of Asia. These markets are driven by favorable long term demographics, undergoing a rapid modernization and digital transformation, and are hopefully turning the page of Covid with renewed perspectives.

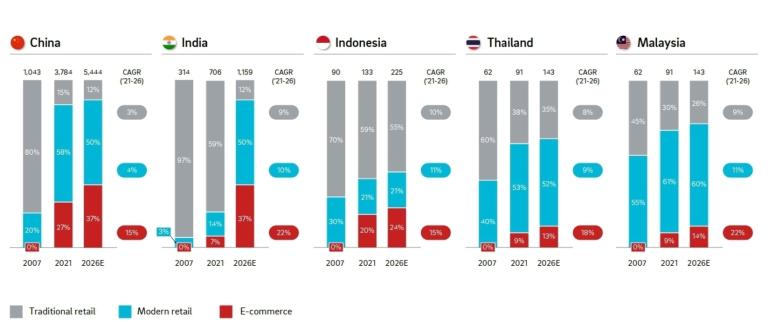

We analysed the countries' retail sector maturity in 2021, a crucial year for all as the starting point of Covid-recovery era. This is provided in the graph below – for selected countries as well as China, where we consider the relative share of 3 retail channels: traditional retail, modern retail and E-commerce.

India's digital commerce revolution is bound to be very different from China's. As digital commerce is now growing fast, modern retail is still a fraction of traditional retail which dominates the Indian market. In other terms, when addressing the upcoming digital retail revolution in India, stakeholders must imagine how digital commerce will co-exist with and in the end transform the value proposition of traditional retail shops.

On the other end of the spectrum is Malaysia. With an already dominant modern retail sector, the best expectation is that Malaysia's retail transformation will be more similar to the one of large cities of eastern China.

Thailand is in a similar situation as Malaysia, albeit with a higher resistance of traditional retail, depending on the region. This may lead to a 2-speed transformation where major cities dominated by modern retailers will follow the path of East-China megacities, and rural areas will take longer to transform, potentially involving models leveraging synergies between digital commerce and traditional stores.

Of all countries, Indonesia appears the most challenging. In our estimates, it is the only country where e-commerce will be greater than modern retail in 2026, yet in a market dominated by traditional retail. In this situation, and given the consumer market size at stake, we should expect a vibrant innovation landscape where multiple transformations will take place concurrently.

The post-covid recovery period – which seems to be starting now – marks the start of a new wave of transformation in Asia's retail sectors. A transformation which requires each market to be addressed according to its own existing retail history and current maturity. In anycase, stakeholders – whereas retailers, FMCG suppliers or investors – should promptly understand the specific dynamics of their priority markets, and develop specific strategies and a digital transformation agenda, corresponding to the waves of transformations to come in their target markets.

If you wish to read more on this and other topics, please download our ASEAN Private Equity Newsletter Quarterly Edition 2022/4 below.

![{[downloads[language].preview]}](https://www.rolandberger.com/publications/publication_image/CGR-Article-pic-0_download_preview.jpg)

We are looking into possible ways of transformation and digitalization of CGR sector on Asian markets comparing to China's path.