The short study explains why the conventional restructuring approach falls short in the current dynamic of change and how restructuring must be rethought as active crisis and future management.

Corporate restructuring in the real estate crisis

Navigating the turbulence: What really matters in real estate restructuring

The real estate sector is experiencing probably the worst crisis in its history. Rising interest rates and an economic downturn are creating choppy waters, forcing companies to navigate a dramatic drop in residential and commercial real estate values. The level of borrowed capital – traditionally high in the industry – poses an additional problem in times of crisis. To protect themselves as best they can, companies must now get full transparency, examine all the options available to them in a restructuring program and take decisive steps.

"Restructuring a business in the real estate sector is complex and requires actions that need to be aligned with a whole range of stakeholders. Preparing the necessary steps early and with professional help is crucial."

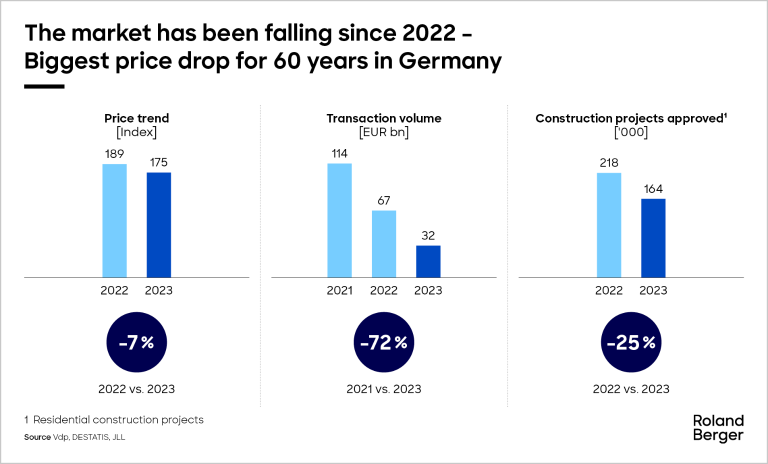

Having been such a profitable business for so long, in more recent times the whole of the real estate sector has been hit hard. The long period of low financing costs and high transaction volumes is over. Rapidly rising interest rates and stubbornly high inflation coupled with high construction and energy costs and a recession that threatens to spill over into a second year are putting more and more companies in a precarious position: the recent drop in real estate prices in Germany has seen values fall sharper and faster than at any time in the past 60 years. Sellers are hoping for better times; buyers are awaiting even steeper price reductions.

The volume of transactions in the German real estate market declined by 72% between the start of 2022 and the end of 2023. Commercial real estate was impacted most severely. While demand for residential properties continues to grow and is causing rents to rise despite a slight fall in prices, the market for office, administrative and retail space is collapsing. The pandemic-induced explosion in working from home has conspired with the online shopping trend and an excess of red tape to reinforce the trend and dramatically dampen the demand for commercial space. The vacancy rate in Germany is now up at around 6%, and although this is relatively low by international standards, the US market shows how far things can go: in some places, 20% or more of commercial properties lie empty.

"There are signs in commercial real estate of a big increase in non-performing loans – action will need to be taken."

The financing dilemma

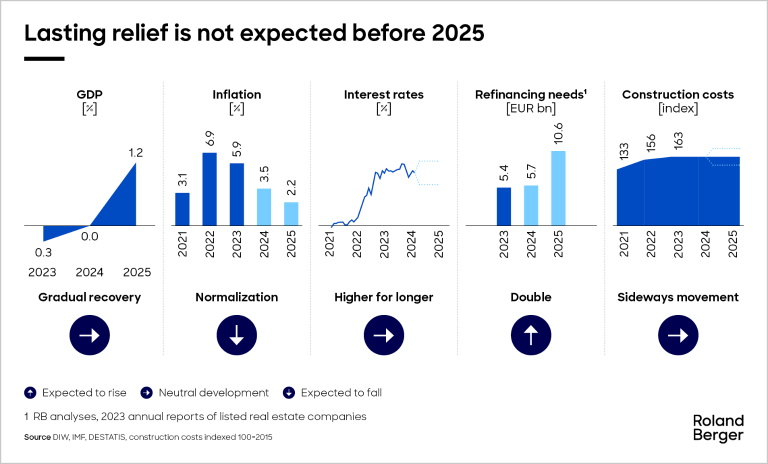

The biggest uncertainty still lies in predicting where interest rates are going to go. Traditionally characterized by low levels of equity and high levels of debt compared to other sectors of the economy, the real estate industry is extremely sensitive to fluctuations in the cost of capital. The direction of travel in recent years has been alarming: European Central Bank data show that the effective interest rate for long-term loans granted to German companies rose from 1.6% in 2020 to 3.9% in 2023. Experts anticipate a moderate fallback at best for 2024 and 2025. And this comes at a time when many real estate companies will have a considerable need to refinance their borrowing in the years to come.

Significantly rising interest costs are one problem. Another is the noticeably more restrictive lending policy among banks, for instance around the amount of collateral they expect companies to provide. A first wave of insolvencies has already hit project developers, who are at the beginning of the value chain in the real estate industry. The crisis seems likely to spread to downstream service and construction players given the difficult context currently. The more critical the situation, the more decision-makers need to keep a cool head and a steady hand.

First and foremost: Full transparency is crucial

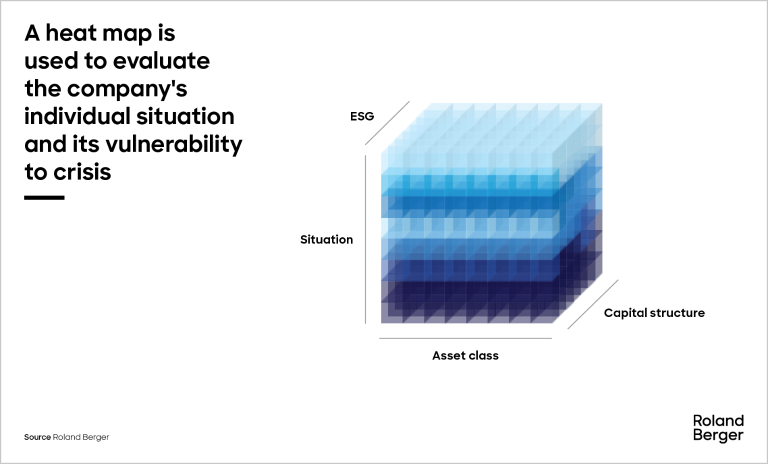

Successfully navigating your way out of the crisis demands a structured approach. It starts with having full transparency around how serious the situation actually is. Roland Berger has developed a proprietary heat map that can be used with real estate companies to evaluate how vulnerable they are and assess their current situation. The results give you a basis for decision-making with two key advantages: within the company, it creates a shared understanding of the actual situation, and beyond the company, it gives management the tools to communicate a reliable and compelling message to investors and lenders. A sound analysis of the situation as it currently stands will include valuations of company assets, overviews of current financing arrangements and maturity dates as well as an outline of cost developments. Analyzing actual scenarios will show how much room for maneuver you have.

A clear focus on financial restructuring

Based on the results of that process, step two involves critically assessing the options for your company, developing an action plan and implementing it. We know from project experience that operational changes are a necessary prerequisite for getting a company back on the road to success. However, a restructuring plan will only be effective if it addresses the financial aspects while not forgetting to adapt the company's strategic positioning.

In most cases, there will be no way to avoid a full-scale financial restructuring. Available options range from adjusting or renegotiating the financing structure to prolonging existing loan agreements and restructuring equity and liabilities from top to bottom. Selling individual properties is also a possibility.

Success factors in real estate business restructuring

A structured approach is crucial for successful restructuring. Particularly in critical situations, it is essential to carefully coordinate all of the measures being considered and combine them in a comprehensive approach to develop a targeted restructuring program. To improve the chances of success, you need to establish and maintain a clearly defined process of communication and cooperation.

In phase one of the project, you will need to try and secure short-term financing by negotiating with investors and lenders. Quickly agree on stabilization measures like postponing planned debt repayments and waiving debt covenants if necessary. It makes sense to establish a cash office that will be responsible for planning and managing company liquidity.

After stabilizing the liquidity situation, you will need to develop an integrated restructuring program that incorporates all necessary levers and measures to tackle the crisis. In order to have a basis for analyzing the performance of your real estate portfolio, it's important to understand the local real estate markets and how they are expected to develop – we work with local real estate experts to get the latest insights.

Then you will map out the entire restructuring program in a robust, integrated business plan geared towards various different scenarios. This serves as the key basis for negotiating with the various stakeholders and regularly evaluating the success of the restructuring.

You will need to do various analyses and evaluate your options to work out an amicable solution together with your lenders, investors and other stakeholders. Where consensual negotiations are not an option, there are also alternative paths to achieving debt relief for your company.

As with any transaction or transformation, the process is key. Efficient coordination of all stakeholders and effective communications are essential – experience in dealing with special situations and knowledge of the necessary process is a distinct advantage that will determine the success or failure of your business restructuring.

Stephan Schmitz co-authored this article.

_person_144.png?v=782903)

_person_320.png?v=782903)