The situation in the German construction industry has worsened and further decline is on the way. The Roland Berger Construction Trend Radar reports.

Roland Berger Construction Trend Radar 2024

The crisis continues for German construction companies but our latest industry analysis suggests there is a light at the end of the tunnel

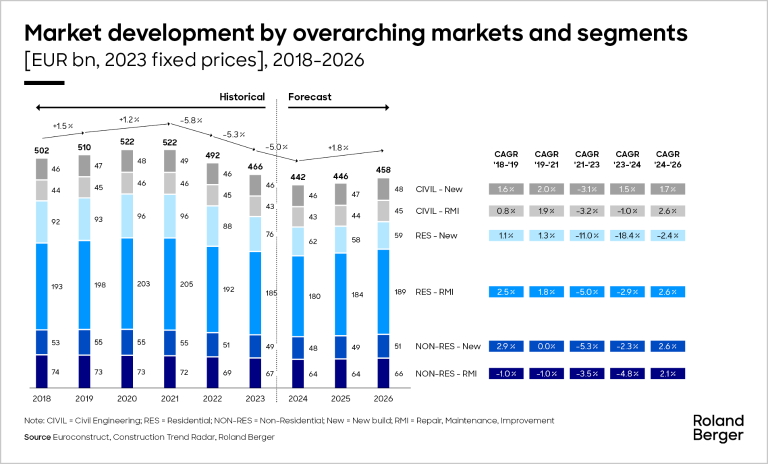

These are testing times for the German construction industry. After two years of decline, the market is set to shrink once more in 2024, with a 5% decline forecast. However, there is a light at the end of the tunnel. This negative trend is set to bottom out in 2024, before the market stabilizes in 2025 and grows again in 2026, according to our latest Construction Trend Radar report.

Key to this gradual change is a more stable civil engineering market. The energy, telco, and public transport sectors are now beginning to drive growth in sales, order income, and order backlog.

Germany’s residential market paints a more mixed picture. The new-build segment is set to continue its significant recent decline through 2025, before stabilizing in 2026. Things are more positive for the repair, maintenance, and improvement (RMI) segment, however, with a slight decline expected in 2024, ahead of an uptick in 2025 and beyond due to strong underlying demand for renovation.

Initially, growth will be slow – even slower than recently expected. We have had to revise our overall market forecast from late 2023: we now expect a CAGR from 2024-2026 of 1.8%, not 3.7% due to the continued struggles in residential construction and a longer ramp-up phase following reduced capacities in construction companies.

Slight encouragement in macroeconomic factors

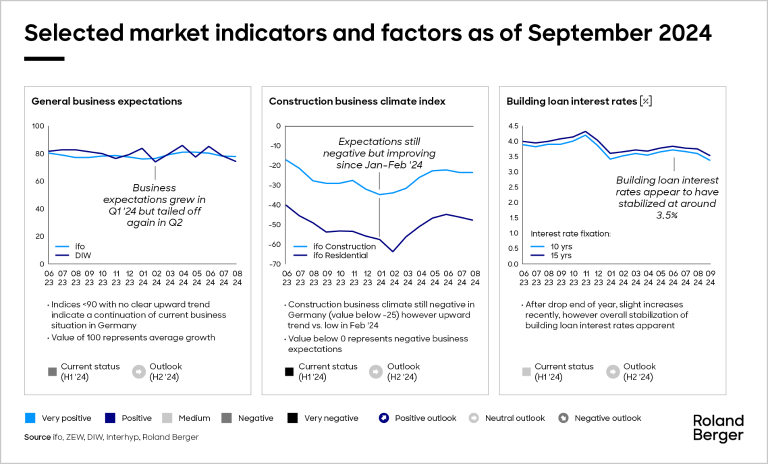

There are early signs of a recovery beginning to emerge in the wider business landscape. Economic outlooks from researchers at DIW and ifo remain negative, but they do suggest the decline in the business landscape is slowing. Construction business climate responses are starting to improve.

Elsewhere, inflation rates and energy costs are no longer rising. Interest rates, including for building loans, are stabilizing, and supply chains have recovered from prior disruptions.

"Many companies in the construction value chain are currently experiencing declines in net income and revenue. However, some have successfully optimized capacities and costs to maintain margins and are using the consolidation phase to explore topics such as artificial intelligence and the circular economy to improve long-term efficiency and competitiveness."

Comparing segments within the construction market

The Construction Trend Radar takes a detailed look at different segments within the construction sector, measured across three KPIs: order income, sales, and order backlog.

January 2024 saw the lowest order income value in the residential segment since January 2018. However, since then, things have started to pick up. February 2024 saw a 19% rise, with a 21% uptick in March. In Q2, growth stabilized across all three indicators. But the overall figures remain well below the levels of Q1 2023 – highlighting just how far the recovery still has to go.

In the non-residential segment, H1 figures show mixed development: order incomes have suffered, particularly compared to other segments. Meanwhile, backlog and sales were less affected but still down or flat compared to 2023.

For civil and infrastructure, each of the three KPIs shows solid growth, a trend we expect to continue.

Falls in income and revenue for many construction companies

An analysis of selected companies across the construction value chain shows that many saw a fall in net income as well as some impact on net revenue from 2022 to 2023.

Most saw minor falls in average delta revenue, with the construction and distribution segments seeing an increase of 11% and 9% respectively. It’s in income, where the real variation shows up. Distributors saw net income fall by an average of 43%, while project developers and real estate investors saw net income fall by a massive 177%. But it isn’t all doom and gloom. Average income levels for building products firms remained stable, and construction companies saw average delta net income rise by 19%.

How to survive the crisis and thrive after the storm

Companies throughout the construction value chain need to take a variety of strategic and operational steps as they move through and out of the current crisis. We have compiled a comprehensive list of these steps and them into three main sections:

- Imperatives during and after the crisis

- Overcome challenges and exploit opportunities during the crisis

- Be ready to thrive after the storm

For more information about the range of potential actions in each area, as well as further details on our expectations for each segment in the construction sector, please download the latest Construction Radar below.

Register now to access the full Construction Radar DACH 2024 and explore the persisting crisis in the German construction industry, which is gradually abating. Furthermore, you get regular news and updates directly in your inbox.