The fifth edition of Romanian E-Mobility Index analyzes the rise of battery electric vans in the mobility area

Romanian E-Mobility Index: Demand surges thanks to generous incentives

Sixth annual edition of Roland Berger’s report analyzes xEV sales and regulatory environment

Adoption of electric vehicles has reached record levels in Romania on the back of generous purchasing incentives. This is one of the key findings of Roland Berger’s sixth annual Romanian E-Mobility Index. The study analyzes the full spectrum of Romania’s e-mobility landscape, including demand, offering, regulation, and charging infrastructure. In 2022, the index stands at 63 points (of a possible 100) – nine points higher than 2021. This edition focuses in detail on the country’s regulatory system and finds that, despite its attractive EV purchases incentives, the government still has work to do to encourage sustainable growth in zero & low-emission vehicle adoption.

Transparency within the Romanian e-mobility ecosystem remains limited. As a result, several key questions remain largely unanswered – a gap the Romanian E-Mobility Index aims to bridge. It offers a data-driven analysis into areas such as: How Romania’s e-mobility market compares to more mature markets; the evolution of key market drivers; how total cost of ownership compares with internal combustion engine vehicles; and the outlook for national e-mobility infrastructure.

How Romania’s regulatory system compares

Romania currently offers some of the most generous incentives in Europe for purchasing electric or plug-in hybrid-electric vehicles (xEVs). This is in stark contrast to other major EU nations such as Germany, France, Sweden, and the Netherlands, which are gradually reducing or removing their own incentives. In 2022, for example, the budget for Romania’s Rabla Plus EV purchase incentive program almost doubled compared to 2021.

This may seem positive, but a lack of punitive measures, such as low-emission zones or increased taxation of highly polluting vehicles, mean these incentives are limiting sustainable adoption of xEVs by creating a reliance on incentives.

While Romania’s vehicle tax system considers engine displacement and level of electrification, key European peers use further metrics to create a more refined approach. A more beneficial Romanian tax framework would consider the vehicle’s value as well as CO2 emissions and pollution levels to encourage more eco-friendly mobility.

A lack of low-emission zones could also be harming Romania’s progress. Important for indirectly encouraging xEV adoption, they are becoming more widespread in Western Europe but remain a rarity in Eastern Europe.

1 in 9 new vehicles now chargeable

Registrations of new xEVs & PHEVs in 2022 were higher than the past four years combined. In total, more than 15,000 new plug-chargeable vehicles were registered, a 70% increase compared to 2021, with government incentives and a wider selection of vehicles the driving factors.

Sharp rise in EV purchases

The share of new xEVs & PHEVs in total new passenger car registrations is at a record high, rising from 7.3% in 2021 to 11.7% in 2022. However, this still lies some way behind many Western European countries: in major European markets, xEVs & PHEVs accounted for 21% of new registrations.

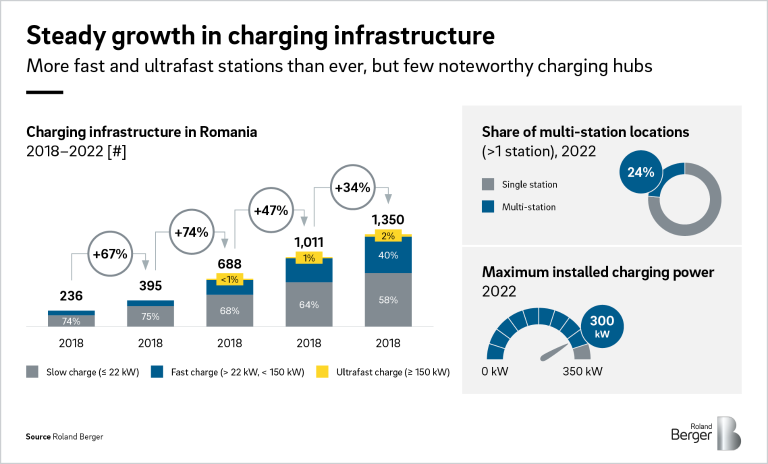

Steady growth in charging infrastructure

The number of charging locations in Romania continues to increase by approximately 300 units each year, now totaling ca. 1,350. But only a quarter of these have two or more stations. The government aims to fund the construction of 6,500 stations by 2026. Fast and ultrafast charging stations are becoming more prevalent and now account for 42% of the market, up from 25% in 2021.

Retailers now own 30% of the country’s charging infrastructure, followed by the food service sector. Fuel stations showed the highest growth of all segments, while growth at malls and office locations is slowing down.

Geographically speaking, the availability of fast and ultrafast charging varies significantly, with Romania’s economic centers expected to continue to dominate.

Broader choice of fully electric vehicles

Once again, the market offering for xEVs and PHEVs increased in 2022, although the growth rate was slower than in previous years. There was greater choice in terms of fully electric vehicles, but the plug-in hybrid market remains largely unchanged. The Dacia Spring remained the top-selling electric vehicle in Romania with approximately 60% of all new EV registrations.

High time to think ahead

As Romania’s e-mobility market moves closer to maturity, a variety of organizations across the value chain are rushing to seize the accompanying opportunities.

Charging infrastructure is approaching full commercialization and the choice of locations yet to be monetized is diminishing. Speed of deployment is crucial as the best locations are likely to be occupied in the next two to three years.

Sectors such as energy, automotive , and retail are increasingly overlapping with intensifying competition – a fact traditional energy players must consider when designing their strategies.

Overall, e-mobility in Romania remains an important opportunity to optimize operational costs, especially in light of continued government incentives and oil price uncertainty.

About the Romanian E-Mobility Index

The Romanian E-Mobility Index is an annual report that aims to increase transparency within the Romanian e-mobility ecosystem. It adopts a data-driven perspective centered around the market’s major developments as well as related technologies.

Register now to download the full PDF on the “Romanian E-Mobility Index" including key insights, current developments as well as an analysis of the entire spectrum of Romanias e-mobility landscape, including demand, supply, taxation and charging infrastructure.