Software market

Trends in Southeast Asia

"Software industry is at cusp of inflexion point in Southeast Asia and poised for next phase of growth driven by Cloud Services including SaaS and IT managed services and increased industry specialization."

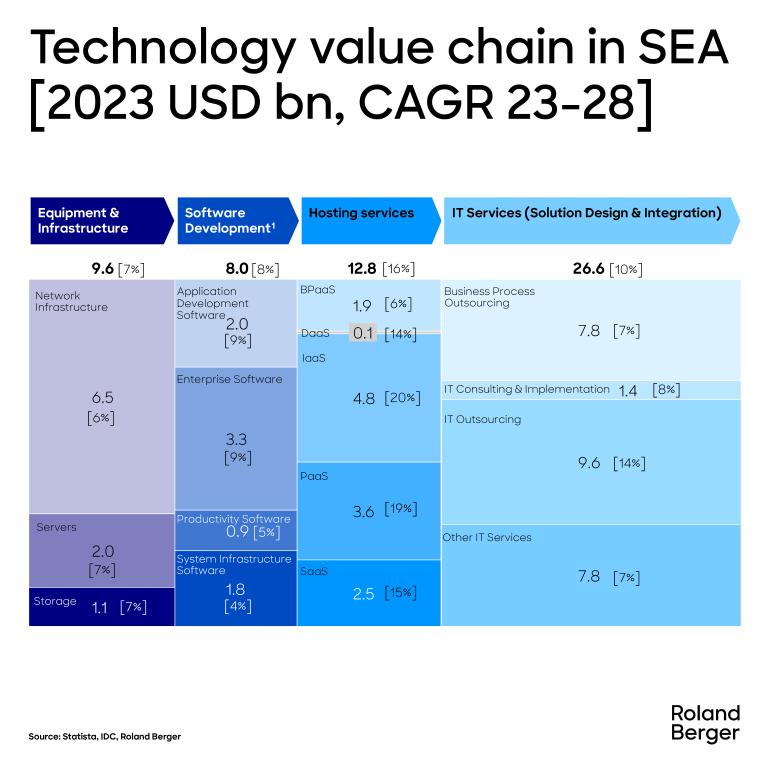

Southeast Asia's IT/Tech value chain is vibrant and growing, propelled by digital transformation, increasing internet penetration, and the region's rapidly expanding economy. It is estimated at USD 66 billion (bn) and projected to grow at 7% CAGR, reaching over USD 94 billion by 2028.

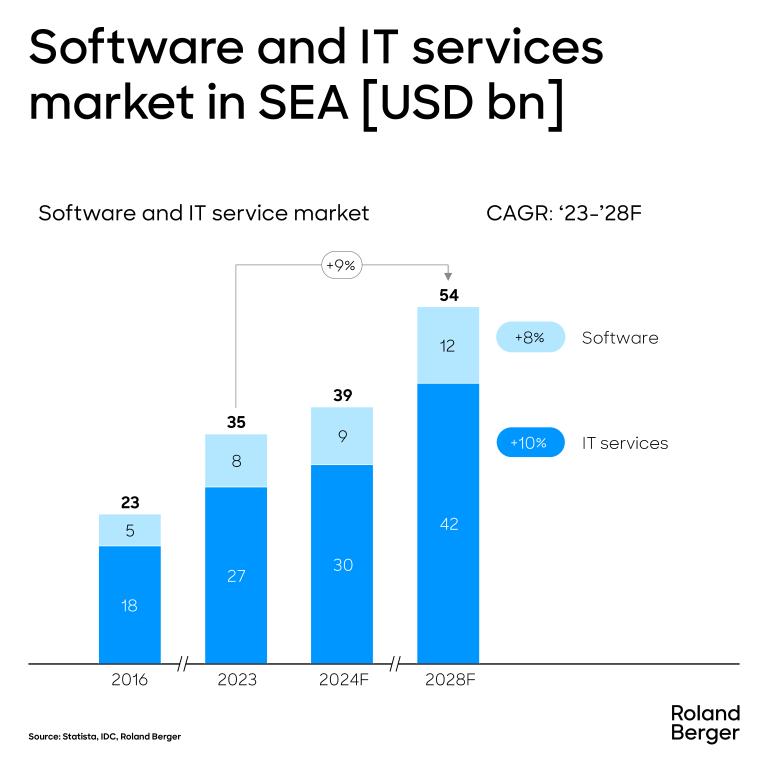

At the same time, the Southeast Asian software market is at an inflection point and will continue to see higher growth rates compared to the global average. Certain segments, such as SaaS and IT services, will perform better than others, particularly in the geography of Vietnam, Indonesia, and Malaysia for SaaS and IT services. All this will imply that we are entering into a phase with significant potential for PE funds.

The software and IT services market in Southeast Asia is projected to grow at a 9% CAGR, reaching a value of USD 54 bn by 2028. This growth is driven by several key factors, including the increased adoption of mobility solutions, a surge in data proliferation led by scalability mobility and 5G deployment, a rising focus on big data and analytics, a growing number of enterprises driving digital transformation, and the rapid adoption of cloud computing, IoT, and automation. These factors are creating a fertile ground for potential investment opportunities in the region.

Despite challenges such as system integration and interoperability issues arising from legacy technology stacks and architecture design, the high cost of full stack transformation, and high customization needs, there is continued adoption of advanced technology across various industries, including BFSI, telecom, and the public sector of SEA.

Key insights on application development software, enterprise software, productivity software, system infrastructure software and SaaS trends in Sountheast Asia can be found in the full article.

Opportunities for investors in SEA technology market

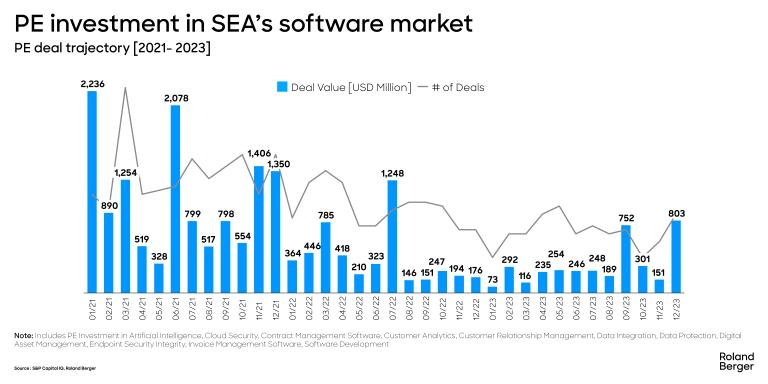

Private equity investments in software have shown increasing returns between 2018 and the first half of 2022. During this period, software-generated 25% higher internal rates of return than those of other PE sectors. Post-2022, the software sector demonstrated resilience in facing challenges such as inflation and higher scrutiny of IT spending in organizations. Despite these factors, some software segments, such as fintech, ad tech, and e-commerce, were affected more than others, leading to a 25% decrease in enterprise value over 18 months. It resulted in a decline in PE’s tech deal value in 2023 by over $9 billion, compared with 2021, mainly due to fewer and smaller deals in the region.

The next twelve months should see an increased investment push in the sector as many players in this segment look at investments at reasonable valuations to fund their growth and drive new solutions. Software spending in Southeast Asia should increase given the further push on digitization, regulatory push, and increased focus on digital governance. It might drive companies to invest in systems to improve data management and reporting and enhance operations across large, medium, and small enterprises. Growth will be more pronounced in SaaS segments across the Southeast Asia region.

With such a prevailing backdrop, investors will have several opportunities in the software market of SEA:

1. Focus on growth

2. Diversify portfolio for higher ROI

3. Drive scale

Register here to get the full ASEAN Private Equity Newsletter.