Follow the latest industry trends in our monthly update

The automotive industry's road to recovery

By Ron Zheng, Norbert Dressler and Stephan Keese

How OEMs and suppliers can prepare for the new normal

Automakers were suffering before the coronavirus pandemic; now they must brace themselves for a very different post-crisis landscape. In this article we look at the strategic implications that could help them better understand – and plan for – the new normal.

As governments around the world begin to bring the SARS-CoV-2 pandemic under control, hard-hit businesses are turning their attention from crisis management to recovery.

The automotive industry , in particular, is in shock. It was already in the midst of a significant downturn before the virus struck, enduring falling volumes and margins, overcapacities, tighter emissions requirements and a costly shift towards electrification and digitalization. And now, fallout from the pandemic is driving changes in policy, consumer behavior and the economy that threaten automakers’ long-term business model.

The upshot of these pressures will be a ‘new normal’ in the industry. Although uncertainty remains over the type of recovery the global economy will experience, automotive leaders need to think about what this may look like now. As such, the purpose of this article, and a later full report, is to examine the long-term strategic implications of the corona crisis.

To determine these, Roland Berger analyzed dozens of potential scenarios based on plausible government responses and types of economic recovery. Working through these scenarios produced a set of key implications for the industry in the studied regions (US, Europe and China), including several eye-catching takeaways:

- Automakers will have to retrench their global footprint as cash reserves fall and trade tariffs bite

- OEMs will see lower dealer revenues and margins as consumers opt for fewer and cheaper cars

- Industry consolidation will be accelerated as companies look to cut costs

- New policies may alter the course of electrification in the US and Europe, while China’s dominance will grow

- The use of software will become increasingly important as a means of reducing costs

To counteract these, we advise planning for the ‘new normal now’ and offer recommendations on rethinking strategy and redesigning operating models.

What we did: methodology

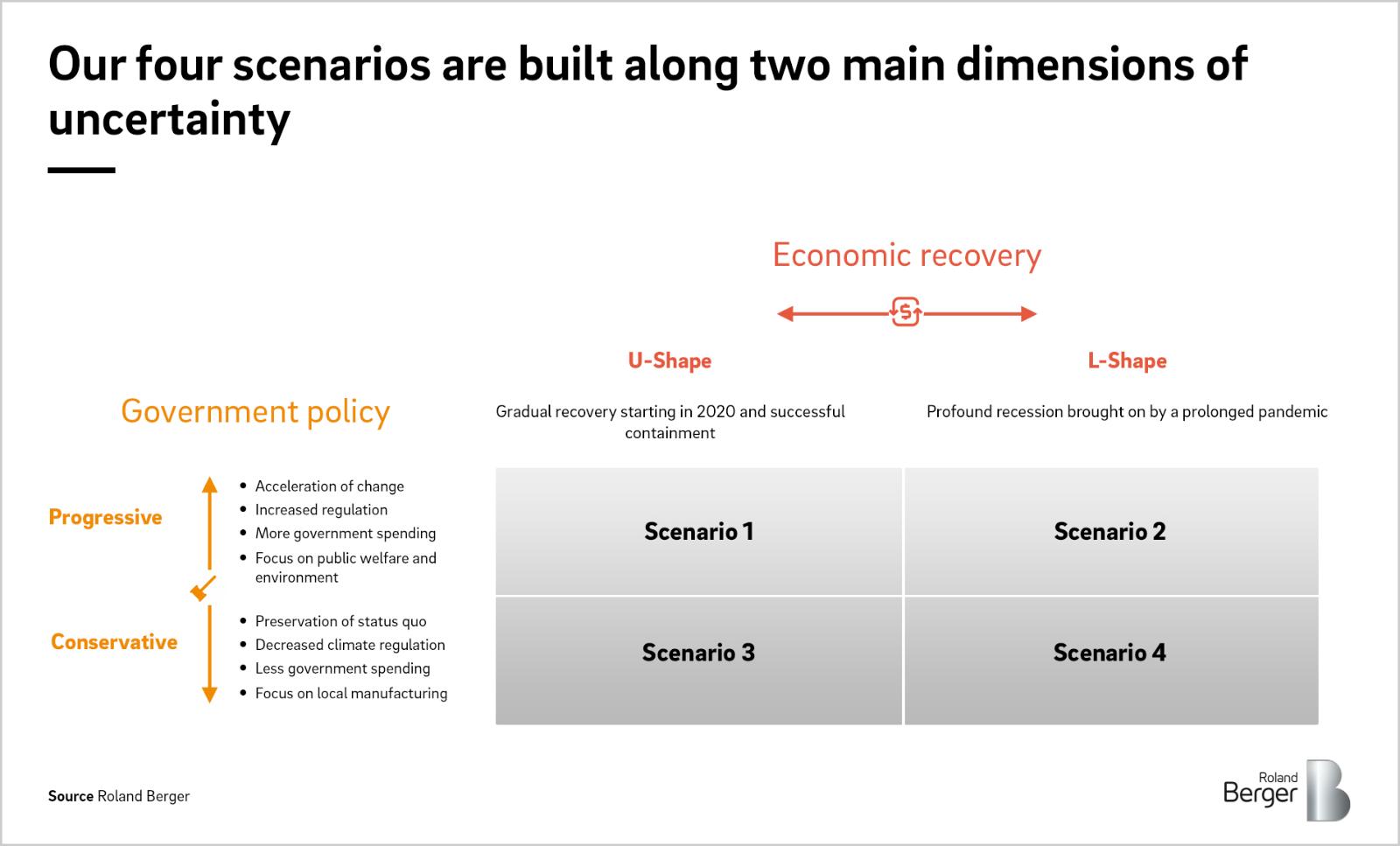

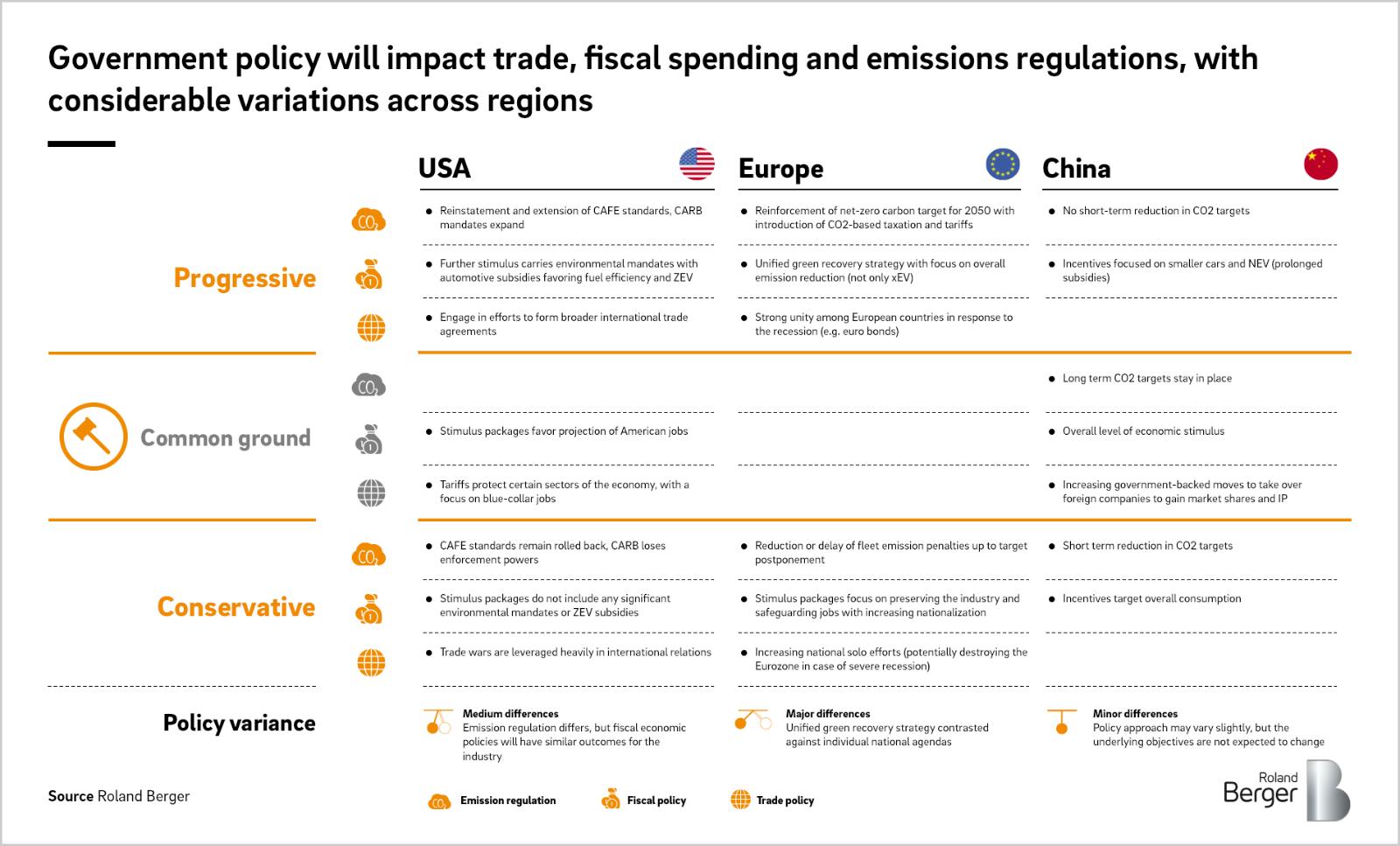

We built our scenarios by combining different possible outcomes for the three different regions and thinking through their interdependencies. All were constructed along the two main dimensions of uncertainty: the speed and nature of economic recovery, and the general direction of government policy (see Graphic 1). The former was split into a quick (U-shaped) or slow (L-shaped) recovery. The latter considered trade, emissions and fiscal policy, in a range from progressive to conservative (see Graphic 2).

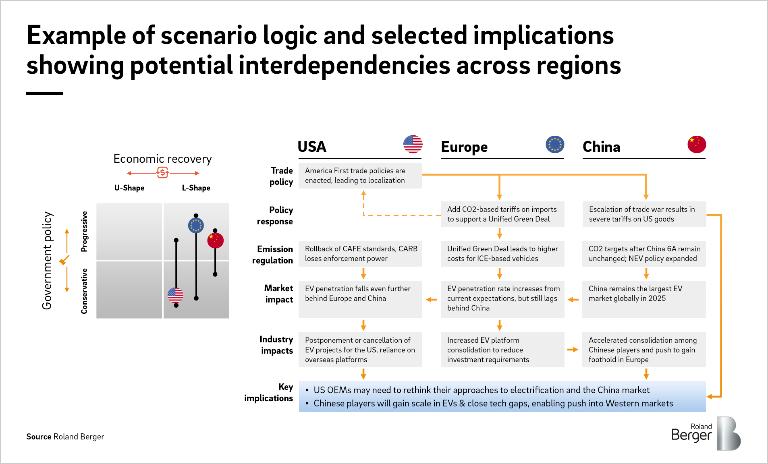

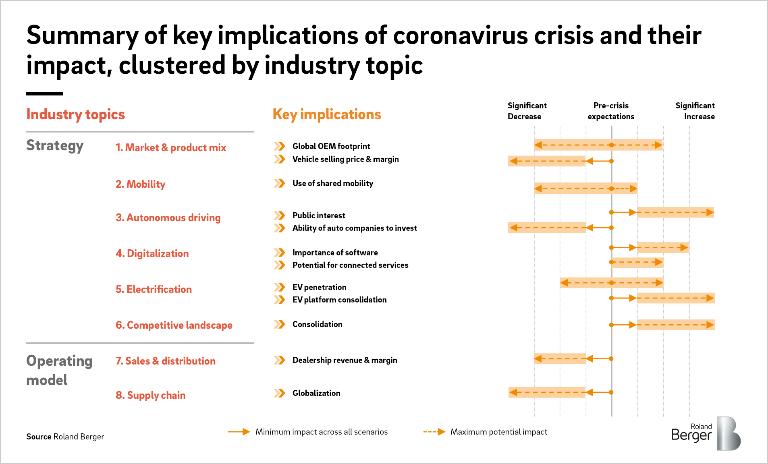

Implications were derived by working through each scenario (see Graphic 3 for an example of our scenario logic) and were then clustered into eight industry topics. Six are strategic, encompassing changes to the Market & product mix and Competitive landscape, as well as the disruptive industry trends of Mobility, Autonomous driving, Digitalization and Electrification. Two others look at how operating models might be impacted by changes in Sales & distribution and the Supply chain.

What we found: Implications and themes

A summary of our findings is shown in Graphic 4. It highlights the most important implications in each industry topic and gives an idea of their likely impact.

We also identified several cross-industry themes that are relevant to all scenarios but have different effects in different regions. These provide a useful framework to consider the implications holistically.

Fall in cash reserves

Automotive companies will have less cash after the pandemic. The crisis will drain their reserves and, afterwards, lower and less profitable sales volumes will hit earnings. This will affect all six company strategy topics, across all three regions.

In Market & product mix, low cash reserves will in part drive some US and European OEMs to reduce their global footprint and focus on their core markets. Ford and GM, for example, have already exited several global markets and are now highly focused on their home market and China. But maintaining relevance in China requires heavy investment in electric vehicles (EVs). Bearing in mind post-pandemic cash levels and protectionist trade policies, should they just stick to the US in the future, merge overseas operations and use generic EV platforms of competitors?

A lack of cash also means an inability to invest in Mobility and Autonomous driving, while having to consolidate EV platforms as part of the push towards Electrification. Also, to save money, OEMs will increasingly rely on software to reduce costs, so Digitalization will become more cost driven rather than revenue/service driven. The Competitive landscape will evolve in response to these changes, as automotive companies increasingly rely on partnerships and drive consolidation through M&A and portfolio decisions.

Consumer behavior

Our scenarios showed that consumer behavior and preferences will change in two ways after the coronavirus crisis. First, people will have less money to spend, and second, they will care more about health and safety.

This will particularly impact the vehicle selling price and margin (Market & product mix). Reduced consumer buying power in the US, Europe and China will force a shift towards cheaper vehicles and trims, and as a result, OEMs and suppliers will have to cut costs by reducing complexity and material costs.

Consumer behavior regarding personal health and safety will be the key driver in Mobility. People will want to use forms of transportation that limit exposure to others, slowing the shift from private vehicle ownership but also increasing the use of services such as ride hailing, particularly in the US, where use of public transportation will be heavily substituted. Meanwhile in Europe, these changes are likely to result in failures and consolidation of mobility service providers.

Health concerns are likely to increase public interest in Autonomous driving, leading to a resurgence of investment from outside the industry, and a clearer regulatory path. However, automotive companies will continue to scale back investments in autonomous driving, turning instead to partnerships and increasing reliance on technology companies. There will be new opportunities in connected services, but these benefits will likely be outweighed by the expected fall in dealer revenues and margins (Sales & distribution).

Policy decisions

Government decisions on how to balance risk and economic recovery will play a major part in shaping the post-crisis automotive landscape. According to our scenarios, Europe and China are more likely to adapt to new consumer behavior by investing in public transit than the US. This will affect Mobility and influence how people use different modes of transportation. For example, China will move to make individual mobility less attractive, for instance through taxation.

The rate of Electrification is another topic where policy will influence outcomes. In Europe, a green policy agenda could accelerate the shift away from ICE vehicles, while China is likely to increase its EV dominance as it holds steady with its emissions targets and subsidy program. Meanwhile in the US, lowering of emissions targets and EV subsidies would cause EV penetration to fall further behind that of Europe and China, with the effect that US OEMs further retrench their global footprints.

Regarding the Supply chain, we expect post-crisis policies to cause a significant decrease in globalization. US and European OEMs will aim to regionalize supply chains to reduce their dependence on China, a move that is likely to be exacerbated by protectionist policies such as incentivized re-shoring and trade wars.

Direct intervention is another possibility. Governments could try to mitigate some of the economic impact of the crisis through stimulus or subsidies, as has been proposed by automakers recently. However, we expect these will be financial lifelines rather than profit generators.

"Automakers need to start planning for the long-term now"

What to do: The new normal

In general, the worse the recession, the more extreme the effect on cash levels, consumer behavior and policies. This means the dynamics outlined above will be amplified in the case of an L-shaped economic recovery. But they will still have a significant impact in the event of a U-shaped recovery.

As a result, automotive companies need to start planning for the long-term now. The ‘new normal’ will require rethinking strategy, from product offerings to acquisitions, and redesigning operating models to shift priorities, enhance customer relationships and adapt to new supply chains.

A failure to act may do more damage than the virus itself.