The future of WOAN

![{[downloads[language].preview]}](https://www.rolandberger.com/publications/publication_image/female-hand-5g-sign_Future_of_WOAN__pdf_Cover_download_preview.jpg)

Can Malaysia be a nord star for 5G wholesale open access network?

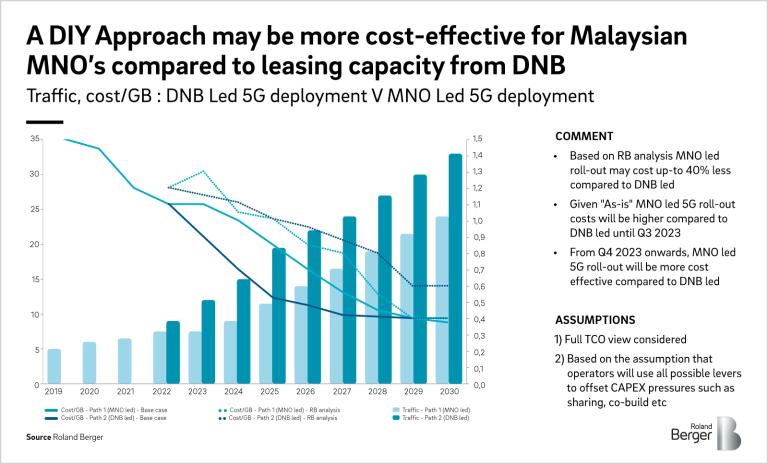

WOAN or Wholesale Open Access Network is not a new concept. Several countries such as South Africa, Mexico and Rwanda have experimented with the idea before Malaysia. However, despite its numerous potential benefits, the world is yet to see a successful implementation of the WOAN. Why has the WOAN failed to gain traction with Mobile Network Operators despite the promise of substantial cost savings, up to ten times compared to the DIY model, and a reduction in time to market by up to 50%? Why has the WOAN faced pushback from the very MNOs who are supposed to benefit from it? Here we take an impartial look at Malaysia’s unique Dual 5G network approach and whether it will be enough to address the concerns of Malaysian MNOs around the pitfalls of a single nationalized WOAN.

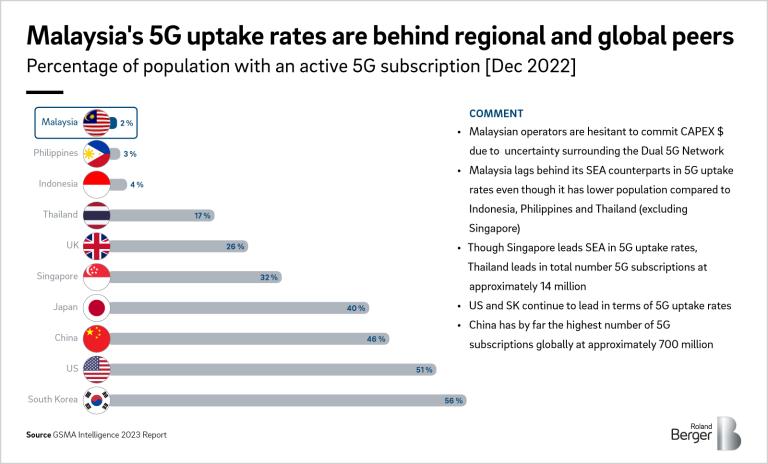

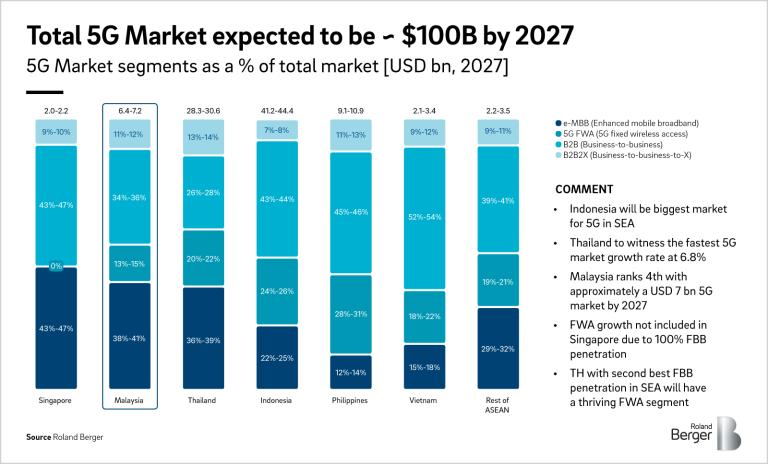

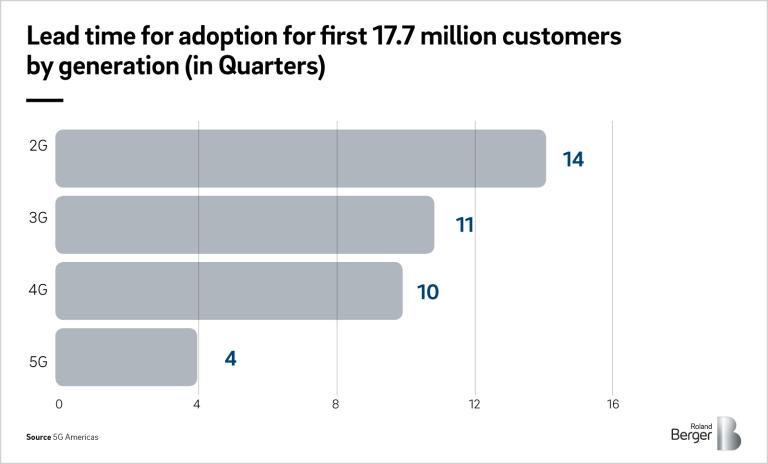

5G roll-out in Malaysia was delayed, compared to its regional counterparts and global peers. Singapore and Thailand powered ahead in their 5G roll-outs with Singapore becoming the first country globally to reach almost 99% SA-5G coverage, and Thailand recording the highest number of active 5G subscribers in the region at approximately 14 million. Indonesia set a new roll-out record with almost 40,000 5G sites (as of Q3 2023). Malaysia is still undecided on its nationwide 5G roll-out plans. With 5G poised to become the backbone of industry 4.0, Malaysia risks "being" left behind in ASEAN's $3trillion 5G-enabled-economy (by 2030). This delay has the potential to dent the reputation of Malaysia as a regional economic powerhouse.

Unlike most countries globally, Malaysia chose a PPP model for its 5G roll-out, with a government owned SPV (Special Purpose Vehicle) as the sole provider of wholesale 5G access to MNOs in the country. The aim was simple - to reduce deployment costs versus MNO led 5G deployment by

a) avoiding duplication of infrastructure;

b) maximizing the use of scarce resources such as spectrum;

c) and therefore providing cost effective and quality 5G services to all Malaysians.

Most countries, including Malaysia, have declared 5G as “Critical National Infrastructure.” 5G will form the cornerstone of Industry 4.0. and a source of competitive advantage for nations as they vie for technological superiority. The stakes are high, and Governments worldwide have been highly vocal about their priorities and concerns surrounding 5G w.r.t architecture, standards, security and choice of suppliers that can be summed up as follows:

a) Unconstrained capacity

b) Zero-trust security

c) Maximum self-reliance

Are two 5G access networks really the solution?

While a second 5G wholesale network will address the immediate concerns of Malaysian MNOs to some degree, key questions will remain.

1. Current 5G spectrum is exclusively owned by DNB and would most likely be re-allocated between the two 5G networks, which could mean further painstaking negotiations and hence, further delays. Spectrum fragmentation will also have an adverse impact on the 5G QOS.

2. With growing negative public sentiment regarding Malaysia’s 5G roll-out strategy, operators must ensure that any potential cost benefits of such an arrangement pass on to the consumer.

3. The second 5G vendor roll-out starts early next year (Jan 2024) and is contingent upon DNB reaching 80% 5G coverage by the end of this year. What will happen to DNB once its mandate is fulfilled? How will MNOs manage the "Wholesaler-Retailer under the same roof conundrum"? If they will be equity holders in both the networks, then they are ultimately funding two networks which a) they did not want to begin with and b) puts further strain on their already debt ridden balance sheets.

4. Malaysian MNOs need to make this work, and the onus is on them to ensure seamless interoperability between the two 5G networks and their respective cores. As of today, inter-vendor interoperability is far from plug-and-play and will be a challenge for most telcos. Not to mention a further increase in Operating Costs of up to 10%.

While there seems to be no silver bullet, operators can employ proactive strategies to be better prepared for the new realities, and the challenges they bring.

1. Timing is the key: Operators must decide whether to wait for the second 5G network and get dragged further behind in their 5G plans or move to finalize capacity agreements with DNB.

2. Technology and architecture: >90% of the 200+ live commercial networks globally have followed the LTE>NSA>SA evolution curve for 5G. Malaysian operators have a significant 4G footprint and taking this tested and tried route would make sense. However, another option exists to compensate for lost time, i.e., going directly to the SA option. Even though counter-intuitive, we believe every MNO in Malaysia should evaluate this option as the benefits might outweigh the cost.

3. B2S or Build to specification: While having two 5G wholesale vendors does provide some flexibility, it is still not the same as a DIY model and limits the options of MNOs to build networks tailor-made to their specifications. While having wholesale provider levels the playing field for challengers to some extent, access network, being closest to the customer, is the biggest differentiator for MNO's and they must build in mechanisms to preserve their differentiation on network quality during negotiations with the two 5G networks.

4. Align vendor strategy with the 5G network provider: By aligning their vendor strategies with their 5G network providers, Malaysian MNOs can reduce testing and system integration costs by up to 10% and TTM by up to 25%. Therefore, MNOs must be proactive and devise network roll-out and evolution plans in lockstep with the technology roadmap of their 5G network providers. Based on our experience, a joint Go-To-Market by MNOs in such a scenario could provide cost benefits of up to 30% in procurement synergies.

5. Start with a target operating model in mind and align the pyramid bottom up with their 5G Network Provider, starting with Platforms > Technology > Processes > People > and Governance to minimize friction and ensure clear demarcation of SOW vertically and horizontally. Start building capabilities and re-skilling the workforce to transition to more agile workflows. Based on our experience, operators today possess < 50% of the capabilities that a fully virtualized and disaggregated 5G network of tomorrow will need.

If you wish to read more on the topic, please download the full article below.

![{[downloads[language].preview]}](https://www.rolandberger.com/publications/publication_image/female-hand-5g-sign_Future_of_WOAN__pdf_Cover_download_preview.jpg)

Can Malaysia be a nord star for 5G wholesale open access network?