Our latest study examines the opportunities and the challenges of ecosystems for insurance companies.

The future of reinsurance

By Ulrich Kleipaß, Clemens Frey and Carsten Küst

New opportunities in dynamic times

The reinsurance industry, traditionally focused on risk transfer, is navigating a rapidly evolving landscape characterized by significant shifts in risk patterns, operational environments, and capital demands. As global challenges, such as climate change and cyber threats, become more complex, reinsurers must adjust their strategies to stay resilient and relevant. This article explores the key trends shaping the future of reinsurance, highlighting the evolution of risk, operational transformation, and the vital relationships between reinsurers, primary insurers, and brokers.

"As reinsurers navigate an increasingly complex risk landscape, from intensifying natural catastrophes to emerging cyber threats, the ability to adapt and innovate will be crucial for maintaining resilience and relevance in the industry."

Emerging risk trends: A new paradigm for reinsurers

The risk environment for reinsurers is growing increasingly complex, driven by the emergence of new risk categories and the intensification of existing ones. Notable trends include the increasing frequency and severity of natural catastrophes, particularly secondary perils like severe weather events, which necessitate recalibrated models and tailored risk management strategies.

Cybersecurity risks, driven by more sophisticated threats, demand specialized insurance products and greater capital allocation. The COVID-19 pandemic has underscored the need for better understanding and management of pandemic risks, leading to potential new public-private risk-sharing mechanisms. Longevity risks are rising with the global aging population, requiring innovative product offerings, while political unrest introduces volatile risks that are difficult to quantify but present market opportunities if managed with robust coverage and policy wording.Geopolitical tensions and protectionist policies are challenging the global operating model of reinsurers, highlighting the need for localized risk management, reinforced friend-shoring, and the potential for ring-fencing certain business units.

"The future of reinsurance lies not just in risk transfer, but in embracing digital transformation, addressing ESG criteria, and exploring new capital avenues to meet the evolving needs of a changing world."

Operational and capital environment: Transforming the business model

The operational and capital environment for reinsurers is also undergoing significant changes, influenced by digital transformation, regulatory pressures, and the emergence of alternative capital sources. Digital technologies, such as artificial intelligence , are transforming risk assessment, streamlining operations, and enhancing interactions with clients and partners. This shift improves efficiency and creates new value but also requires employee reskilling.

In the U.S., social inflation is driving up claims costs, particularly in liability risks, prompting a reassessment of underwriting practices and policy terms. The growth of insurance-linked securities (ILS) and catastrophe bonds offers new avenues for risk transfer and capital diversification. Meanwhile, ongoing consolidation in the reinsurance broker market is leading to fewer, larger players with increased market power. Additionally, rising regulatory demands related to Environmental, Social, and Governance (ESG) criteria are prompting reinsurers to integrate these factors into their underwriting processes. ESG considerations are becoming increasingly important for attracting investors and capturing new business opportunities in markets where sustainable investing is gaining traction.

Geopolitical tensions and protectionist policies are challenging the global operating model of reinsurers, highlighting the need for localized risk management, reinforced friend-shoring, and the potential for ring-fencing certain business units.

Strategic Implications and the way ahead

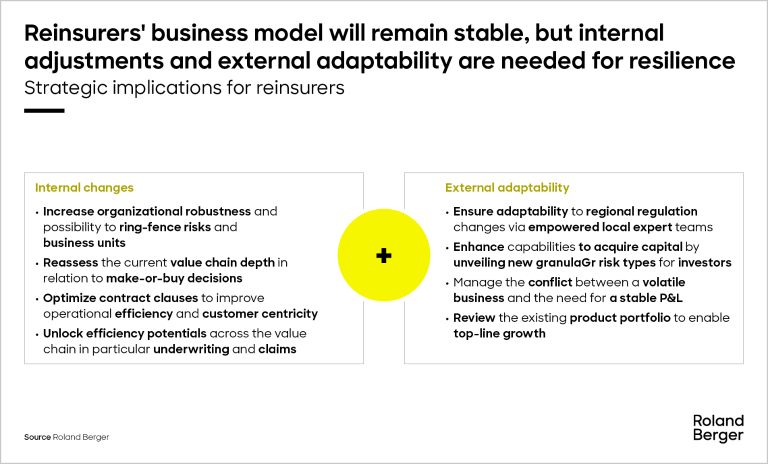

Despite these challenges, the fundamental business model of reinsurance is likely to remain unchanged in the foreseeable future. However, reinsurers must make regular adjustments to pricing and underwriting processes to reflect shifts in market sentiment. New types of risks need to be effectively integrated into product portfolios, and claims handling processes must continuously evolve to address changes in severity and frequency.

Internally, reinsurers should reassess the depth of their value chain in relation to make-or-buy decisions and increase organizational robustness, including the capability to ring-fence risks and business units. Optimizing contract clauses can improve operational efficiency and enhance customer centricity. Additionally, unlocking efficiency potentials across the value chain, particularly in underwriting and claims, is crucial.

Externally, reinsurers must enhance their capabilities to acquire capital by unveiling new, granular risk types that attract investors. Ensuring adaptability to regional regulatory changes through empowered local expert teams is essential, as is managing the conflict between the volatility of the business environment and the need for a stable P&L. Finally, reviewing the existing product portfolio is necessary to enable top-line growth.

In conclusion, the reinsurance industry is at a crossroads. By staying agile and responsive to these dynamic times, reinsurers can successfully navigate emerging risks, transform operational models, and capitalize on new opportunities in the ever-evolving landscape.