Roland Berger addresses the challenges facing telecoms operators, presenting six levers for growth opportunities and three models for future success

eSIMs: More opportunity than threat

By Alfredo Arpaia and Alexis de Peretti

Why telecoms operators are optimistic on eSIM adoption

Manufacturer innovation is driving increased eSIM adoption for mobile and IoT devices. The impact on operators could be significant. In a recent global survey by Roland Berger, top telecom executives shared a range of insights on the topic, including: why eSIMs for mobile devices are not yet a short-term priority for the consumer segment, but are already for enterprise customers and IoT devices; the potential impact on customer management; possible revenue and cost benefits; threats from other stakeholders; and the role of regulation.

eSIMs and their advantages

eSIMs are the digital evolution of physical SIM cards, offering multiple advantages: they can be reprogramed remotely and host multiple subscriptions, offering users greater flexibility and convenience as well as removing the need to replace a physical SIM upon number portability. They also reduce the plastic waste and carbon footprint associated with SIM manufacturing and distribution. And without the need for a physical SIM slot, eSIMs enable manufacturers to produce higher-performance devices, utilizing the extra space for enhancements such as increased battery capacity or higher-performing cameras or CPUs.

eSIMs set for major growth by 2030

Initially launched in consumer wearables just over five years ago, eSIM technology is now becoming increasingly popular. This growth is predominantly driven by manufacturer innovation: all new smartphone models from Apple and Samsung, for instance, now have eSIM capability.

In the smartphone segment, 10% of connections made in 2023 were eSIMs. This is expected to show a CAGR of around 40% over the rest of the decade, reaching approximately 75% of all smartphone connections in 2030.

The continued expansion of IoT technologies means eSIMs are also set for greater adoption in a variety of industries, including manufacturing, automotive, logistics, and utilities.

But what do these changes mean for operators? In late 2023, we spoke with 11 top managers from primary telecoms operators across North America, Europe, Africa, the Middle East, Asia (excluding China), and Oceania. This article outlines the key findings.

Key survey results

eSIMs a major factor but not a short-term priority in the consumer segment

All the operators we surveyed said eSIMs are factored into their strategies, offering the option to adopt eSIM at least for some customer segments (typically business customers).

However, less than 20% of interviewees said eSIMs were currently a top priority due to the low adoption rates of eSIM-enabled devices among their customer bases.

The most promising segments appear to be IoT (30% of respondents) and enterprise (20%), albeit with different respective rationales and limitations.

For IoT devices, including wearables, the possibility of remotely configuring an eSIM with different connectivity plans enables greater flexibility, especially for devices like smartwatches that are shipped to multiple countries. However, some respondents noted the modest adoption of cellular IoT networks as a limitation.

Among mobile SIM customers, the enterprise segment appears more attractive than the consumer one in the short term. One key factor is the lower price sensitivity for both service subscriptions and eSIM-enabled device adoption. There is also a higher concentration of international travelers who could benefit more from eSIM adoption to reduce roaming charges.

Mid-term adoption shows potential upsides

There is a consensus among respondents that eSIMs are likely to be widely adopted in the mid-term. This is expected to mostly be enabled by more affordable eSIM-equipped devices and the natural handset replacement cycle.

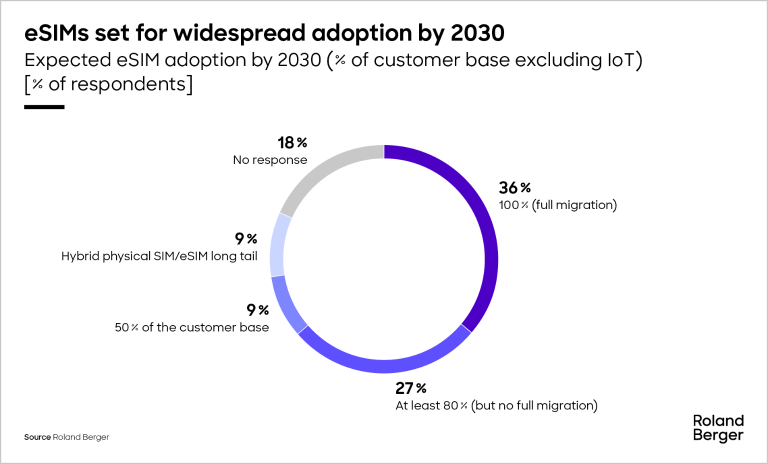

More than half of participants expect at least 80% of the entire subscriber base to have eSIMs by 2030. Just over a third of respondents anticipate a complete migration, with less than 10% foreseeing a hybrid ‘physical SIM/eSIM’ long-tail scenario.

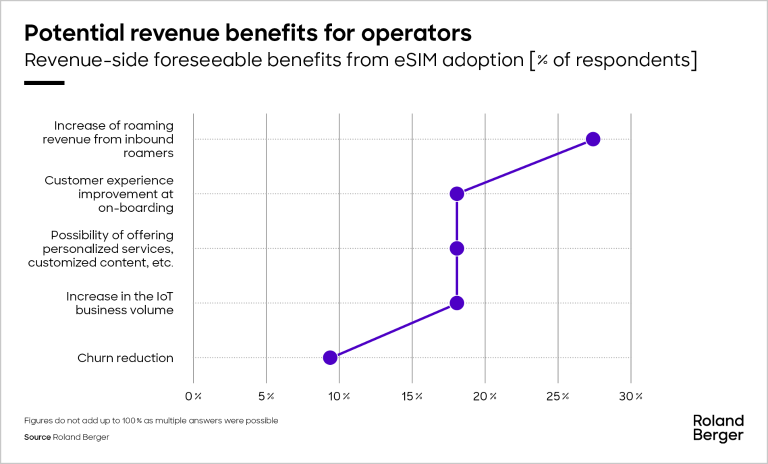

Operators perceive the move to eSIMs more as an opportunity than a threat in terms of both revenue and costs. On the revenue side, the increase of roaming revenue from inbound travelers is expected to be the main benefit.

Customer experience improvement at on-boarding, more personalized services, and an increase in IoT business volume received an equal weighting as the second-largest benefit, followed by churn reduction.

Meanwhile, on the cost side, 40% of participants named the reduction of physical SIM supply chain costs as a key benefit. The same percentage cited a reduction of subscriber acquisition or retention costs (SAC/SRC), including reduction of the physical retail store footprint and increase in digital channel adoption for customer reach.

Incidentally, less than 10% of respondents highlighted the risk of an increase in churn rate and subscriber acquisition or retention costs driven by easier ways to switch service provider. This happens in the retail energy market, for instance, albeit where the service is more commoditized.

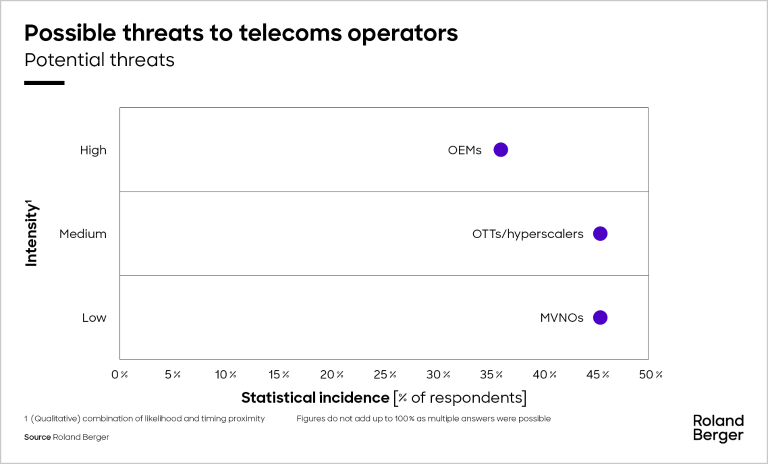

Clouding the picture somewhat are some clear potential threats to operators from other stakeholders in the value chain. For varying reasons, however, these threats do not appear to be imminent and/or substantial.

Named by almost half of all respondents, mobile virtual network operators (MVNOs) rank low on the threat intensity scale as they typically target the lower end of the consumer SIM subscriber base. This cohort is expected to be among the last segments to adopt eSIMs. It is also the least likely to have positive impacts on revenue: these users are typically more price-sensitive and less loyal, driven by offer prices rather than content or services, as well as less likely to use international roaming services.

Over-the-top (OTT) companies, or ‘hyperscalers’, such as Amazon and Google, were also cited as potential threats by almost half of respondents. They rank slightly higher than MVNOs, but are still not perceived as a substantial threat.

These companies are more likely to leverage eSIMs to deliver higher value or personalized content, rather than commoditized connectivity. Even within connectivity services, they are more likely to focus on roaming services, leveraging their existing core service-customer base. Ultimately, OTTs appear unlikely to generate enough volumes to have a remarkable impact on the market.

Device manufacturers such as Apple and Samsung are seen as the most serious potential threat to mobile operators, although only by just over a third of respondents. These OEMs can intermediate the market between mobile operators and end customers, causing the former to lose control over the latter.

However, among the respondents that named this threat, only a minority see it as imminent for numerous reasons: mobile operators are likely to defend their relationships with end customers; setting up telecoms operations in any given country requires a minimum level of investment as well as knowledge of the market and competitive landscape; and telecoms services regulation varies by country.

For most, the commercialization of eSIM-only devices is unlikely to happen in the short term, and, if so, only by Apple.

Win-win for most stakeholders

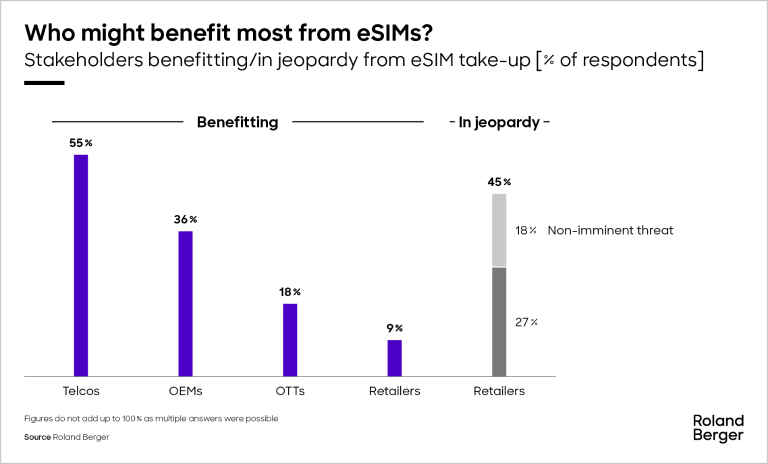

The vast majority of interviewees believe almost all value chain stakeholders can benefit from eSIM adoption.

According to over half of respondents, telco operators are the most likely to gain as they can expand their pool of addressable customers, improve customer service levels, and reduce overall costs. Global players can further benefit from roaming customers.

Named by just over a third of respondents, device manufacturers can use the space once devoted to physical SIMs to include new features or functions in their products, including higher-performing cameras, CPUs or batteries. They could also extract value from specific mobile operators embedding eSIMs in their devices.

For OTTs, eSIMs enable cross-border content as well as the potential to tap into a share of roaming revenue thanks to their global footprint.

A small minority of participants believe retailers could benefit from eSIMs if they position themselves as ‘solution’ sellers rather than physical SIM-only distributors.

At the same time, retailers appear to be the stakeholders most at jeopardy from eSIMs. However, this risk does not appear imminent as a certain retail store footprint is likely to remain in place in the mid-term according to around 20% of respondents, included in the half signaling retailers in jeopardy.

How regulation can aid the eSIM transition

According to two thirds of respondents, regulation must help facilitate a managed transition to widespread eSIM adoption on mobile devices, ensuring operators do not lose control over the customer base.

More specifically, interviewees called for a definition of the eSIM registration process; a clear, service definition (including eSIM-based) to be mandatorily provided by a registered license holder; and a smoother customer registration process, including remotely.

Operators confident about end-customer relationships

Three quarters of respondents are confident of maintaining their relationships with end customers, despite a change to the current operating model, especially for customer contact points, which are likely to become more digital and virtual (e.g. e-stores but also network-driven according to the network on which the eSIM is registered).

What’s next?

Driven by manufacturer innovation, eSIM adoption is expected to gain traction among mobile customers in the short-to-mid-term. Mobile operators appear well positioned to benefit from the opportunities arising from this shift. These benefits cover both the revenue side, such as roaming, as well as cost, such as reduced spending on acquiring or retaining subscribers.

But operators are not the only ones who can benefit from wider eSIM adoption: other industry stakeholders such as device manufacturers and OTT companies can also capture some of the new value generated.

To ensure they are not left behind, mobile operators should focus on leveraging digital touchpoints and sales channels with customers, with the ultimate objective of retaining a direct relationship and control over their client base.

Leveraging eSIM technical features, for instance to offer personalized services to subscribers, could be another retention lever for mobile operators towards their customer base. Mobile operators can also pursue the inbound roaming opportunity more proactively by aiming to directly interact with end customers.

About this study

This study is based on 11 interviews with top managers (two mobile unit directors, three heads of strategy, five heads of mobile customer segments, two heads of product/technology strategy) of primary telecoms operators across North America, Europe, Africa, Middle East, Asia and Oceania during Q3 2023.

Further readings