Electromobility: Key raw material nickel is in short supply

OEMs, cell manufacturers and suppliers have to secure their supply chains

Calls for national or at least European-based battery production are becoming louder, especially from politicians. The main worry is the growing dependence on Asian manufacturers. The fact that it is even more important to have access to crucial raw materials is often ignored in the discussion. If the supply of raw materials is even an issue, it is mainly in connection with cobalt and lithium. However, at current estimates, both battery raw materials are at best subject to a moderate supply and price risk. The situation for nickel is quite different: this key commodity is particularly scarce, which entails significant risks for the economic efficiency of batteries - and thus for tomorrow's electromobility.

"National or European cell manufacturers will only have a chance if they secure their supply chains all the way to the mine. If they fail to do that, they will suffer a fate similar to that of the German photovoltaic industry."

Largest increase in nickel-rich materials

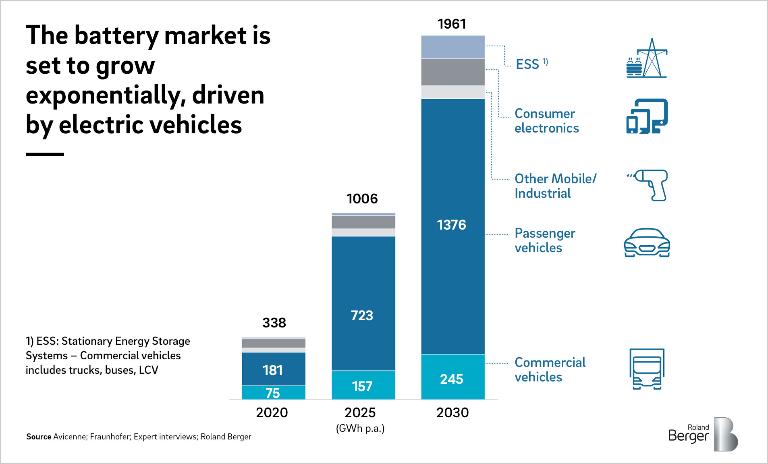

The demand for cobalt et al has thus been growing at steep rates for years. Nickel and nickel-rich materials currently show the greatest relative increase. On the one hand this development is linked to the higher energy density of nickel-rich cathode active materials and on the other to the desire to replace cobalt as much as possible (for political and environmental reasons).

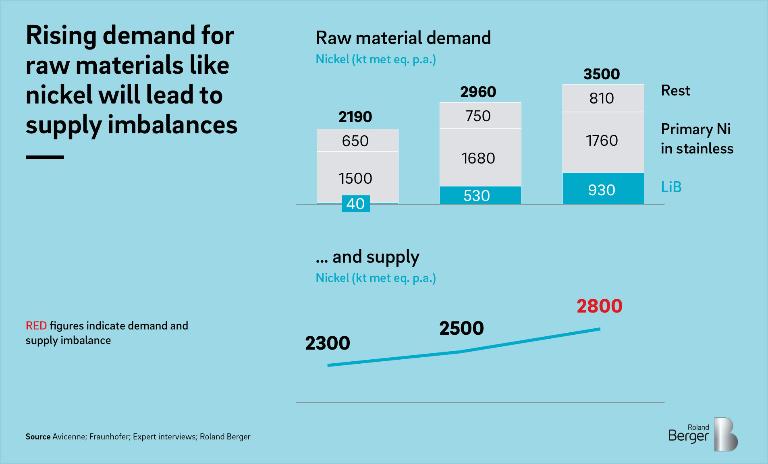

While supply and demand for cobalt are set to increase at a comparable rate following last year's speculative price swings and lithium supply will tend to rise in the course of new mining projects, this is unlikely to be the case with nickel – in fact, quite the opposite is expected. That's because only grade I nickel is suitable for the production of high-energy cathode active materials.

Over the past three years, stocks have more than halved from around 500kt in Jan 2016 to around 220kt in December 2018, while the stock price of almost USD 12,000 per tonne is below the cash costs of many mines. With NCM811 and the increased use of other nickel-rich chemistries, supply should become even more difficult from 2022 onwards. Mine closures in the Philippines last year and the threat of an export ban on ore from Indonesia starting in 2022 further exacerbate the situation. New "national" or European cell manufacturers will only have a chance if they secure the supply chain all the way to the mine. If they fail to do that, they will not be able to compete with the established cell manufacturers and will suffer a fate similar to that of the German photovoltaic industry, which have been subsidised with billions of euros without success.

OEMs, cell manufacturers, suppliers and mines must co-operate

This threatens supply bottlenecks, but above all significant price increases, as raw materials are the largest cost block in lithium-ion battery cell production. Around 45 percent of battery cell costs are attributable to cathode active materials alone. Price increases for NCM 811, which amount to between 10 and 20 euros per kWh at cell level, are therefore likely. This not only makes electric mobility much more expensive, it also poses a risk that should not be underestimated for those battery manufacturers and OEMs that have not secured their supply chains. Growing co-operation by OEMs, cell manufacturers, cathode material suppliers and mines is therefore essential.

New "national" or European cell manufacturers will only have a chance if they secure the supply chain all the way to the mine. If they fail to do that, they will not be able to compete with the established cell manufacturers and will suffer a fate similar to that of the German photovoltaic industry, which has been subsidised with billions of euros without success.

Asian companies have demonstrated how to secure access to scarce raw materials. Regarding the long-term supply of cobalt, the major players have positioned themselves well, both through joint ventures and direct investments. For example, LG Chem has entered into two joint ventures with Huayou Zhejiang Cobalt to ensure the supply of cobalt to two precursor and cathode-material factories in China. Such vertical integrations are accompanied by direct investments in mines. Long-term supply contracts are also a popular option for lithium supply. Korean cell suppliers, but also Tesla-Panasonic-SMM and some Chinese and Western cathode manufacturers are well positioned in terms of raw material supply. Western cathode material producers such as BASF have also secured nickel supply contracts, in BASF's case with Norilsk Nickel.

The market will consolidate rapidly in the coming years - and the dominance of Asian battery producers will continue to increase. By the middle of the next decade, magnesium-rich cell compositions could relax the situation. Until then, the field will be further divided - between those who have access to critical resources and those who don't.