The COVID-19 pandemic will hit the economy harder than the 2008 financial crisis, and most industries will recover slower this time than they did after the financial crash.

Three scenarios for how Coronavirus may affect economies and industries

By Klaus Fuest

COVID-19 has the potential to trigger a global economic crisis

Corona Economic Impact - Part 2

Corona Economic Impact - Part 3

COVID-19 has spread to more than 110 countries so far, with many seeing a steep rise in new infections. While vaccines are in development and initial treatments are showing some signs of success, the potential human impact of the disease is immense and a cause for global concern. Besides this human impact, the coronavirus also has the potential to trigger an economic crisis. Analysts currently expect to see a negative impact on all sectors of the economy, from bottlenecks in logistics and plant shutdowns to downturns in business investments and consumer spending.

At Roland Berger, we are continually assessing the potential disruption to global business, with a particular emphasis on supply chains and specific industries. Our analysis below focuses on how the spread of the virus may affect economic growth in key regions (China, the United States, the European Union) and industries (automotive, mechanical engineering, logistics, pharmaceuticals). We develop three scenarios for how the situation may develop in 2020 and 2021, ranging from a fast recovery to a profound recession triggered by the coronavirus.

A severe blow to GDP growth

In China, the focal point of the coronavirus outbreak, we forecast that GDP growth could drop as much as 3.5 percentage points in 2020 in a worst-case scenario. Our "Profound Recession" scenario further foresees a second wave of the outbreak in early 2021, with new flare-ups outside the Hubei province and quarantine measures extended to other regions. Supply will be severely disrupted, with factories remaining closed and numerous bankruptcies, while fiscal and monetary policy responses will not start pushing growth until Q3 2020. In our more moderate "Delayed Cure" scenario, the number of new infections will slow down but quarantines will remain in place, causing bottlenecks in supply and a downturn in domestic demand and exports. In our most optimistic, "Fast Recovery" scenario, the Chinese government's measures would be effective, quarantines quickly lifted and production soon return to normal, leading to just a short-term dip in demand.

Europe, as the world's biggest trading block, could be particularly hard hit by an extended corona outbreak. Our worst-case scenario foresees full containment not being achieved until 2021. The healthcare system will experience capacity shortages, and production in several industries will be disrupted. In the Delayed Cure scenario, supply chains from Asia to Europe, particularly important for pharmaceutical raw materials and electronics, will be in jeopardy and crucial supply chains within Europe will also start to break down. We will see a temporary decline in consumption and investments. In the optimistic Fast Recovery scenario, disruptions will only occur in specific sectors, the supply shock will be less strong, domestic production will only be impacted in Italy and demand will fall in just a few industries, such as travel and tourism.

With its strong focus on the domestic market and orientation towards services, the United States economy is not likely to be as badly affected as other regions. True, our worst-case scenario foresees a strong impact on NAFTA supply chains and a drop in consumption, with a resulting decline in GDP of 1.2 percent in 2020. But in our moderate scenario, supply chains are interrupted in selected industries only and fiscal and monetary stimulus are likely, given that this is an election year. In the best-case scenario, we see no slowdown in GDP growth, with domestic demand stable and business largely continuing as usual.

Impact on industry varies

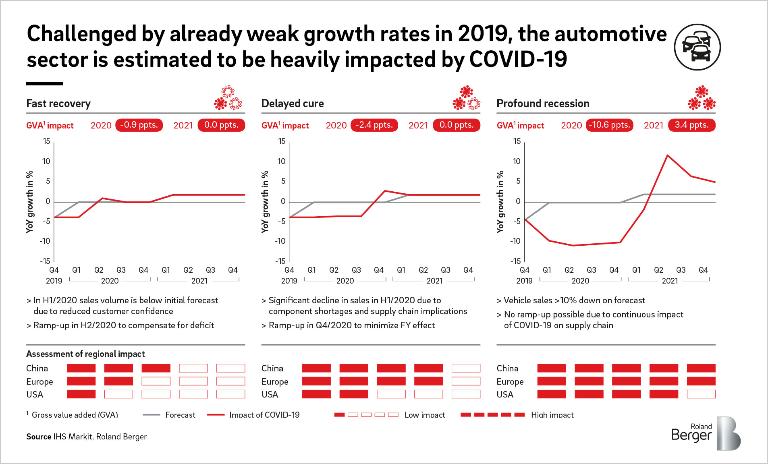

The impact of COVID-19 on different business sectors varies due to the differences in supply and demand patterns. The automotive industry, already weakened by slow growth rates in 2019, is likely to experience the biggest downturn. Gross value added (GVA) could fall by as much as 10.6 percentage points in 2020 in the worst-case scenario compared to the base-case scenario without a COVID-19 impact, with vehicle sales down more than 10 percent on their forecast levels and no ramp-up possible due to supply chain problems. In the moderate Delayed Cure scenario, a significant decline in sales in H1 2020 due to component shortages and supply chain problems is followed by a ramp-up in Q4 2020, minimizing the full-year effect. In the Fast Recovery scenario, a slight drop in sales volumes in H1 2020 is followed by a compensatory ramp-up in H2 2020.

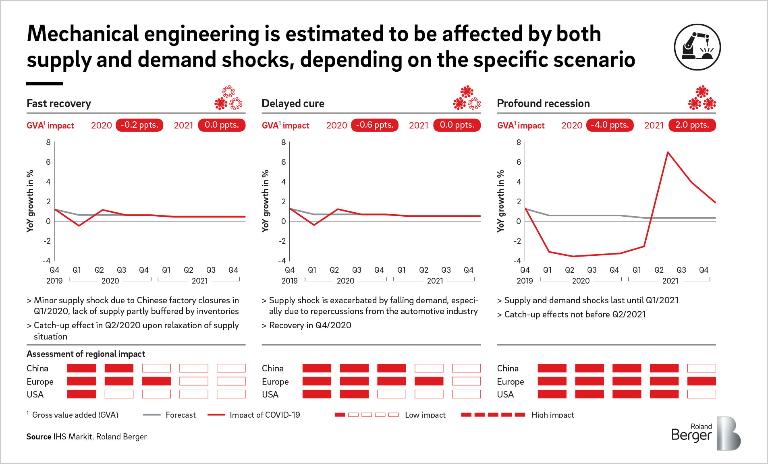

Mechanical engineering will see both supply and demand shocks lasting until Q1 2021 in the worst-case scenario, with catch-up effects not seen before Q2 2021. In the moderate scenario, the supply shock will be exacerbated by falling demand, but recovery will occur in Q4 2020. In the best-case scenario, the closure of Chinese factories only causes a minor shock, with lack of supply partly buffered by inventories; catch-up begins when the supply situation recovers in Q2 2020.

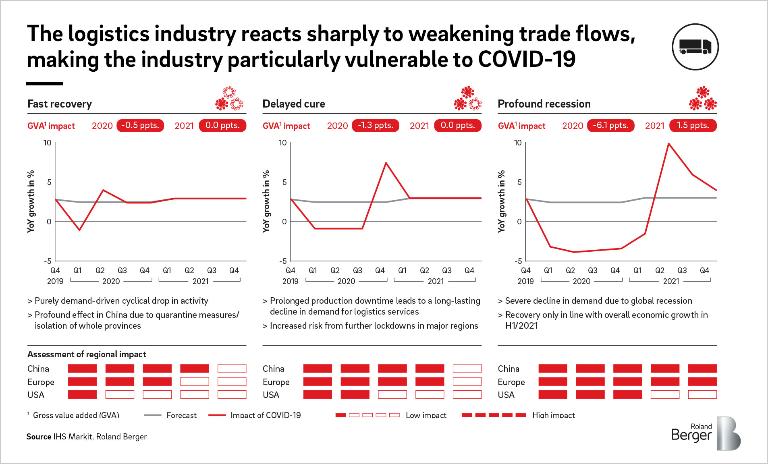

The logistics industry reacts sharply to any weakening in trade flows, making the industry particularly vulnerable to COVID-19. The worst-case Profound Recession scenario foresees a severe decline in demand, with recovery in line with overall economic growth not until H1 2021. The moderate scenario predicts prolonged production downtimes, leading to a lasting decline in demand for logistics services. The industry will also face increased risk from further lockdowns in major regions. In the best-case scenario, the biggest impact is seen in China, due to quarantine measures and the isolation of entire provinces.

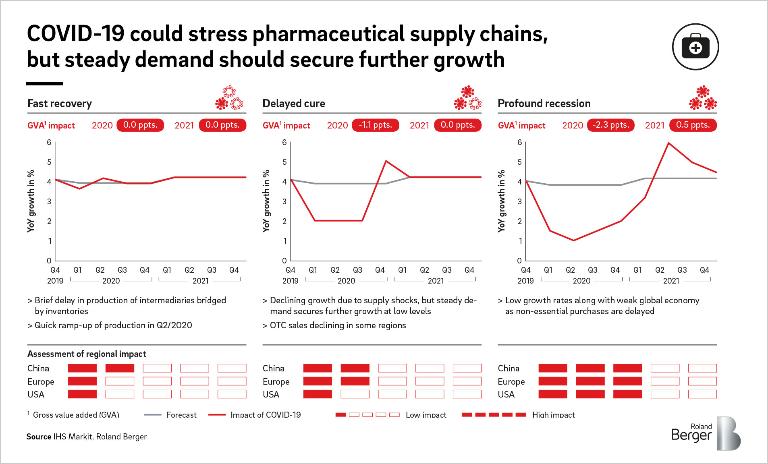

Finally, the pharmaceutical industry will see increased stress on supply chains, but steady demand should ensure further growth. At worst, growth rates will be low, in line with the weak global economy, as non-essential purchases are delayed. In the moderate scenario, growth will slow due to supply shocks but demand will be steady. In the event of a fast recovery, a brief delay in production will be bridged by inventories, followed by a quick ramp-up in production as early as Q2 2020. In this optimistic scenario, the impact in Europe and the United States will be minor.

Roland Berger is monitoring the impact of the spread of COVID-19 on a daily basis. For our latest updates and a detailed assessment of the impact on your region or industry, please contact [email protected] .